Pacing plans for private markets are falling behind as this asset class grows and matures.

These models are a vital component of our portfolio management process, and are designed to manage illiquidity risk, and provide structure and discipline to help investors make measured commitments to take advantage of private market investments. Pacing plans that have remained constant in the face of a changing landscape risk misrepresenting portfolio exposure to private markets, thereby presenting an inaccurate picture in a given year to investors. This can distort exposure to private markets such that investors under allocate to this asset class, and miss potential subsequent gains.

At NEPC, we have taken steps to remedy these shortcomings. Our adjustments to our proprietary pacing plan models, rooted in hours of data analysis, better reflect reality and are more in line with the structural changes in private markets today. We believe our changes to legacy pacing plans provide limited partners with more accurate forecasts, helping them better manage their private markets program and cash flows.

Private Markets and Pacing Plan Models

Once a nascent investment approach, private markets are now a mainstay in institutional investment programs. About 10% or around $15 trillion of the $145 trillion in institutional capital is invested in private markets today, compared to $4 trillion in 2013, according to research from Bain & Co. and Fortune.

As this asset class grew in popularity, the introduction of a pacing plan model—initially created by Yale’s investment office in the mid-2000s—was welcomed by LPs, helping them estimate cashflows and manage liquidity risk while aiming for higher returns in private markets. These models rely on assumptions that capture many but not all real-world situations.

Given the explosive growth of private market investments, this asset class has changed and evolved in myriad ways, including the following that especially impact the quality and accuracy of pacing plan assumptions:

- Fund lives are longer, and

- Distribution of paid-in capital is lower

Pacing Plan Models are Falling Behind

A pacing plan model uses a series of assumptions to calculate a future level of commitment. These assumptions are at a portfolio and a fund level.

- Portfolio level assumptions:

- Target and current allocation of private markets in an LP’s portfolio

- Expected returns of the portfolio and any future cashflow that might affect its growth

- Fund level assumptions:

- Vintage and strategy type: Provide differentiated profiles across existing and future investments

- Fund life: Typical duration of a fund in years

- Asset growth rate: Expected growth of assets for the private markets portfolio and the rest of the investment program

- Call rate: The pace at which capital is called in each period as percentage of uncalled commitments

- Distribution rate: Pace at which capital is distributed to LPs:

- Yield – relevant for income-generating strategies such as real estate, private debt, and infrastructure

- Bow – the rate at which distributions accelerate as the fund approaches its end of life (higher bow means slower distributions early on and higher distributions later)

- Time: the time left until the end of the fund’s life

Keeping these core assumptions in mind, the challenges currently facing pacing plan outputs are

- Net asset values have remained elevated and actual fund lives are extending beyond the

assumptions of the model, thereby reducing future capacity. - Realized distributions have been lower than expected for the last couple of years, particularly in venture capital.

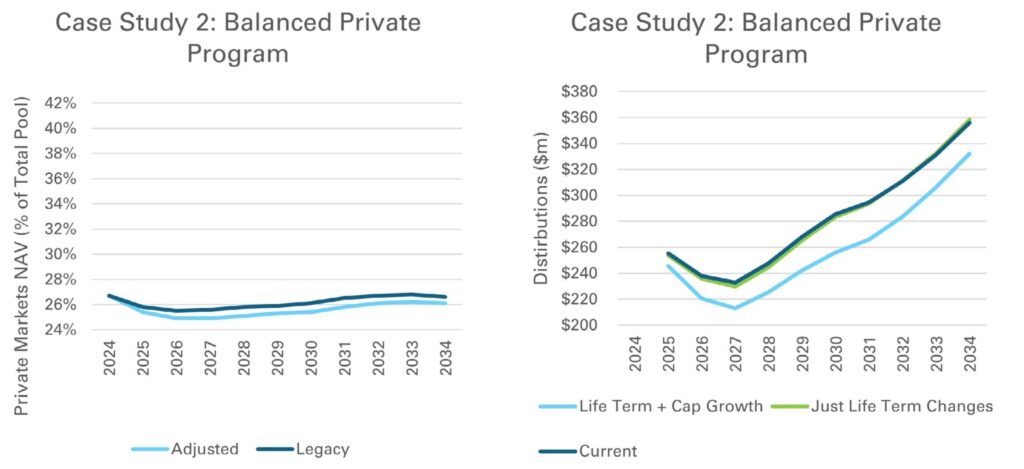

As a result of the longer fund life and lower distributions, the pacing model is recommending smaller commitments to private markets today, and lumping overdue distributions into 2026 and 2027 (when it is unlikely they will occur all at once or at such magnitude). This not only skews asset allocation decisions, leaving investors potentially underexposed to private markets, but also warps return expectations, jeopardizing investors’ calculations for cash flow and liquidity.

