Increasing interest in private credit has led to a fundamental shift in investors’ portfolios, with many setting permanent dedicated allocations to the asset class.

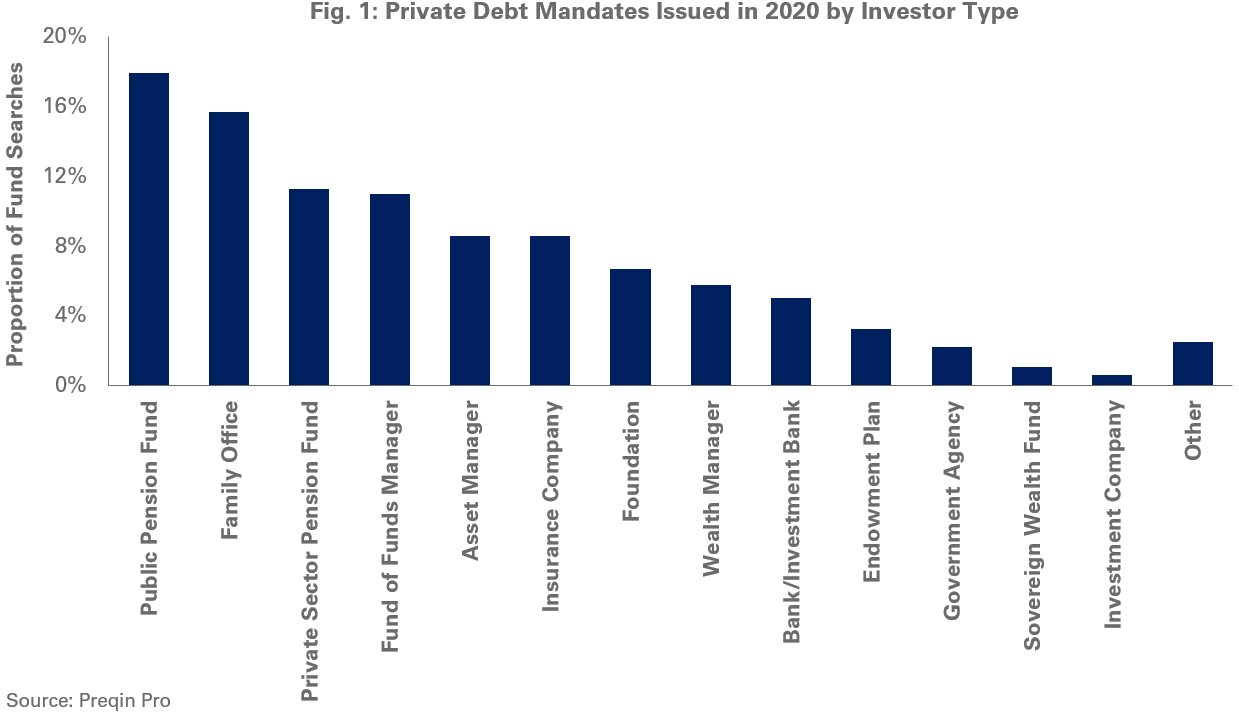

The uptick in popularity stems from the relatively higher yields and portfolio diversification offered by private credit. This sustained demand for private credit (Figure 1) is fueling the creation of investment vehicles and structures that will make implementation easier for different types of institutional investors.

With premiums on U.S. high-yield debt hovering near historic lows, yield-starved investors are looking to alternative solutions, such as private credit, to achieve their requisite returns and generate income. In 2020, fundraising in the private credit space hit a record high of $163.8 billion across direct lending, mezzanine, distress and niche strategies, according to Preqin. Private credit, depending on the strategy, can potentially generate quarterly income distributions and achieve net returns of 5%-to-15%. Typically, the asset class also exhibits less mark-to-market volatility than public fixed income debt due to the longer lock-up period of the fund structures, smoothed pricing of quarterly valuations for private investments, and, often times, the hold-to-maturity nature of the loans.

In addition to providing portfolio diversification relative to equity allocations, these strategies can also serve as a diversifier to public fixed income by targeting smaller companies and atypical sector exposures. Some private credit approaches will also invest in non-corporate loans and/or loans with unique collateral packages, further differentiating them from more traditional fixed income. Additionally, some strategies use floating-interest-rate loans, which investors may find attractive when considering inflationary risk within their total portfolios. These benefits have led investors to carve out a separate and defined allocation to private credit and we expect these allocations will continue to grow.

As the private credit landscape continues to mature and evolve, managers are increasingly focused on creating vehicles that cater to institution-specific needs. The goal is to construct investments that render private credit more attractive for investors from an implementation perspective, for instance, whether it is the manager acting as an ERISA fiduciary, or QPAM, an evergreen structure for those concerned about illiquidity, or frequent manager searches and legal reviews, or rated note/feeder structures for insurance companies. At NEPC, we are at the forefront of this evolution, working with managers in our efforts to cater to our clients’ needs. We specialize in helping our clients with portfolio construction, manager selection and fee negotiations in a marketplace inundated with limited partners and fund managers.

We also believe investors should be well acquainted with all aspects, including the limitations, of investing in private credit. Typically, these funds are illiquid and require lock-ups of four-to-12 years, even with structural features such as evergreen vehicles. The flood of capital and managers in this space in recent years has led to spread compression and, in certain instances, deteriorating credit quality. As a result, managers have become increasingly keen on applying fund-level leverage to their strategies in order to make up the difference with historical returns. However, the fund-level leverage can have an adverse impact on performance should the portfolio encounter significant issues, as the leverage magnifies both positive and negative results. Rather than allowing increases in fund-level leverage, investors should focus on negotiating down fees with managers as a way to enhance net performance.

Certain private credit strategies, such as distressed-for-control, require macroeconomic tailwinds to generate attractive returns. With these approaches, investors should be prepared for potentially depressed returns relative to expectations should the necessary conditions not materialize during the life of a fund. Accurately timing the market is extremely difficult from the perspective of a limited partner, so investors often have to re-up with managers in anticipation of these tailwinds, even if performance is subdued.

Additionally, not all private credit strategies or managers are created equal in terms of risk. Risk can vary, depending on equity exposure, concentrated portfolios, sector over-weights or just general poor credit underwriting. Some approaches also utilize significant amounts of payment-in-kind (PIK) interest, as opposed to cash interest, which amortizes and naturally de-risks loans over time. While PIK interest can potentially generate higher total returns than cash interest, it limits current distributions and may not be suitable for investors who rely on regular income. As with any investment, investors should consider the potential benefits and risks of private credit and the appropriate way to implement and access these exposures in order to achieve desired goals.

To learn more, please reach out to your NEPC consultant. We can help assess your specific situation, needs and best course of action in moving forward with a private credit allocation.