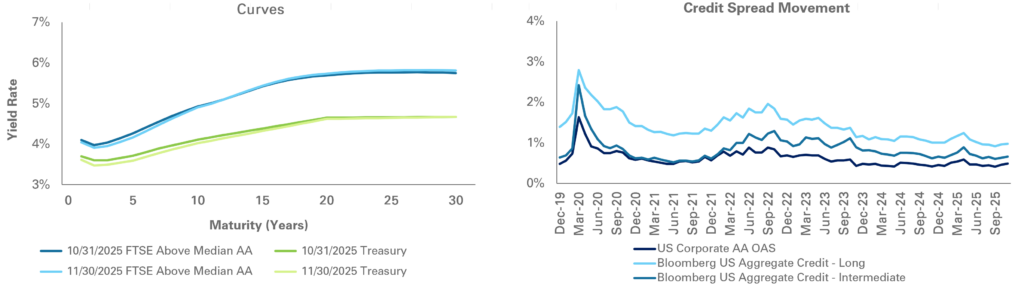

In November, defined benefit pension plan sponsors likely experienced only modest changes in funded status due to limited movement in rates and credit spreads, and generally flat global equity markets. The Treasury yield curve decreased slightly at the long end; the 10- and 30-year yields dropped to 4.02% and 4.62%, respectively.

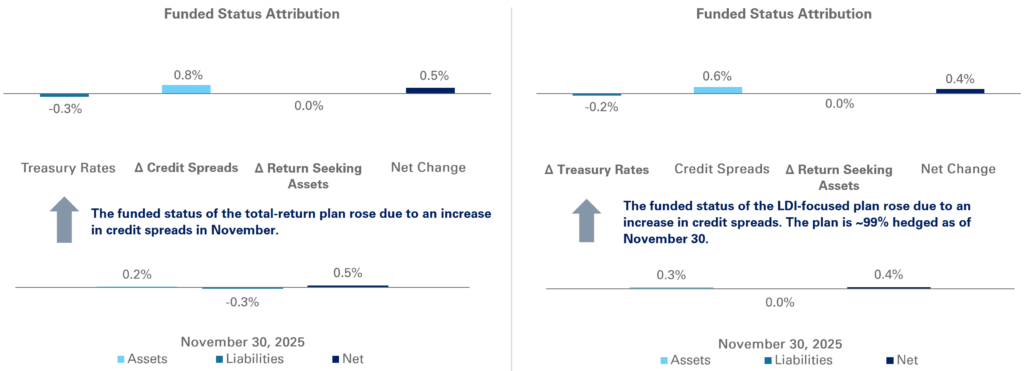

Changes in Treasury rates had a modest impact on funded status for the total-return and LDI-focused plans. The discount rates rose for NEPC’s two hypothetical pension plans by two and one basis points, respectively, with the open total-return plan increasing to 5.48% and the frozen LDI-focused plan rising to 5.25%. NEPC’s hypothetical total-return pension plan and LDI-focused plan saw increases in funded status of 0.5% and 0.4%, respectively.

We anticipate continued market volatility and the potential for market disruption. Plan sponsors should diligently monitor sources of change in funded status versus expectations, as equities and interest rates are likely to remain volatile. This includes closely observing interest-rate hedge ratios and allocating across the yield curve as interest rates change.

Source: Factset, FTSE and Brentwood LLC, as of November 30, 2025

Rate Movement

Retiree Buyout Index

The Buyout Index for retirees is estimated to be approximately 106.1% of PBO, as of November 30, 2025

Recent Insights from NEPC

Private Market Pacing Plans: Out of Step with Changing Times

Recent Corporate Pension Headlines

PRT Litigation Update:

PRT Litigation Update: NEPC continues to monitor the ongoing litigation and volume of pension risk transfers, providing quarterly updates to clients. In the third quarter, the tension between dismissals and denials persisted, with the cases against General Electric and AT&T dismissed, while the Bristol Meyers motion to dismiss was denied. Further, there was a new lawsuit filed against IBM and its independent fiduciary. The overhanging litigation appears to be a key concern, fueling the sharp drop off in PRT transactions through the most recently reported quarter ending June 30. PRT sales declined by about 45% in the second quarter from the first quarter, according to LIMRA data. NEPC will continue to monitor the situation and report to clients.

Sources: “Judge Dismisses AT&T PRT Case, Says Plaintiffs Have Standing.” PLANSPONSOR, October 7, 2025. “U.S. pension risk transfers plummet in Q2 over litigation concerns, economic volatility.” Pensions & Investments, as of September 22, 2025.