The Portfolio Construction Framework

The success of an asset allocation strategy is contingent upon a sound manager implementation policy. Combining opportunistic active managers with passive managers, and appropriately sizing positions can help private wealth clients increase after-tax returns and bolster their ability to meet their financial objectives.

Establishing a framework to evaluate active managers and understanding the role passive strategies can play in a portfolio are important considerations for taxable families.

The Case for Active

Three primary factors should be considered when active managers are included in a taxable portfolio:

- Investment merit: The manager should have a sustainable competitive advantage, such as the ability to detect trends, unique market access or an edge in trading. Weighing these considerations helps develop an investment thesis and a process for identifying quality asset managers with a repeatable process, while avoiding the churn that can result from chasing performance.

- Tax-awareness: After meeting with hundreds of managers, analyzing their portfolios, and monitoring their performance, we have found that tax-aware managers are the minority. However, there may be elements in a manager’s process or approach that fuel certain tax advantages. For example, managers with longer holding periods or those who sell securities that have gone down in value may generate short-term losses and/or long-terms gains for investors. When identifying and recommending active managers, we look for those who minimize the negative impact of taxes by recognizing losses, deferring gains, and avoiding short-term capital gains whenever possible.

- Breadth of mandate: If finding tax-aware managers is difficult, it is even more challenging to identify tax-aware managers with a high potential for excess return or alpha. Historically, we have found that managers who are benchmark-agnostic or who pursue broader mandates are often able to produce higher levels of excess return. To be sure, thinking outside the benchmark can introduce a higher level of tracking error to the portfolio. That said, for many private wealth clients, a higher level of after-tax out performance is a more important consideration.

A Place for Passive

Many passive strategies can incorporate tax awareness and defer capital gains or harvest losses. Therefore, they often play a key role in private wealth portfolios. When used appropriately, these strategies can become an attractive way to gain the desired market exposure in a low-cost, tax-efficient manner. Depending upon the structure used, it may be possible to defer some or all capital gains into the future and, in some cases, across generations. In many instances, a tax-loss harvesting strategy may present additional benefits as the losses generated can be used to offset gains produced elsewhere in the portfolio, thus creating tax alpha and improving the overall after-tax return of the total portfolio.

