Now may be a good time for U.S. employers to check in on their defined benefit plans amid the ongoing tumult and uncertainty in the world.

Plans have come a long way since legislation and rising rates bolstered their funded status to the point where many are now fully funded. However, the recent uptick in market volatility may upend these hard-won gains. As a result, now is an opportune time for plan sponsors to examine the benefits and risks of the pension plan within the context of their overall business and reconfirm plan objectives and the investment strategy.

At NEPC, we have identified the following three areas for plan sponsors to consider while reevaluating their DB plans.

REVIEW, REASSESS, RECONFIRM

Pension relief from the American Rescue Plan and the Infrastructure Investment and Jobs Act of 2021 reduced or eliminated minimum required contributions for the next decade with the extension of the use of inflated discount rates. Given this somewhat new position of having a well-funded, low or no-contribution pension plan, the urgency to transfer the liability has been reduced and become less attractive from a cost perspective. As more corporations choose to keep the pension plan under their own purview, it becomes imperative to reassess the end state of the pension plan and ensure that the funded status gains earned over the last few years are protected against market movements. We recommend analyzing hurdle rate targets and liability-hedging strategies to ensure asset allocations and expected returns are in line with current liability profiles.

Every plan’s journey is different with many potential decision points along the way. With plan objectives and end-state goals in mind, it is important to review your plan’s future goals and consider the impact of various strategies, for instance, pension risk transfers, annuity buy-ins and plan hibernation. The cost of implementation, plan time horizon, liability size and participant benefit profile are important factors to determine the best approach for your unique situation. An action seen more frequently as plans’ funded status improves is a pension risk transfer. For plans that have, or are considering, risk transfer activities such as lump-sum payouts or annuity buyouts to reduce plan liabilities, it is important to understand the impact on residual plan assets and liabilities leading into and after the risk transfer. Finally, it is imperative to reconfirm that your plans’ allocation targets align with the remaining liability profile and revised plan objectives.

GOVERNANCE

The COVID-19 pandemic has highlighted the need to ensure processes are in place for nimble and consistent implementation. Investment and risk management opportunities can arise quickly and, often, don’t align with quarterly meeting schedules.

After more than a decade of an LDI hedging journey, plan liability durations may be shorter as many plans are closed to new entrants or have frozen benefits altogether, and populations have aged. Lower duration and plans’ higher funded status have reduced overall volatility and shifted the risks. It is important to understand the different sources of volatility and evaluate key drivers and attribution of funded status volatility.

Despite the current forecast for higher interest rates, we recommend plans hedge with discipline and remain within interest rate hedge ratio targets as the future rate path remains unknown. We caution against over-hedging as asset and liability durations may change quickly as interest rates move.

Within the context of your investment policy and strategic investment framework, we believe plan sponsors can better prepare for action and capitalize on market opportunities with prudent governance frameworks in place. For those with allocation glide paths in place, agility can be advantageous for hedging interest rate risk. We recommend monitoring the funded status of a plan’s glide path on a more frequent basis or delegating authority to execute policies to committee members, staff, a completion manager, or an outsourced chief investment officer (OCIO).

OPPORTUNITIES

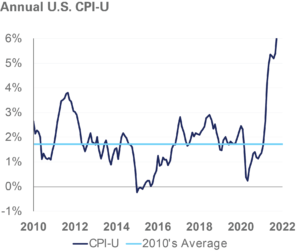

Inflation is currently at a multi-decade high and potential monetary policy response is dominating headlines. While inflation poses varying risks and opportunities throughout capital markets, it is important to recognize the inflation impact on a corporate defined benefit plan. Inflation can be a pension plan’s ally as liability values shrink with rising rates, despite some plans having inflationary components in their benefit formulas.

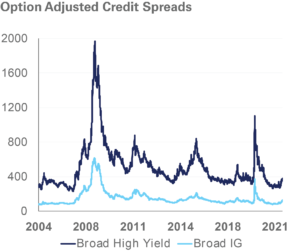

With increased scrutiny on inflation and potential policy actions of the Federal Reserve, we urge sponsors to look beyond the headlines and be mindful of credit spread levels in multiple market segments. Though credit spreads overall have widened somewhat from historically tight levels, ongoing monitoring of two segments—long-corporate and high-yield debt—are especially relevant for this discussion. Long-corporate spreads and high-yield credit continue to trade below historical medians. For plans with return-seeking fixed-income exposure, we recommend an assessment of credit quality of dedicated allocations to lower quality credit.

At NEPC, our Asset Allocation Committee reviews monthly a broad range of economic indicators and crafts investment views over both medium- and long-term horizons. These views can be implemented through changes to active allocation relative to a strategic target or by employing dynamic tilts to deploy excess portfolio cash. Given the current interest rate environment, we suggest maintaining hedge ratio targets while being prepared to lean into credit if there is a period of outsized spreads.

As we find ourselves at an economic crossroads, NEPC investment advisors are available, as always, to help interpret market dynamics and how they may apply to your unique situation and plan objectives.