Key Takeaways

- Bonds remain a valuable diversifier to growth-sensitive assets

- Unintended consequences from negative rates have been minimal so far

- The likelihood of a global negative-rate environment, including the US, has increased but is still relatively low

- Investment actions can be split between two distinct scenarios:

- Avoid negative-yielding debt when it is a subset of developed-market bonds

- Review portfolio construction and asset allocation when negative-yielding bonds are pervasive, including the US

Many developed economies are in a period of sustained negative interest rates, as their central banks fight obstinately low inflation and anemic growth. What seemed like extreme—but temporary—monetary intervention in various parts of Europe and Japan now seems like the new normal. While these policies have little to show for in economic expansion or price increases, they fueled a record high of $17 trillion of negative-yielding debt globally in August 2019, according to data from Bloomberg; these bonds total $14.6 trillion, as of early March.

Central banks adopt a policy of negative rates for various reasons, including an expectation that negative short-term rates will dampen rates across the yield curve. This should lower borrowing costs, spurring banks to lend and promoting investment activity further out on the yield and risk curves, creating a wealth effect. That said, negative interest rates can also have potentially adverse consequences that become magnified and pronounced the longer they go on. These penalties include challenged banking business models, subdued investment returns, and, despite central bankers’ best intentions to fuel spending, increased savings, as households try to offset the lower investment returns by squirreling away funds to prepare for life events such as college and retirement.

In the investment world, these sub-zero rates challenge long-held tenets of risk, reward and diversification. Furthermore, these negative rates, which initially appeared limited to parts of Europe and Japan, seem closer to home, as the gravity of global yields drags US yields to record lows. This unprecedented period offers no easy investment solutions: safer assets have low or even negative forward-looking returns, while higher returns will require shouldering increased anticipated volatility.

Unfortunately, investors have few options for assets that offer diversification from risky investments but still carry positive returns.

At NEPC, we believe this stark new reality may require investors to reassess how they view risk in their portfolio. This does not mean investors cannot build portfolios that can weather various economic cycles. Be it through different sources of balance or the inclusion of negative bonds, right-sized, for the benefits they can still provide, investors have options to take on this challenge. Diversification and balance will always be important, even if rates become negative everywhere.

The Role of Bonds in an Investment Portfolio

Let’s consider why bonds sit in an investor’s portfolio: They are a dependable source of income but, more importantly, they exhibit a reliable negative correlation to the growth risk that dominates most portfolios. That negative correlation is portfolio protection; bonds are return-yielding insurance. Would negative-yielding insurance be the worst possible investment to hold? Paying for insurance is not novel. We do it in our own lives, in our businesses and, if the environment forces it, we may have to do the same in our investment portfolios.

There are multiple reasons why this might make sense:

- While negative-yielding bonds are clearly unattractive, they are likely more attractive than even more negative cash. An investor with an objective of outperforming cash may choose negative-yielding bonds, despite the likelihood of loss.

- Certain investors may have liabilities or future commitments that are either implicitly or explicitly interest-rate sensitive and holding interest-rate-sensitive assets, such as bonds, may be appropriate regardless of yield due to their ability to reduce risk of the combined asset-liability structure.

- Negative-yielding debt can still provide diversification to growth-sensitive assets. An investor may choose to hold these bonds within a diversified portfolio to balance against other risk exposures. The deterrent of a negative expected return could be more than offset by liquid and defensive portfolio characteristics they might provide.

- As we have already seen in Europe and Japan, negative rates do not ensure a bottom in rates. Negative rates can become increasingly negative, providing surprising but positive returns to a portfolio, often when other assets are underperforming. An investor with a belief that rates will move lower, that is, even more negative, could buy negative-yielding bonds and earn a profit as the bonds’ prices increase at lower yields.

For US investors, we should think about two distinct environments when considering the challenges that negative-yielding bonds present. The first: the one we live in today, where negative-yielding debt has grown, but is still just a subset of investable developed bonds. Presently, positive-yielding alternatives exist to play the classic role of bonds in a portfolio. The second alternative: a potential future where investment choices are made against a backdrop where negative-yielding bonds are pervasive in the developed world, even in the United States.