The Fix: Adjustments and Portfolio Management Considerations

The NEPC investment team has closely followed the shifts in private markets and their impact on investment programs. Our fixes are grounded in the quantitative analysis of the universe of all pacing plan inputs noted above; a sample size of over 100 live private market programs—running the gamut from seasoned to new, large to small, diversified to venture-heavy—we manage on behalf of our institutional and private wealth LPs; and qualitative reasoning given the evolving dynamics affecting private markets today, for instance, the flow of capital, return generators for each strategy, and types of new vehicles.

Based on our exhaustive research, we have made the following adjustments to our commitment pacing plan framework:

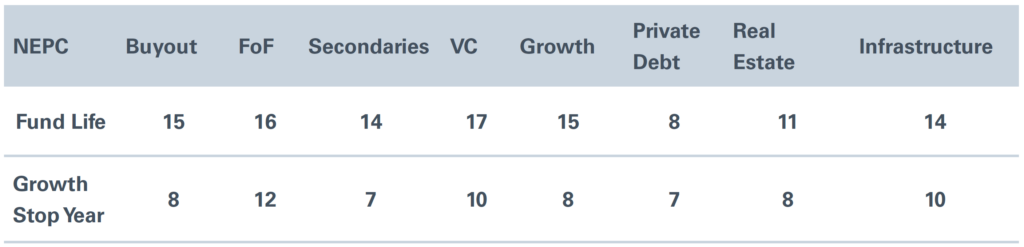

- Extend the fund life of venture capital: Our proprietary pacing model has already adapted to lengthening fund lives with longer life assumptions than most. We are currently lengthening the lives of venture capital funds by two years relative to our prior assumptions for a total fund life span of 17 years, in alignment with the actual lifecycle of funds.

- Cap growth rate earlier in fund life: Our research shows that the majority of value in private funds is created well before the end of the life of a fund, settling into its long-term level between seven and 12 years into a fund’s life, depending on the asset class. The results in lower private market NAVs, lower forecasts for distributions and higher commitment forecasts. We believe these are a more realistic reflection of the current environment.

In addition, LPs may consider more actively managing their private markets programs, with particular attention given to funds that are underperforming or have longer durations. While the secondary market is now more institutionalized, LPs must balance decisions with tradeoffs, including costs such as time and NAV discounts. When a secondary sale makes sense, the portfolio can be positioned for better overall outcomes and reduced risk associated with stagnant investments.

It is also important to evaluate the opportunity cost of maintaining these positions. Consider, for instance, how capital tied up in underperforming or longer-dated funds could be alternatively allocated to future commitments that may offer more favorable growth prospects. This approach ensures that resources are continually optimized in alignment with the evolving investment environment.

If necessary, future research may include adjustments on expected returns given the rise of registered and semi-liquid funds, and private vehicles greenlit for 401(k) plans. Also, current pacing models do not account for direct co-investment positions, general partner-led secondary sale decisions and semi-liquid investments and require customization at the individual LP level.

We will continue to closely monitor private markets as we implement a framework to help clients manage their private markets investment programs. Also, it is equally vital investors partner with an advocate to guide them through the decision-making process as manager selection is paramount to achieve returns that will outperform public markets. In general, we suggest maintaining regular and consistent pacing and advise against trying to time private markets. We encourage re-upping with strong, top-tier general partners; if capital is constrained, we propose a smaller check but advocate continued participation as access might be lost permanently if a fund is skipped.

We encourage proactively meeting with your NEPC consultant to discuss managing your private markets portfolio. As always, we are here to help our clients navigate every investment environment.