The markets aren’t serving a free lunch anymore.

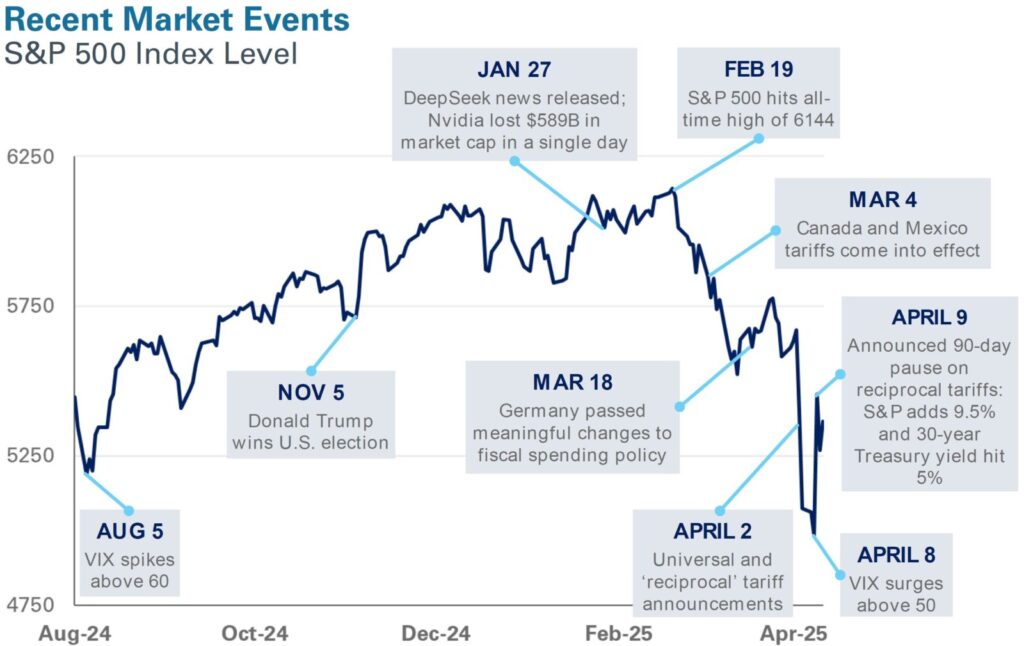

New policies around tariffs and trade have pierced through the calm, fueling volatility that has rocked portfolios and shaken the complacency of investors used to the easy gains of the past two years. Investors are struggling to find their footing in this new normal, with markets swinging one way and then another as policies are announced, denounced, negotiated and walked back on. Volatile markets require greater vigilance and active decision making. Enter: Outsourced Chief Investment Officer (OCIO). As investors attempt to make sense of the goings-on in the marketplace, we remind them of the power and the value of these services, especially in times of turmoil and uncertainty. An effective OCIO framework can not only help clients get through market turbulence, but also take advantage of it.

At NEPC, we believe disciplined portfolio management during periods of volatility can help protect long-term investment objectives. Strategic rebalancing during dislocations allows for adjustments that are grounded in each investor’s unique set of circumstances, policy statements, and asset allocation goals. The aim is to preserve the integrity of a portfolio’s long-term financial objectives while recognizing and adapting to the near-time challenges posed by an evolving investment landscape.

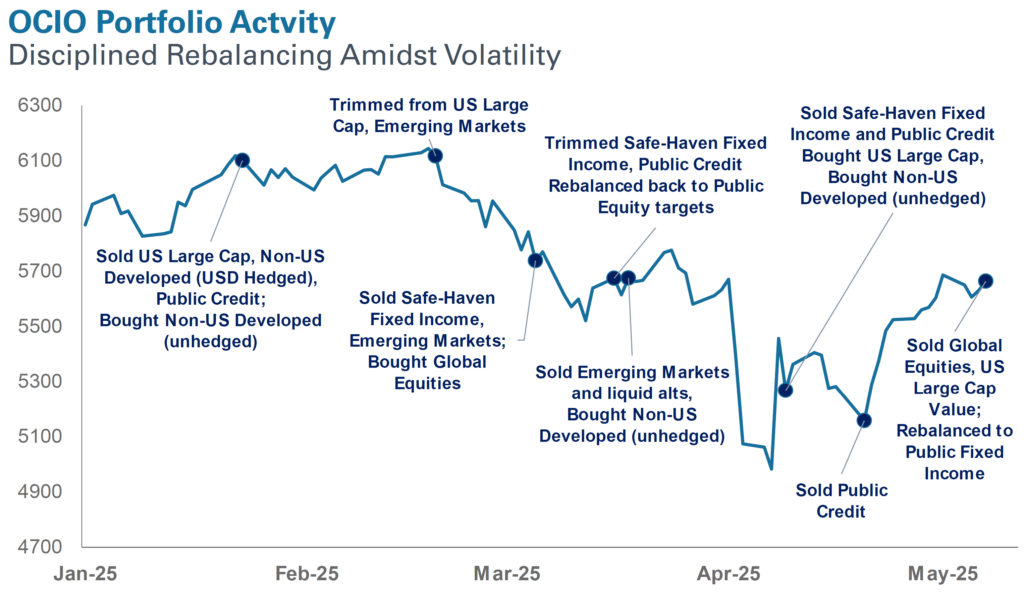

NEPC OCIO Team in Action

As markets sold off in March, the first drawdown primarily affected U.S. markets with year-to-date declines of 6% in the S&P 500 through mid-March. The uncertainties around tariffs, rates and implementation weighed down growth assets, while non-U.S. markets fared better, creating an opportunity to sell public fixed income and harvest gains from non-U.S. stocks to top up our U.S. leaning allocations.

