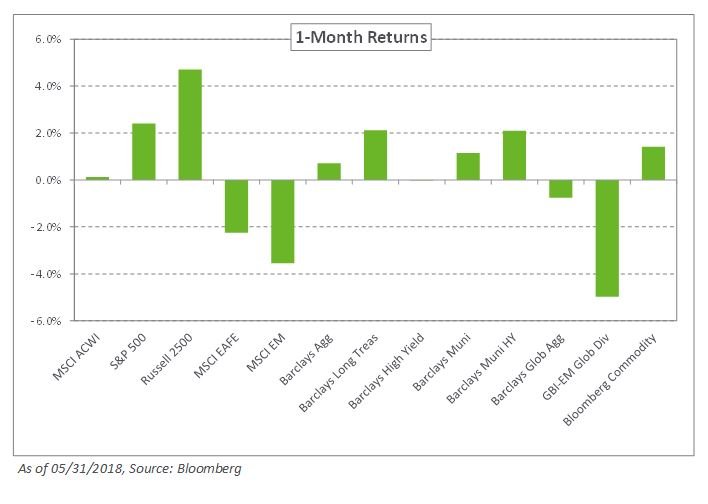

Volatility remained a mainstay in May amid festering trade tensions between the US and China and Italy’s struggle to form a new government. The US dollar strengthened 2% relative to a basket of major currencies, fueling declines of 2.2% and 3.5% in the MSCI EAFE and MSCI Emerging Markets indexes, respectively. In contrast, the S&P 500 Index gained 2.4% last month.

Within fixed income, safe-haven asset classes edged up modestly. The yield curve shifted downward slightly with the 10-year declining nine basis points to 2.86%, despite hitting 3.1% during the month, and the 30-year falling 10 basis points to 3.03%. As a result, the Barclays Long US Treasury and Barclays Long Credit indexes increased 2.1% and 0.5%, respectively. Outside the US, European government bond yields broadly declined with the 10-year German Bund yield falling 22 basis points to 0.34%. The spread between 10-year German and Italian sovereign debt touched 2.53%—the highest since 2013—amid political turmoil in Italy. In emerging markets, weakening local currencies fueled declines of 5% in the JPM GBI-EM Index.

Liquid real assets maintained their winning streak as oil prices, bolstered by OPEC production cuts, geopolitical instability in some oil-producing regions and strong global demand, touched $80 per barrel — a first since 2014. Additionally, the Alerian MLP Index continued to rebound – increasing 5.0% for the month.

At NEPC, we expect underlying market conditions to remain supportive for international and emerging market equities. With the potential for continued volatility, we encourage the addition of safe-haven fixed-income exposure to mitigate the impact of potential market drawdowns. We remind clients to stay committed to a risk-balanced approach and to evaluate market opportunities should larger short-term dislocations occur.