The NEPC Asset Allocation Committee is retiring one of its key market themes as it explores and analyzes the prevailing trends influencing asset allocation and investment strategies.

Not making the cut: Federal Reserve Gradualism.

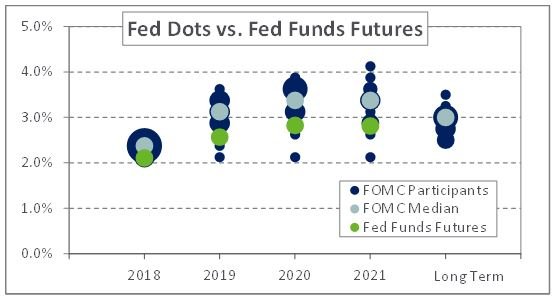

For us, this theme underscored a Fed tightening (raising the Fed Funds rate) that was:

- Slower in pace than the market’s expectations (as measured by Fed Funds futures)

- Aimed at a longer-term “normalization” of higher rates, and

- Telegraphed and carried out to not disrupt markets.

The theme’s removal stems from a shift in the first two tenets. We find the pace of tightening monetary policy now exceeds the expectations of the market. Also, the Federal Open Market Committee’s “dot chart” expects the interest rate in 2020 to be higher than the long-term Fed Funds rate.

Source: Federal Reserve, Bloomberg

To be sure, we still expect the Fed to respond cautiously to growth, employment and inflation estimates over time, and to be measured in its communication. Meanwhile, the unwinding of the assets on the central bank’s balance sheet is still expected to span many years. We still expect the Fed to play a prominent role in global financial markets, with its new leadership tested through a future recession.

As for the extraordinary level of quantitative easing we saw at the peak of the financial crisis, only time will tell whether it will be a part of a central bank’s standard arsenal in times of economic distress, or if the Fed and its global counterparts will actively work to decrease their dominance over markets.

A little background on our key market themes: While we have always viewed our asset allocation and investment strategies through the lens of prevailing market trends, these were formally incorporated in 2016.

Since inception, this is how we have defined them:

Key market themes are factors that define global markets and can be expected to both evolve and remain relevant without a clear timeline of conclusion. At times, themes may be challenged. Disruption of a theme will likely produce significant volatility and change market dynamics. Our intent is for clients to be aware of these themes and understand their implications.

Our ongoing themes are:

| Key Market Theme | Summary | Established |

| China Transitions | The transformation of the world’s second largest economy’s demographics and capital markets, and its shift to being consumer-oriented rather than export-focused | 1990s |

| Extended US Economic Cycle | A long but slow recovery | 2012 |

| Globalization Backlash | Political discontent with globalization, an uneven economic recovery and a stagnating middle-class; Brexit and US elections | 2016 |

| Synchronized Economic Resurgence | Market stability the world over results in a unified improvement of global economic conditions | 2018 |

Stay tuned for the continued evolution of themes and their implications.