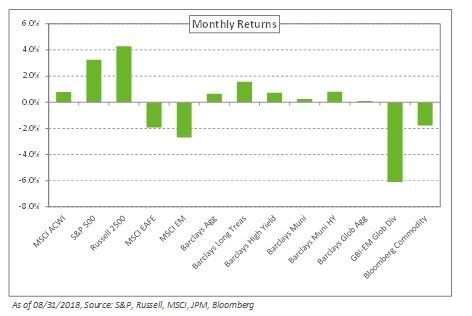

Non-US equities declined in August amid escalating trade tensions between the US and its major trading partners, a currency crisis in Turkey, and uncertainty in Italy. A spate of positive macroeconomic data was unable to lift the MSCI Europe Index, which fell 2.8% last month. Emerging market equities also ended lower, losing 2.7%, according to the MSCI Emerging Markets Index. Meanwhile, US stocks held firm with the S&P 500 Index gaining 3.3%, as robust GDP growth in the second quarter overshadowed trade disputes and macroeconomic worries.

Within fixed income, geopolitical turmoil pushed safe-haven debt higher with the 10-year US Treasury yield falling 10 basis points to 2.86% and the 10-year German bund yield declining 12 basis points to 0.33%. Credit spreads were modestly wider across the board with emerging markets bearing the brunt, declining 1.7%, according to the JPM Emerging Market Bond Index; local emerging market debt fared worse with the JPM GBI-EM Global Diversified Index falling 6.1% as Turkey’s currency travails and US dollar strength impacted returns.

In real assets, the Bloomberg Commodity Index declined 1.8% as the trade dispute between the US and China weighed on the agriculture sub-index, which fell 6.0% in August. Meanwhile, master limited partnerships (MLPs) continued their run, ending the month up 1.6% with year-to-date gains totaling 7.6%.

As the seasons change, our recommendation to add international and emerging market equities remains unchanged, especially given the recent sell-off in emerging markets. Further, we encourage the addition of safe-haven fixed-income exposure because of their attractive yields and their ability to mitigate potential economic disruption.