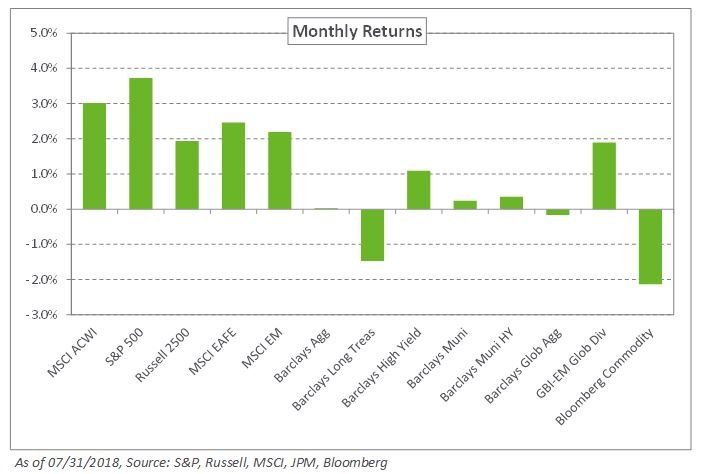

Equities saw no respite from volatility in June as trade concerns weighed on markets. Despite the uncertainty, the S&P 500 Index eked out gains of 0.6% for the month – ending the quarter up 3.4%. However, markets outside the US fared worse. Roiled by a strengthening US dollar—the yuan, for instance, fell 4.2% versus the dollar—the MSCI EAFE and MSCI Emerging Markets indexes declined 1.2% and 4.2%, respectively.

Last month, the Federal Reserve raised rates for the second time in 2018 and signaled the likelihood of two additional hikes this year. In contrast, the European Central Bank, on the back of disappointing economic data and low core inflation, said it would not increase interest rates until at least the end of summer 2019. However, in a move towards tightening monetary policy, the ECB confirmed it would end its quantitative easing program by the end of this year.

While most US safe-haven fixed-income assets were in the black, long credit-based indexes declined as long credit spreads increased 10 basis points in June. As a result, the Barclays Long Credit Index fell 1.2% last month. Additionally, emerging market debt indexes declined amid fund outflows and currency weakness, with the JPM EMBI Global Diversified and the JPM GBI-EM Global Diversified indexes falling 1.2% and 2.9%, respectively.

In real assets, oil continued its run – ending the month up 10.6%. That said, the Bloomberg Commodity Index declined 3.5% during the month as agriculture and metals weighed on returns.

Despite the recent volatility, our global outlook remains broadly unchanged amid a supportive economic backdrop for international and emerging market equities. With the potential for continued trade-related volatility, we encourage the addition of safe-haven fixed-income exposure to mitigate the impact of potential market drawdowns. We remind clients to stay committed to a risk-balanced approach and to evaluate market opportunities should larger short-term dislocations occur.