Insurance companies were in the eye of storm during the Global Financial Crisis of 2008. The fall of behemoth AIG made headlines and the subsequent collapse of monoline bond insurers kept the industry in the news. As valuations of corporate debt, mortgage- and asset-backed securities plummeted, and the preferred stock in Fannie Mae and Freddie Mac was rendered worthless, insurers waited for the sky to fall. Life insurers were thought to be vulnerable because of their holdings of commercial mortgage-backed securities, while the property and casualty industry was under pressure amid predictions of widespread destruction in municipal bonds. But the sky stayed intact. And the projections of mass defaults came to naught.

It was the large holdings of straitlaced high-grade debt—a staple in many insurance portfolios—that helped most US insurance balance sheets emerge with only minor bruises relative to other institutional investors. The recovery period post-Katrina and after the Financial Crisis opened up attractive opportunities for investment in the insurance industry. At the same time, a new world of under-valued and deeply-discounted assets had hedge funds and private equity firms scouring the landscape for capital pools to deploy. It was a perfect storm.

Initially, alternative investment capital that flowed into the insurance universe spurred the rapid evolution of the hedge fund reinsurance model in Bermuda and the Caymans. More attention was paid to portfolio risk levels as insurers learned from the missteps of Max Re and Scottish Re. Although the hedge fund reinsurance business plan still leveraged the investment part of the balance sheet to deliver superior returns, the new entrants were more balanced in their investment risk approach. Private equity money also came in, with big names, for instance, Apollo Global Management; Apollo caused a splash with its creation of Athene, an insurance entity that sought to lift blocks of annuity businesses from traditional insurers and create a stable base of capital for illiquid investing.

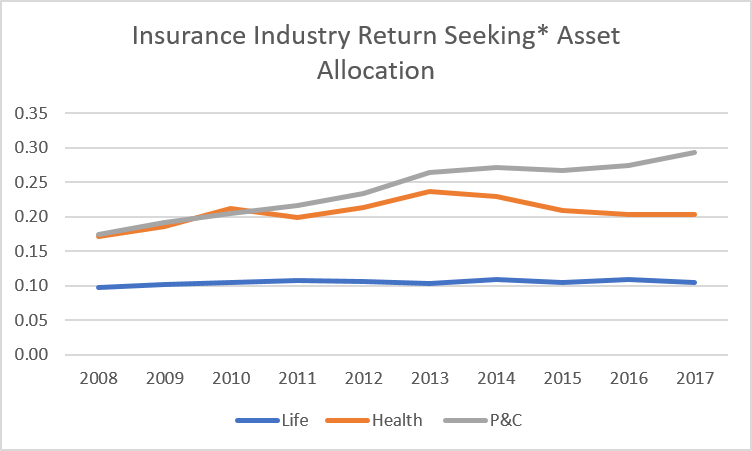

Continued low interest rates and the impact of new entrants with the desire and capacity to add risk, put pressure on traditional insurers with plain vanilla investment portfolios. The risk pathway of the industry was one of measured evolution. Initially, many insurers built out risk allocations with assets that were only a step away from traditional bond portfolios. Depleted public equity holdings were replenished and high-yield corporate bond allocations were funded in the early stages of the economic recovery. The second stage of the movement was into “pseudo alternatives.” The first income-generating asset classes to be added to this category included leveraged loans, mezzanine debt and master limited partnerships. As credit spreads tightened on these securities, insurers looked to gradually add more complex and less liquid investments, migrating to private markets.

At NEPC, we continue to recommend that insurance companies build portfolios to weather all storms. This includes the use of more sophisticated investment solutions that access the traditional drivers of return – credit, term and some equity. While it is difficult to imagine insurers moving significantly away from the conservative investment philosophies that have served them well over time, the addition of more complex assets in recent years has served as an incremental driver of return, providing diversification over a business cycle. Although every push to increase returns through more diverse investments faces resistance from the intricate web of regulators and ratings agencies, it is unlikely that insurers will dial back their exposure to these assets.

For NEPC’s complete coverage of the 10-year anniversary of the Financial Crisis, click here.