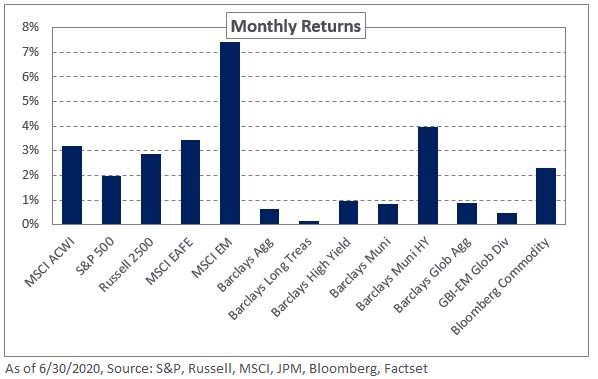

Risk assets added to recent gains as economies around the world relaxed restrictions and central banks and governments continued to provide extraordinary stimulus to offset the weak economic backdrop. Despite a pandemic and a recession, investors embraced risk in their search for yield amid significant central bank intervention and low rates. As a result, global equities posted strong returns following the correction at the end of the first quarter. US equities, as measured by the S&P 500 Index, increased 2.0% in June for a 20.5% return during the quarter. This marked the largest quarterly gain for the index since 1998. In addition, US small caps outperformed large caps with the Russell 2000 increasing 3.5% for the month and 25.4% for the quarter.

Non-US equities also benefitted from the risk-on sentiment and recent weakness in the dollar. The MSCI EAFE Index gained 3.4%, while the euro appreciated 1.0% relative to the dollar in June. Emerging markets outperformed during the month, rising 7.4%, as broad currency appreciation supported returns; the MSCI Emerging Market Currency Index appreciated 1.2% last month.

In fixed income, global rates were mostly unchanged in June, resulting in relatively flat returns for Treasury-based indexes. However, the US 10-year breakeven inflation figure increased 19 basis points, underscoring a rise in inflation expectations. In credit, spreads continued to tighten, reflecting Fed intervention in fixed-income markets. The option-adjusted spreads of the Barclays US Investment Grade and Barclays US High Yield indexes declined 24 and 11 basis points, respectively.

In real assets, spot WTI crude oil bolstered recent gains, up 10.4% for the month. The recent increase pushed quarter-to-date returns to 91.5% as demand has begun to recover with economies reopening and continued production cuts from OPEC+. In addition, spot gold prices rose 3% last month, with investors likely looking to the asset class as a portfolio hedge.

While the recent performance of risk assets has been encouraging, we remind investors of the significant headwinds still surrounding the global economy, especially as positive COVID-19 cases trend higher across the United States. In the face of such uncertainty, we expect heightened volatility to continue across capital markets, given the wide range of possible economic outcomes. To that end, we encourage investors to be disciplined and mindful of market liquidity. We recommend investors maintain at least one quarter of spending needs in cash as potential market dislocations can trigger bouts of illiquidity across publicly-traded markets.