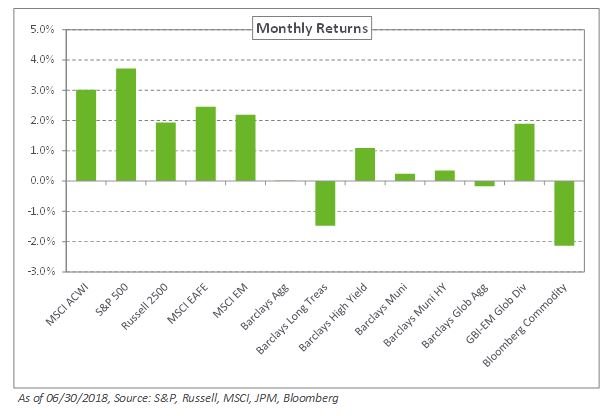

Developed market equities forged ahead in July as robust economic data and strong corporate earnings offset concerns around escalating trade tensions between the United States and China. The S&P 500 returned 3.7% last month as US GDP growth hit 4.1% in the second quarter. A healthy earnings season pushed the MSCI Europe Index up 3.3%. Emerging market equities rebounded, up 2.2%, according to the MSCI EM Index; despite these gains, emerging markets posted their worst quarter since 2015 with losses of nearly 8% in the second quarter, as a stronger US dollar eroded returns and concerns swirled around election results in Turkey and Mexico.

In fixed income, the 10-year US Treasury yield rose to 2.96% in July, up 10 basis points from the previous month. Still, the spread between the 10-year and two-year Treasuries continued to narrow, ending the month at 0.28% — the smallest differential since 2007. Yields also rose on German and Japanese 10-year bonds, increasing 14 and three basis points, respectively. Emerging market bonds were in the black with gains of 2.6% and 1.9%, according to the JPM EMBI Global Diversified and JPM GBI-EM Global Diversified indexes, respectively.

The oil rally came to an end last month amid concerns around oversupply, causing spot prices to decline 7.3% in July. In contrast, master limited partnerships (MLPs) maintained their winning streak, returning 6.6% on the month, as the industry continues to consolidate and streamline.

Our global outlook remains intact. We support the addition of international and emerging market equities, particularly as the sustainability of US earnings and economic growth comes into question. We believe short-term volatility is likely here to stay as trade discussions are in flux. We recommend adding safe-haven fixed-income exposure to mitigate the impact of potential market draw-downs.