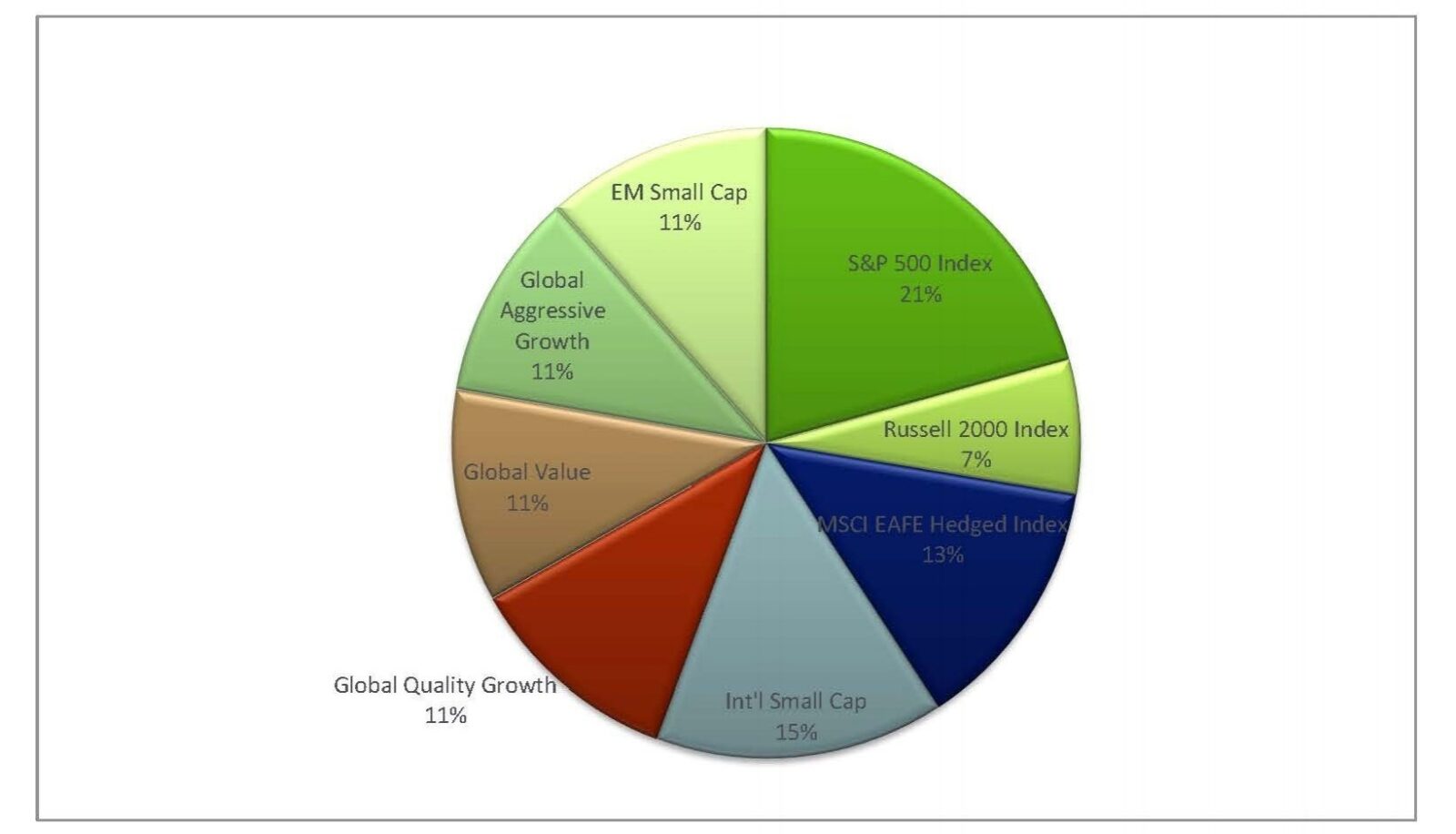

Exhibit 1(a): Portfolio Allocation by Market Value

Sizing Considerations

During the portfolio construction process, a subsequent factor that should also be addressed is the structure or relative weights of each manager in the portfolio; simplistic methods such as equal weighting or funding levels based upon the amount of capital available at a point in time may not result in optimal returns.

Although every private wealth client’s situation is unique, we have frequently found that a core/satellite approach with varying weights is the optimal solution. Utilization of a passive tax-loss harvesting strategy for the core of an equity portfolio provides broad-based market exposure that is cost-effective and tax-efficient. With the core in place, there is greater flexibility to seek out active managers who are more likely to deviate from market benchmarks and, if chosen well, potentially outperform over market cycles.

It is also important to note that each manager’s contribution to active risk may significantly differ from their proportional weighting in a portfolio, as seen in a hypothetical equity portfolio (Exhibit 1) containing 40% in passive strategies and 60% in active managers representing a variety of styles. With each active manager pursuing a different strategy—some may seek out performance through concentration, others through broader mandates or better downside protection—the level of active risk will also vary. By analyzing each manager’s contribution to active risk and adjusting their position size, it is possible to adjust the overall portfolio to get to the desired level of active risk.

Exhibit 1(b): Portfolio Allocation by Contribution to Active Risk

Summing It Up

Manager implementation plays a vital role in the overall process of constructing portfolios, especially given the challenge that taxes present for individuals and families, privately-owned family businesses and family offices. Decisions regarding active or passive management, tax-loss harvesting techniques, opportunistic strategies and position sizing will impact the after-tax return of a portfolio and the ability of private wealth clients to meet their investment objectives.

To this end, the amount of passive exposure in a portfolio can be tailored based on the tax requirements, cost considerations and desired level of tracking error. This passive exposure may be complemented by performance-seeking benchmark-agnostic managers with more flexibility to capitalize on opportunities or add a more tactical bent to the portfolio.

Constructing a portfolio with appropriate weightings for the underlying managers allows private wealth clients to potentially achieve greater upside participation and stronger downside protection. Although no portfolio can outperform in all market environments, we believe that a core/satellite approach customized to meet specific investment goals greatly increases the likelihood of clients achieving their financial objectives over time.