Negative Bonds as an Investment Choice

This is the world we have been living in for some time. Investors seeking diversification are looking at a tradeoff with every asset in their portfolio and every potential asset that might be included. That tradeoff is between each asset’s return potential and its expected portfolio benefit, that is, its correlation and risk. Of course, we would love to find high-performing assets with low volatility and negative correlation to the rest of the portfolio, but those assets are more likely to be found in fairy tales than as a choice in asset allocation models. Instead, we have low-return assets with good correlation benefits, for instance, bonds and commodities, or more favorable return assets with poor correlations in the equity and credit spectrums. For investors seeking bonds in their portfolio, they must make that same tradeoff within an asset class.

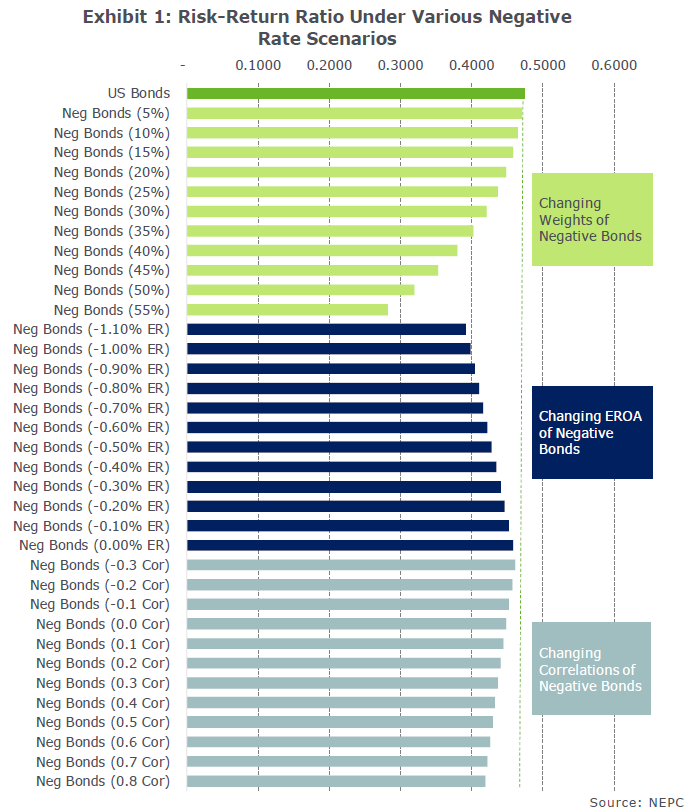

We studied how negative-yielding non-US bonds might fit alongside positive-yielding US bonds in a diversified portfolio (Exhibit 1). We took a US bond allocation and tried adding negative-yielding bonds at different levels within the bond allocation, different expected returns, and different correlations. Our findings indicate there are no set of allocation, return, or correlations, where negative bonds make sense. The Sharpe Ratio of these mixes is worse than just US bonds in every case.

In a world where negative-yielding bonds are among other positive-yielding bonds that have similar portfolio characteristics, investors probably should choose to look past negative-debt markets, sacrificing some diversification within their bond portfolio for enhanced returns and similar portfolio characteristics.

What If There Is No Choice?

Not too long ago, the notion that all bond markets in the developed world, including the United States, could offer negative yields seemed farfetched. Today, investors can envision such a scenario. To be sure, the Federal Reserve would respond but, like its peers, it may not have the necessary ammunition to provide a substantial stimulatory response. Historically, a reduction in short-term rates of over four percentage points has been typically required to stimulate the US economy out of recession. With the current Fed policy rate at 1.50% to 1.75%, the firepower needed to promote growth may be lacking. While the central bank may at first try (again) a zero Fed Funds rate and quantitative easing program, it is not utterly fanciful to think that at some point the Fed may try a further reduction in rates below zero to spark the necessary growth to shake off a recession.

To be clear, this is not a prediction or a foregone conclusion. The US economy, despite entering its eleventh year of an economic expansion, appears still on solid footing. And regardless of when the economy ebbs and the Fed needs to act, the central bank and, to a lesser extent, the US government (if there is a coordinated monetary and fiscal response) have a powerful arsenal of tools, including a government balance sheet that can be levered up and the ability to inject fiscal stimulation directly into the economy, which may render it unnecessary to deploy negative rates.

That said, the decline in US rates over the last few months, and a deeper dive into negative yields in Europe and Japan have increased the possibility of an environment where negative rates are pervasive. Given the importance of bonds and the reliance on them in investors’ portfolios, it is important to consider this scenario and develop a game plan to manage assets through such an unprecedented period.

The biggest challenge for investors: to build a risk-balanced portfolio when bonds—critically important to balance the typical portfolio’s dominant growth risk—come with a negative yield. It is in sovereign debt markets that investors see the direct pricing and yields resulting from a negative-rate policy, but market expectations arising from negative yields extend far beyond sovereign rates.

