All eyes are on private equity funds as they report first-quarter performance. These financial results, which typically lag public markets by a quarter, are especially significant: it is the first quarterly return period for private equity funds that reflects the impact of the Covid-19 pandemic on valuations. While final numbers will be available in a few weeks, the preliminary returns for US private equity show a 7.3% decline in valuations in the first quarter, according to data compiled from ThomsonOne/C|A.

The illiquidity in private markets adds another layer of complexity this time around with economic conditions making it difficult to value assets in this space. This presents a challenge to investors seeking to understand the true impact of the economic downturn on their private equity investments, especially as many publicly-traded stocks have significantly rebounded from the pandemic-induced selloff.

During these volatile times, we are here to address questions our clients may have. Here is a sampling of our responses to some recent queries:

Q: How does the market volatility affect private equity allocations in the near term?

NEPC: For many investors, relative exposure to private equity went up in the first quarter of 2020 as liquid public equity stocks lost 20%-to-25%. Since private equity is valued with the lag of a quarter, those valuations were up 5.8% following a strong fourth quarter, show data from ThomsonOne/C|A. However, the spike in private equity allocations in the first quarter of 2020 is likely short-lived. While the quarterly decline in private equity valuations is the first to reflect the Covid-19 pandemic, public equities have rebounded significantly in the second quarter of 2020. To that end, with public stock valuations where they are, we expect private equity allocations to return to or inch slightly above the pre-Covid-19 pandemic levels seen in the fourth quarter of 2019.

Q: What should we expect for private equity valuations going forward?

NEPC: Typically, private equity valuations show less volatility than public equities as private equity fund managers usually bring a conservative lens to their fair-value reporting process. This valuation process is made more difficult when there are few recent deals to serve as points of comparison. We believe the rebound in public equities has more to do with fiscal and monetary stimuli than dramatic improvements in the companies’ underlying financial fundamentals. While public stocks can provide a reference point, private equity valuations are primarily driven by fundamental performance and outlook of the companies. With many privately-owned, often smaller, businesses experiencing severe disruptions in revenues and supply chains, we may see declines in valuations for some private equity funds in subsequent quarters despite the recent rebound in public equities. And these lower valuations may create attractive new investment opportunities.

Q: How should we view current private equity allocations versus targets?

