Liability driven investment-focused pension plans that hedge interest-rate risk with long-duration bonds fared better in 2020 than longer-duration total-return plans with allocations more focused on equities.

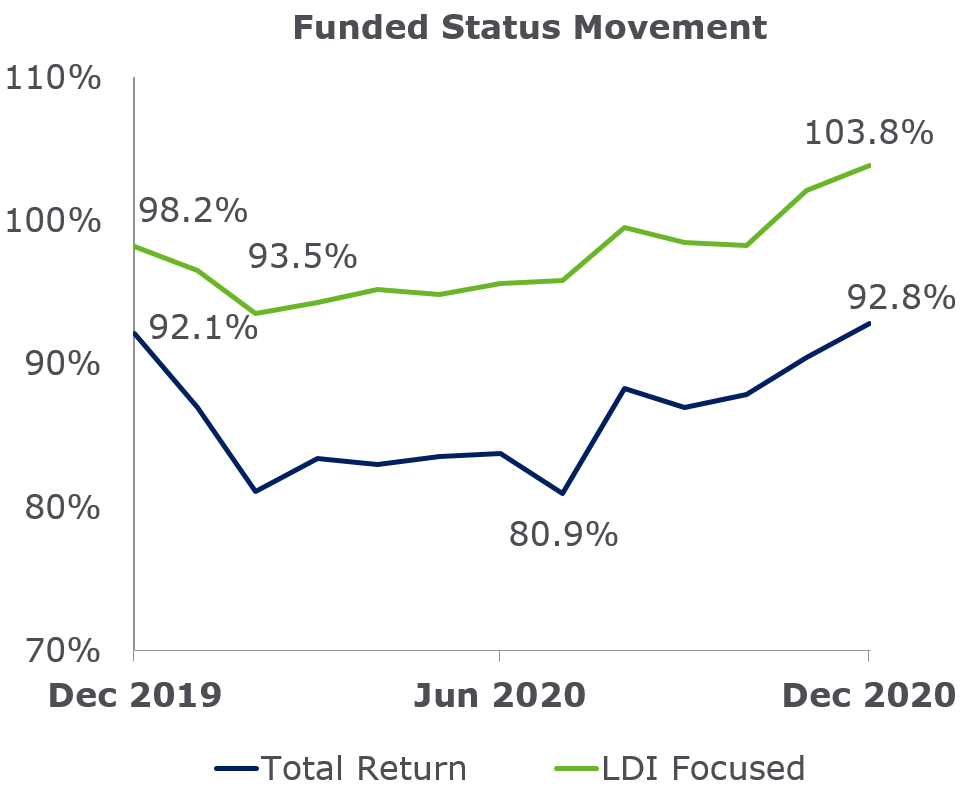

The increase in funded status through the use of LDI underscores its effectiveness as a tool to manage portfolio risk and reduce funded status volatility. At NEPC, we track the funded status of two hypothetical pension plans: a longer-duration open plan investing in a total-return portfolio, and a shorter-duration frozen plan that hedges interest rate risk. The funded status of a typical LDI-hedged corporate pension plan increased over 5% in 2020. In contrast, a total-return approach resulted in lower funded status for the better part of the year, ultimately finishing up less than 1%, despite robust equity returns. While the higher equity allocations of a total-return plan helped offset the increase in liabilities, the rally in long bonds boosted returns for plans incorporating LDI.