The funding sources were liquid, with minimal transaction costs. Also, the trades were done such that the portfolios held adequate safe-haven assets—Treasuries and investment-grade fixed income—to preserve liquidity. At NEPC, we recognize that the cash flow needs of our clients do not stop when markets sell off. As we rebalanced portfolios, we kept in mind the liquidity needs unique to each client, ensuring that trading across our OCIO portfolios was guided by our clients’ individual investment policy statements.

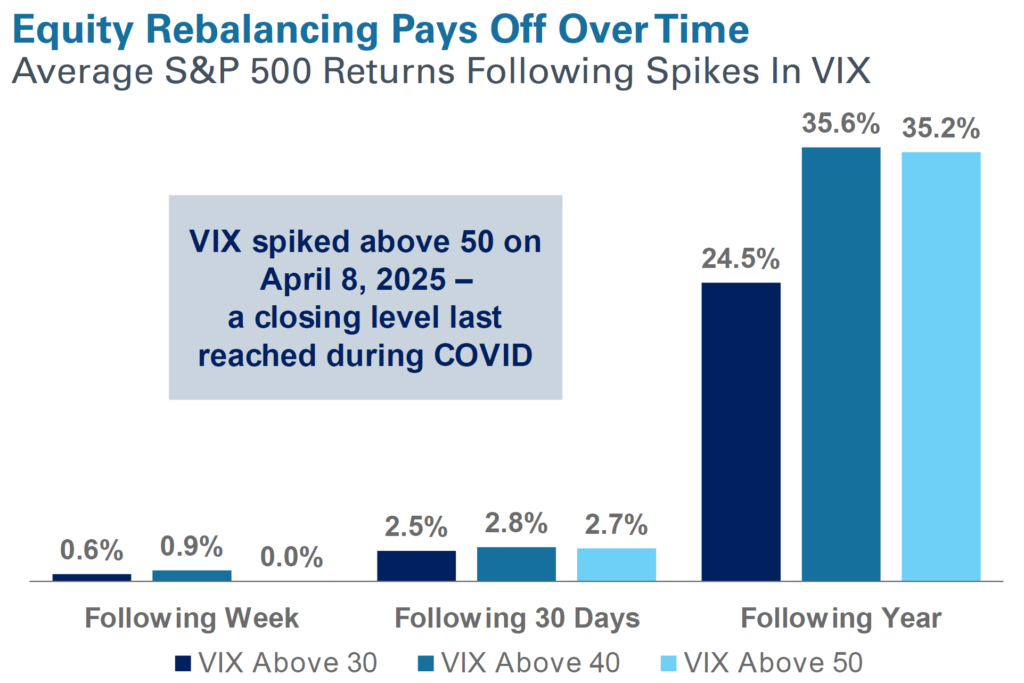

Then, as global equities sold off in early April on the back of announced tariffs that were stiffer than markets expected, we used the opportunity to buy back in. Various studies have demonstrated the additive effects of reentering markets during drawdowns and rebalancing back to targets and, on the other side, harvesting gains while mitigating extreme drifts from targets. NEPC’s asset allocation team looks to the VIX Index, a reliable gauge for market volatility, for guidance around rebalancing: when VIX levels hit 40, it is invariably a sign to review equity allocations relative to strategic targets and add exposure to return to target levels.

Subsequently, as equities rebounded from their lows, rallying mid-April to mid-May—with gains of over 10.4% for the S&P 500—our allocations, coupled with our rebalancing trades, led to a modest overweight in stocks. This resulted in the opportunity to realize gains while adding back to safe-haven exposures and creating dry powder. After being liquidity providers when equities hit a low, we were liquidity takers for our clients’ portfolios. The moves allowed each portfolio to gain from the rallies, and our disciplined approach led to harvesting those returns to add back to safe-haven assets.

Even though we saw these gains play out over the course of weeks, we remind investors that rebalancing is additive over time; in most cases, the effects of rebalancing are not realized immediately, but bear fruit eventually.

The Hallmarks of NEPC OCIO

As stewards of your capital, we approach our responsibilities as an outsourced chief investment officer with deliberation and thoughtfulness. As your OCIO provider, you have the backing of a dedicated consulting team and the might of our operations and research capabilities. Our OCIO clients are served by 25 legal, compliance and operational professionals, and a nine-person OCIO investment team. This team is overseen by a robust governance committee comprising senior leadership across practice groups, providing seasoned investment counsel, oversight and accountability.

Our trades are intentional and thoughtful: we carefully review allocations, particularly those involving regional equities and publicly traded fixed-income securities. Our proprietary in-house rebalancing tools offer a complete look-through into all our OCIO portfolios, provide daily values across all asset classes and pull in parameters of each client’s policy targets and ranges. Our trading tool is complemented with in-house analytics that cover liquidity and scenario analysis, and the ability to stress test portfolios.

We also emphasize the importance of a diversified portfolio. This approach has been instrumental in our relative success so far this year, as U.S. markets sold off, and our non-U.S. positions, coupled with diversifying exposure, cushioned the blow. Also, our recommended safe-haven exposures have been a source of liquidity in a down market, while also helping our clients meet their monthly obligations.

We use periods of market turmoil to rebalance your investments strategically and opportunistically, while keeping in mind your unique set of circumstances such that the integrity of your portfolio’s long-term objectives remains intact. We strive to do what we do best so our clients can do what they do best.

For questions on our OCIO services and how to best implement them in your portfolios, please reach out to your NEPC consultant or visit NEPC.com