Introduction

A hallmark of a successful investment program for private wealth clients is a periodic review of the portfolio and the financial objectives it seeks to fulfill. A thoughtful analysis of the portfolio’s asset allocation strategy is an essential component of this evaluation process. It offers high-net worth individuals and their families an opportunity to critically assess the asset allocation targets in place and confirm that all elements of portfolio construction align with their long-term goals.

We recommend reviewing the asset allocation strategy annually. This process, which entails a high degree of customization, runs the gamut from evaluating new investments, to overweighting allocations with a more favorable risk/return outlook, to identifying weaker prospects that may be trimmed or redeemed. An added complexity: tax implications for the portfolio. At NEPC, we have intentionally developed our process to keep in mind the potential impact of taxes on investments.

SETTING ASSET ALLOCATION ASSUMPTIONS AT NEPC

Every year, NEPC’s Asset Allocation Committee is tasked with establishing and updating our five-to-seven-year and 30-year forecasts for asset classes. As part of its process, the Committee considers future potential returns while challenging research team members on how the markets may perform in order to derive key market themes, current opportunities, and capital market assumptions for over 40 asset classes.

Significant time is also spent discussing the main drivers of future returns. At NEPC, our return assumptions are based on a forward-looking analysis of core return drivers. These drivers establish the foundation of our framework of building blocks. Historical analysis shows us that these building blocks are indeed the drivers of long-term returns. Knowing what they are is academic; forecasting what they will be is an exercise in intellectual rigor.

The methodology of building blocks uses forecasted market and economic data to inform expected returns. While the individual building blocks vary across equity, credit and real assets, the process is similar.

As an example, the building blocks for the equity sub-asset classes—for instance, US large-cap stocks and emerging international equity—look at four key areas to help determine the overall potential for forward returns. These areas include:

- Valuation – An input representing price-to-earnings (P/E) multiple contraction or expansion relative to the long-term trend and adjustment for expected changes in profit margin over the forecast period.

- Inflation – This represents market-specific inflation derived from an index of the revenue-contributing country and region-specific forecasted inflation.

- Real economic growth – This reflects market-specific real growth for each equity asset class as a weighted-average derived from an index of the revenue-contributing country.

- Dividend yield – This is informed by current income distributed to shareholders with adjustments that reflect market conditions and trends.

To quantify the forecasted returns, we use assumptions based on our research such as mean reversion to the historical valuation levels, expected future profit margins and inflation levels. These “blocks” are then combined to determine our forecast.

For example, we use building blocks to forecast an expected growth rate of 5.25% for US large-cap equities and 9.00% for emerging markets (Exhibit 1). For US large-cap stocks over the next five-to-seven years, we are estimating a roughly 2.5% growth rate for real earnings, a 2.5% inflation rate, a 2.0% dividend yield and a 1.75% contraction in the current valuation. The forecasted contraction in the valuation multiple is driven by our estimates for currently elevated levels of P/E ratios and profit margins to revert towards historical averages. Comparing the assumptions for US large-cap stocks and emerging markets equities, we see that we are predicting higher rates of real earnings growth, inflation and almost no valuation adjustment resulting in increased expected returns over the five-to-seven-year period.

LOOKING FORWARD, NOT BACKWARD

Over the long term, real earnings growth, inflation and dividend yield drive stock market performance. To this end, developing a disciplined process to establish forward-looking assumptions is imperative. Far too many firms and advisors rely on backward-looking assumptions to inform their current asset allocation decisions. The result is that they are investing their clients’ resources in the most expensive asset classes and failing to reap the benefits of diversification.

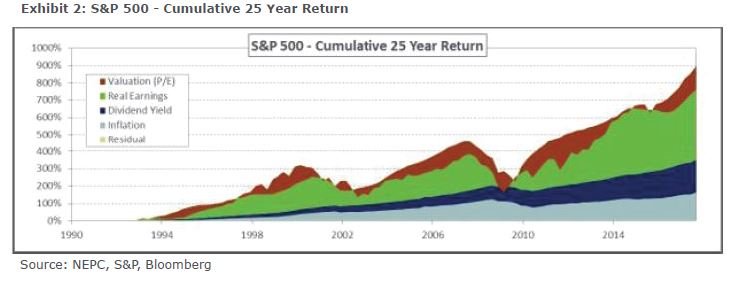

Valuation levels are a volatile source of returns that cannot be relied upon in the event of market distress (Exhibit 2). As the market experiences a slowdown, valuation levels typically revert to-or-below historical levels causing stock prices to go down. By focusing our process for setting assumptions on what affects long-term returns the most, we can establish a reasonably accurate forecast for the directionality of markets over the intermediate-to-long-term time frame. To this end, institutional investors use this information to tweak their asset allocation targets each year; however, private wealth clients also need to consider the tax implications resulting from changes to their portfolio.

THE IMPORTANCE OF TAX IMPLICATIONS

A key difference between private clients and institutional investors is the tax impact associated with each investment decision. A set of after-tax asset allocation assumptions needs to be incorporated into the process for taxable clients to better inform the asset allocation process. While we can make general assumptions about the post-tax return expectations of every asset class, there can be material differences in the actual experience within any given asset class for each investor. Thus, it is vital to customize our private clients’ asset allocation strategy to reflect the implementation and tax implications for each investor.

To do this, we complete the following four additional steps:

- We identify any expected tax-advantaged components of returns, for instance, the tax-exempt income of municipal bonds or strategies/asset classes with return of capital or depreciation benefits.

- We deconstruct the asset-class returns into two components: income and gains.

- We examine the historical turnover in the asset class; we apply this to the gains portion of the return to delineate between short-term and long-term capital gains.

- We apply the appropriate federal, state and net-investment income taxes to each type of earnings to generate an after-tax return. The importance of this cannot be overstated given the tax liabilities associated with income generation and gains realization; it is crucial to understand the tax characteristics which make up the total return of an asset class.

CUSTOMIZING THE ASSET ALLOCATION DECISION

Incorporating the inputs developed through the process described above into a family’s individual asset allocation review process requires a great deal of customization since after-tax returns vary among clients. Tax treatment of managers held in the portfolio may differ from general asset-class assumptions. Cash flows, liquidity needs or unique holdings are just a few of the many factors that must be considered when reviewing the asset allocation strategy.

Further complicating matters are the limitations of asset allocation models. These limitations are one of the reasons we encourage clients to take a multi-faceted approach to the decision-making process. The use of additional tools, such as risk budgeting, and factor or scenario analysis, can provide a better understanding of the potential range of outcomes as individuals and families seek to reaffirm or revise their chosen asset allocation strategy.

CONCLUSION

The asset allocation strategy has a longer-lasting impact on the success of an investment program than almost any other decision. Yet, it can be hard to get right as it requires a disciplined forward-looking return-forecasting process, a multi-faceted asset allocation model and involves a unique set of investment goals. The asset allocation process and the implementation of tactical adjustments become even more difficult when specific tax circumstances are added to this mix. A tactical adjustment may look attractive on a pre-tax basis, but the advantage may be diminished or even lost after accounting for embedded gains in positions that would need to be sold to implement a tactical opportunity. Despite these challenges, we work with our clients to incorporate annually a rigorous and disciplined review. We believe there are no shortcuts to success and that our robust, customized asset allocation process will help our clients’ meet their long-term goals.