A downward shift in rates should lower the discount rate for cashflows of other riskier asset classes and, all else equal, increase prices as sovereign yields form the baseline for the discounting of cashflows across all asset classes. While the path to these higher prices can be helpful for investors, it limits future upside as more of the future growth in cash flows is already priced in. This is less a story of negative yields and more about falling yields, whatever the starting point. This holds true even today after the most recent drop in rates. It will just be that much more dramatic if all rates are negative globally.

A starting point for investors in this scenario is that return expectations across the board will be low while they consider the portfolio benefit of bonds against an expected return that is negative. However, this does not mean that there are no options available for investors. We outline three below:

- Investors may consider other alternatives beyond bonds for diversification. In this environment, with monetary policy maxed out, perhaps debt-driven fiscal policy will be used more actively to promote economic activity. These policies would probably come at different times across countries and the debt build-up in each economy would likely lead to currency weakness relative to other currencies. As other countries join in, their currencies would weaken as well. This seems like an ideal environment to hold hard assets, including precious metals such as gold.

- Focus on the principles of balance, and not the classic outcomes of balancing betas like equities, bonds and real assets. Instead, seek balance within asset classes, and attempt to more conservatively position the equity allocation by building up more defensive factors. Find high-quality but positive-yielding credit investments. Lastly, examine the prospects for higher-yielding markets, like emerging-market debt, and consider how risky these exposures really are given the environment. Study these markets to see if they are safer than their historical experience suggests. Sure, 10 or 20 years ago it would have been improbable to consider emerging-market bonds as safe-haven assets, but then again, $20 trillion of negative-yielding debt would have seemed unbelievable as well. Creative portfolio construction could minimize, but perhaps not eliminate, the need for safe-haven developed-market bonds.

- A hardly creative but certainly uncomfortable solution would be to just own the negative-yielding bonds. An important reminder: regardless of the absolute level of negative-yield bonds, if the yield curve is positively sloping — could there be a starker financial market oxymoron than a positively-sloping negative-yield curve? — an investor is still likely to earn an excess return relative to cash. While this may bring scant comfort in a world of negative returns, it highlights the need for investors to act because negative-return bonds are still more attractive than negative-yielding cash.

We looked at whether it could be beneficial to hold bonds at negative yields (like the analysis above, but with all bonds assumed to be negative.) (Exhibit 2). We found that at slightly negative yields (up till negative 50 basis points), it can beneficial or, at least not too harmful, to hold negative-yielding bonds.

Conclusion

Negative yields appear here to stay in several parts of the world. Should negative rates remain isolated to these regions, it would seem US investors still have plenty of choices to effectively build diversified and risk-balanced portfolios. A potentially scary scenario is one in which the US and other developed countries join Europe and Japan in economic paralyses, and the combination of monetary response and muted inflation expectations send rates into negative territory across the globe. Investors will not only face muted return prospects, but also fewer options to achieve balance in portfolios.

This does not mean investment portfolios lose their ability to withstand various economic environments. It does mean that investors will need to reassess portfolio construction and investment risk. Bonds may remain a valued diversifier to growth-sensitive assets, but it may require creative portfolio construction, including finding other sources of defensiveness, such as sacrificing some quality in the form of lower-rated investment-grade fixed income and higher-quality emerging-market debt, to achieve higher expected returns. Of course, while considering this potential scenario is a useful exercise, the only thing we can predict with certainty is that the unexpected will inevitably happen. To this end, diversification and balance are critical, even if rates are negative everywhere. In fact, diversification and balance will always be important, especially if rates are negative everywhere.

Depending on how you define yield, holding a negative-yielding asset that offers the expectation of uncorrelated returns may not be as alien to portfolios as we may think. Hedge funds, in a zero-rate environment, could have surprisingly similar characteristics in a flashier package to negative-yielding bonds. There is an expected cash return of zero, so hedge funds essentially start with a meaningful negative yield when a fund’s management fee of 1%-to-2% is tacked on. We may be okay paying this negative yield if we still expect positive returns along with, most importantly, positive returns when we really need it. Considering how hedge funds would survive in a negative-rate world instead of a zero-rate world is an interesting discussion for another time. Suffice to say, we do not think hedge funds are the ideal solution for portfolio protection in a negative-rate world as the reliability of their defensiveness is weak, and their fee structure would be challenged in the low-return world that we could expect if rates are negative.