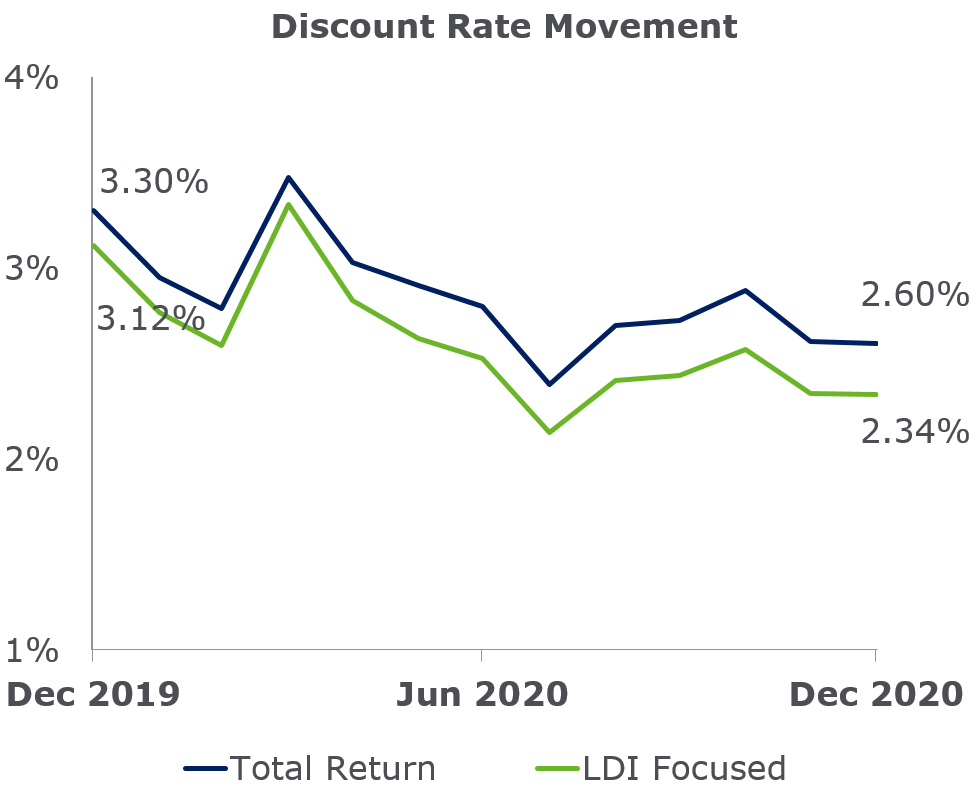

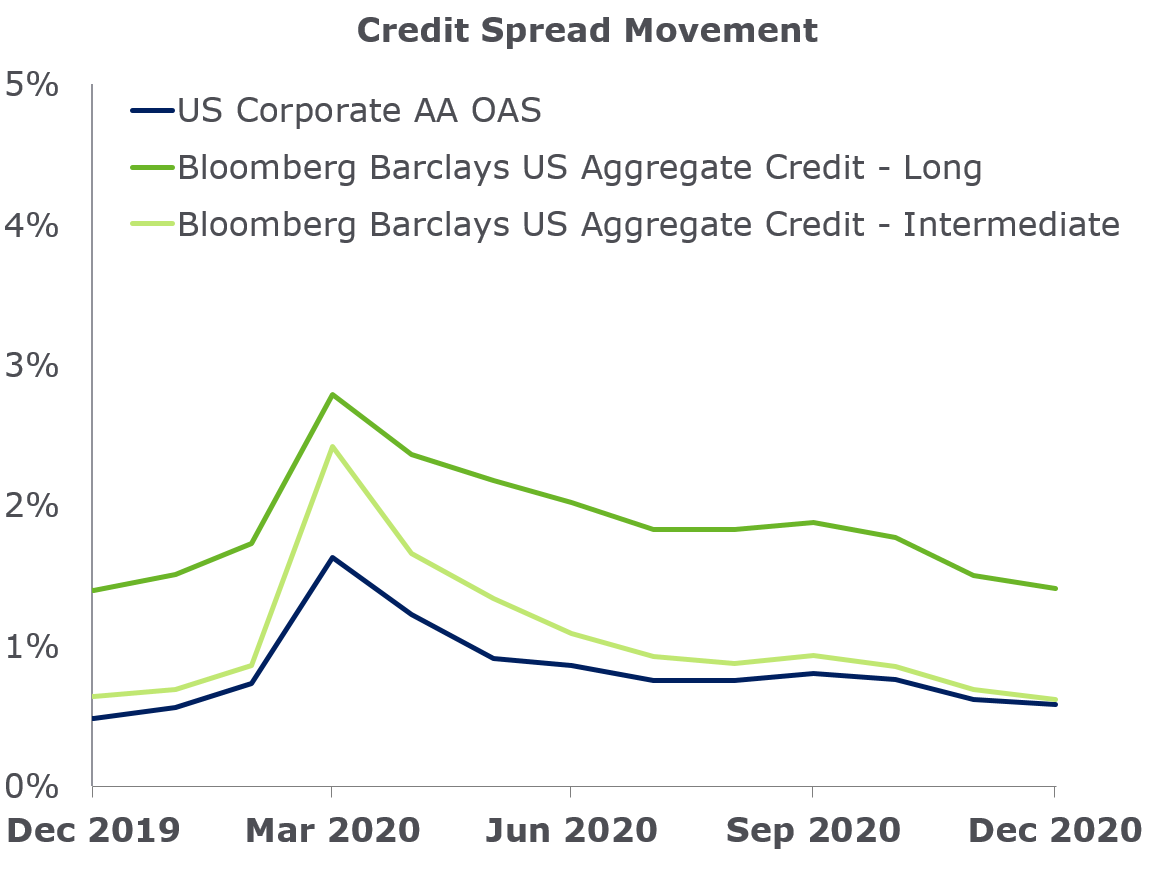

The roller coaster ride of the market was mimicked by movements in discount rates, which are used to value pension liabilities. Treasury rates took a deep dive in March and stayed low as the Federal Reserve stepped in to contain the economic fallout from the COVID-19 pandemic. As a result of tightening credit spreads, discount rates gradually declined from March onward. The fall in discount rates through the year had a greater effect on the liabilities of the longer-duration open plan.

