The 2017 Tax Cut and Jobs Act created a new investment vehicle to help channel resources into low-income urban and rural communities in the United States, while offering tax incentives to wealthy investors.

The program—the brainchild of a bipartisan group of US lawmakers and philanthropists, including tech billionaire Sean Parker, Facebook’s first president—is aimed at mobilizing the vast sums of unrealized capital gains of American individuals and corporations to revitalize economically distressed areas in the United States. American investors are currently sitting atop $2.3 trillion in unrealized capital gains on stocks and mutual funds alone, according to the Economic Innovation Group, a think tank established by Parker.

The Investment in Opportunity Act, the Act on which this little-known component of last year’s tax overhaul is based, is designed to allow individuals and corporations to receive favorable tax treatment on capital gains by reinvesting them in “Opportunity Funds.” These Opportunity Funds, in turn, will back properties and businesses within newly created “Opportunity Zones.” The tax incentives include the deferral of capital gains and a potential reduction of the capital-gains taxes owed.

While NEPC does not generally provide regulatory or tax advice to clients, we believe Opportunity Zones may be of interest to many clients and have prepared this summary as an introduction.

What is an Opportunity Zone?

Governors of each state chose up to 25% of their states’ eligible low-income census tracts to be considered as qualified Opportunity Zones where the federal tax incentive will apply.1 In total, over 8,700 tracts in all 50 states, Washington DC and five US territories received the Opportunity Zone designation. Opportunity Zones span urban, suburban and rural areas. The designation remains in effect until December 31, 2028. A list of the designated Opportunity Zones is available on the web sites of the Local Initiatives Support Corporation (LISC), the US Department of Treasury and the Community Development Financial Institutions Fund.

In determining which communities would qualify as Opportunity Zones, each state considered local priorities, engaged local stakeholders, and incorporated additional selection criteria in ways that reflected their unique local characteristics.

The goal was to balance need and opportunity, while considering factors such as the capacity to absorb new capital, anchor institutions and connectivity to infrastructure and markets.

1In order to be considered for this designation, the census tract had to have a poverty rate of 20% or a median income of less than 80% of the surrounding area.

What is the Tax Incentive?

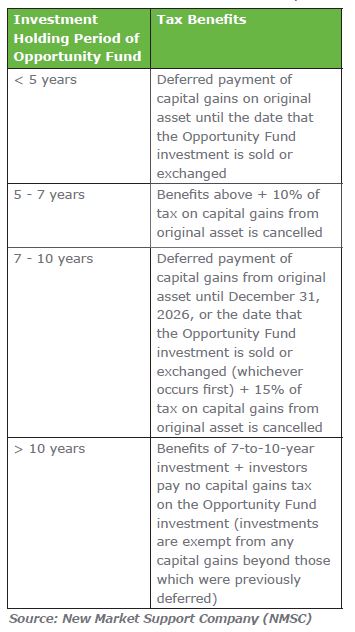

Key to the program are powerful tax incentives aimed at encouraging investments into the Opportunity Zones. Investors who sell or exchange assets with embedded capital gains have 180 days to invest those capital gains into a qualified Opportunity Fund where 90% of its assets are invested in Opportunity Zones. For that investment, the investor will get a deferral and, in certain instances, a partial cancellation, of the capital-gains tax due on the sale or exchange of the original asset. The longer the holding period of the Opportunity Fund investments, the more attractive the tax incentives to the investor.

The original asset sold can be equities, bonds, real estate or a business asset and does not have to have any connection to the Opportunity Zone into which the profits from the sale will be invested. The payment of the capital-gains tax on the original asset is deferred until the earlier of the disposition date of the subsequent Opportunity Fund investment or December 31, 2026, whichever occurs first. Additionally, the investment in the Opportunity Fund may grow tax free if the new Opportunity Fund investment is held for at least 10 years. The following table demonstrates the incentives for long-term investment in the Opportunity Fund.

There remains some confusion regarding the payment of the deferred capital gains tax as December 31, 2026 will fall in the middle of the various holding periods for the different gains cancellation benefits. Additionally, there is some hope that the 2026 date will be extended, which due to the step-up in basis provisions could result in the cancellation of the entire capital-gains tax if the holding period exceeds 10 years. Further clarifications on these issues and others are expected later this year.

What is an Opportunity Fund?

Individual investments to benefit the Opportunity Zone will be held in an aggregated Qualified Opportunity Fund. These funds require that at least 90% of the assets held qualify as Opportunity Zone “property” and must be certified by the US Treasury Department. The “property” designation does not imply that these are only real estate funds; rather, the objective is to encourage business activity in these zones. Thus, the definitions of qualified “property” includes newly issued stock in companies, partnership interests or business property in Qualified Opportunity Zone businesses.

Unlike previous incentive programs that capped benefits and placed restrictions on the industries and regions for investment, the Opportunity Zone law is broad and scalable. The law’s main ask is that the businesses are primarily focused on and derive revenues largely from the Opportunity Zone; the main exceptions are around certain vice-related businesses, which are not allowed. The inclusive nature of the allowable property means that activities in the Opportunity Fund may span real estate, such as rehabilitating a building to use as a tech incubator; venture investments that can back startups; and growth capital that could invest in suppliers to a regional manufacturing facility. Rural communities can benefit from projects that require larger spaces such as agriculture, energy, mining and data centers.

To be sure, the new law requires additional clarification before the funds can be established. Many of the requirements outlined in the Opportunity Zones are like those in existing community development programs, leading supporters of the new law to assume similar standards will apply. It is expected that the Treasury and IRS will hand down rules by the end of 2018, meaning that actual Opportunity Funds will likely emerge in late 2018 or early 2019.

For investors in Opportunity Zones, there are generous benefits. Successful real estate developments can be a catalyst for more economic development and new services in these areas. An important goal is to create startups in the Opportunity Zones to bolster job creation in these communities.

These investments are certainly not without risks. Skeptics point to concerns that may challenge the efficacy of the new program:

- Will the areas that really need the capital receive it?

- What about past programs that were not terribly effective?

- Will development in the zones create more overpriced housing that may exacerbate the cost of living for current residents?

Proponents of Opportunity Zones are committed to making this incentive plan more effective than past programs by creating advocacy and educational tools to help potential investors. They are not only investing in the Opportunity Zones themselves, but also are making sure that the tax incentives are robust enough to encourage the scale and duration of investments needed to make the program a success.

Stay tuned for more information surrounding this opportunity as new details are released around this hidden gem nestled within the Tax Cut and Jobs Act.