John Maynard Keynes wrote of economic instability caused by animal spirits – the idea that human nature works against the clean and tidy world of mathematics. The same holds true for investing – emotions and behaviors can derail an otherwise sound investment approach, especially during periods of volatility, like the kind that has rocked markets in the past few months.

Enter: the investment policy statement (IPS), a document outlining an investment plan, financial goals, risk constraints, and guidelines for reliable, informed decision-making to ensure a balanced and disciplined investment approach. We believe it lays the foundation for an effective advisory relationship, setting up our private wealth clients for success and creating a buffer against kneejerk and impulsive investor behavior that can lead a portfolio awry.

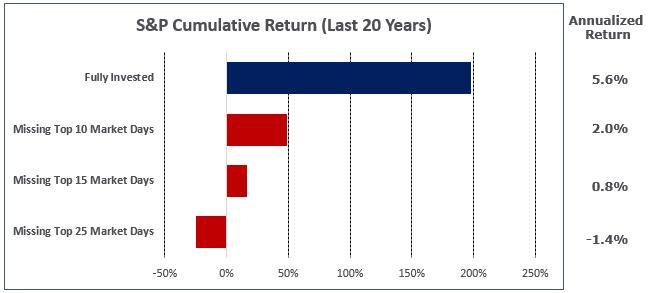

To wit, the chart below shows the impact of missing just a few of the top performing days in the S&P 500 over the last 20 years. You can dramatically impact your overall performance by moving out of the market at just the wrong moment, thereby missing a rebound.

Source: Bloomberg

Data as of December 31, 2018

At NEPC, we approach multi-generational investing by first thoroughly understanding your family’s priorities, mindset, your investment goals, and the level of risk that is acceptable to you. Once we have gathered this information, we collaborate with you to organize and codify those objectives and tolerances in the IPS. This investment policy statement can also include other important instructions for managing a portfolio, such as identifying the parties involved in the investment process and their roles and responsibilities, portfolio governance, portfolio ownership and beneficiaries, tax considerations and applicable rates, and any legal or regulatory restrictions. The policy will serve as a snapshot of our asset allocation work by documenting strategic allocation targets and tactical ranges around those targets; it may also include expected outcomes and the potential for drawdowns. The document serves as the framework for your family’s unique and individual investment program. As your trusted advisor, we will periodically review this document with you to ascertain that your family’s situation, objectives and risk tolerances are still relevant. Updates can also reflect any changes to the asset allocation guidelines.

This initial legwork, while intensive, is essential. The effort especially pays off during an economic downturn, offering a sound roadmap to navigate markets that are at their bleakest. The guidelines in the IPS can help investors rebalance in a disciplined manner, such that gains can be locked in by selling after run-ups and positions can be built or added to in times of stress. In practical terms, a thoughtfully crafted investment policy statement can help you maintain a diversified portfolio while keeping you focused on achieving your financial goals. Emotionally, the IPS helps establish a level of comfort and a sense of control in an uncontrollable marketplace. With this level of structure and discipline, we can hope to overcome our human fallibilities in a rational way. Keynes would be proud.