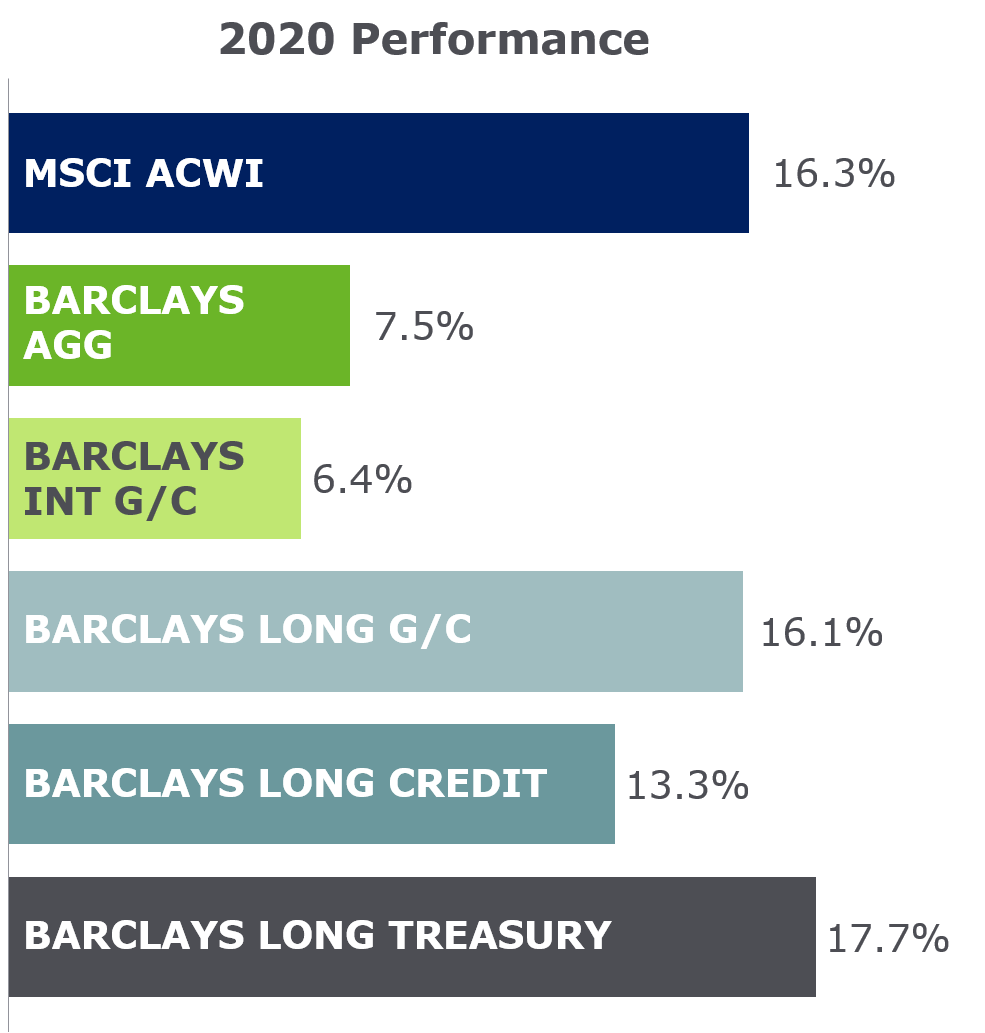

In the first quarter of 2020, equities plummeted 32% as COVID-19 tore through the world, shuttering economies. Subsequently, stocks made a strong comeback—finishing the year with gains of 16.3%, according to the MSCI ACWI Index—as central banks and governments stepped in to bolster economic activity, in line with NEPC’s key market theme of Permanent Interventions.

Treasury rates began to fall in January and February of 2020. In March, even as the Fed lowered interest rates by 1.5%, credit spreads initially widened, offsetting the central bank’s moves for pension liability discount rates. The remainder of the year saw Treasury rates hover around historical lows, while credit spreads slowly tightened back to pre-COVID-19 levels. The resulting declines in discount rates increased liabilities, eroding gains from equities. For the full year, long bonds had returns rivalling equities.

The interconnectedness of equity markets, Treasury rates, and credit spreads highlights the effects that liability duration and asset allocation have on pension funded status. Please contact your NEPC consultant to better understand and integrate these factors in your pension portfolio.