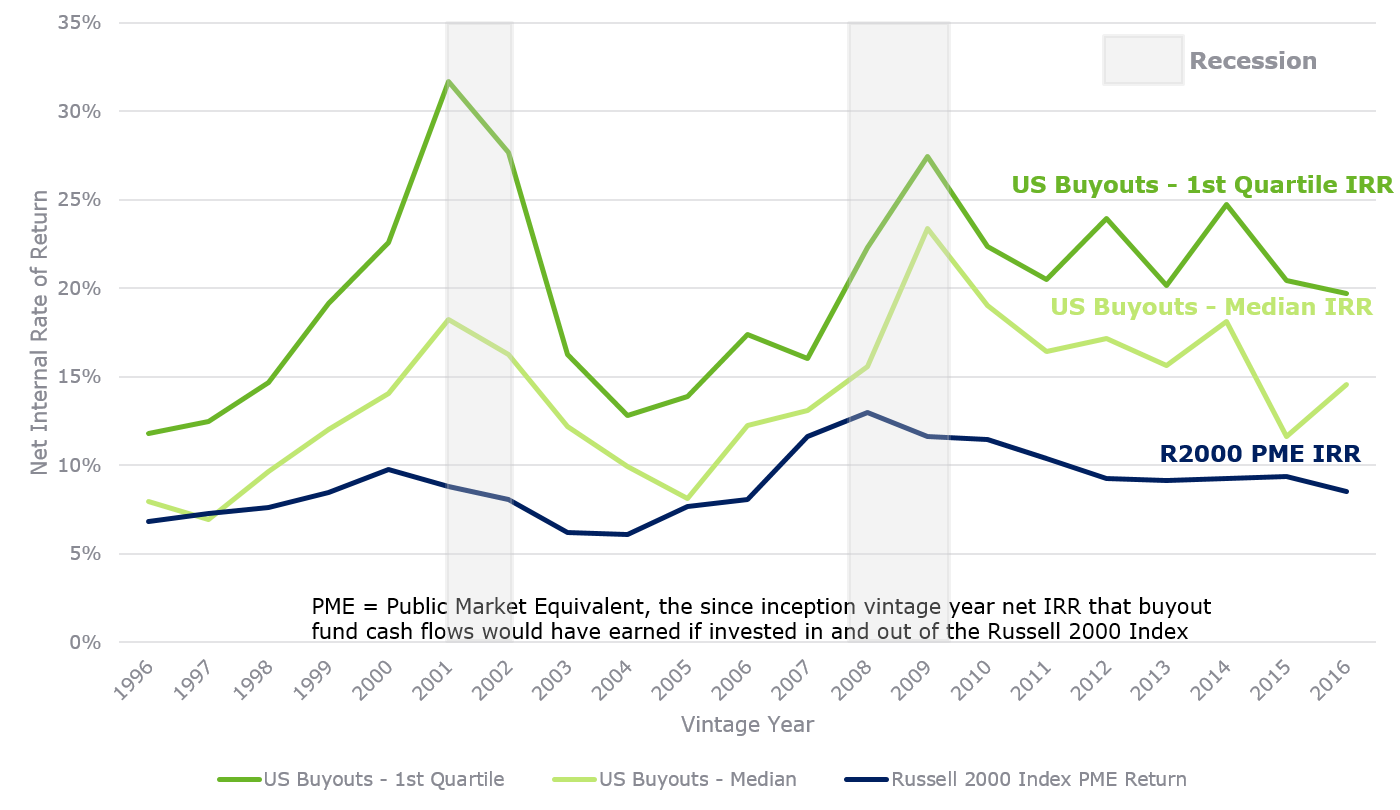

NEPC: We would generally recommend our clients continue making new commitments to private equity, even if this means being moderately overweight to your private equity targets over the next few years. The illiquidity premiums — the excess return private equity offers over publicly-traded investments—tend to widen in a recession. So, commitments made now and over the next few years should prove to be good vintage years (Exhibit 1).

Exhibit 1: Private Equity Returns (by Vintage Year) in Past Recessions

Source: ThomsonOne/C|A private equity database as of December 31, 2019.

Additionally, the next couple of years could be an opportune time to access quality private equity fund managers who are looking to fill their capital raises and may have seen some existing limited partners cut back or fail to re-up; these allocations could also allow investors current and future access to capital-constrained funds.

Q: What if an organization’s liquidity conditions dictate reducing the level of new private equity commitments right now?

NEPC: While we believe it is a favorable time for new commitments, we recognize that organizational liquidity constraints take precedence. If you must reduce your commitments, we recommend you prioritize manager relationships by making smaller commitments to the same number of funds rather than making larger commitments to only one or two funds. This approach not only helps in diversification, but also leaves the door open to future fund commitments. Private equity managers tend to favor existing investors over new ones, so maintaining commitments to well-performing fund managers, and layering in new exposures to otherwise hard-to-access managers—even at relatively low amounts—could provide investors with access to these managers now and for future fundraises when liquidity pressures have likely subsided.

Q: How is the pandemic-induced recession impacting private equity strategies?

NEPC: While the economic downturn may have a significant impact on existing private equity investments, new funds could potentially benefit from fresh opportunities to invest in companies at discounted or distressed valuations. We expect the illiquidity premium to be above average for private equity over the next few vintage years.

At the onset of the pandemic, private equity fund managers initially focused on deep company-by-company reviews of their portfolios. The initial assessments focused on near-term cash positions to make sure that each company had a plan to survive the near-term economic impact and to assess which companies would likely need additional equity infusions to shore-up their balance sheets. In some tough cases—a very small number presently—managers may have concluded that some companies’ businesses are irreparably harmed. In these instances, the companies are likely to fail, but losses to the fund will be capped at the amount previously invested. A deepening recession will likely lead to an adverse outcome for many businesses, which can create investment opportunities for new private equity capital.

While most private equity funds have been focused on their existing portfolios, some are shifting their attention to capitalizing on the dislocation. Deals that are currently being worked on: acquisitions for existing portfolio companies to buy competitors at steep discounts, revisiting companies that were previous targets for investment at lower valuations, and pure distressed/turnaround buys to save companies from going under. With the heightened level of uncertainties related to the pandemic and its economic impact, private equity fund managers are showing restraint. We expect industry- or sector-focused private equity funds will likely be more active currently than generalists, since they are better acquainted with companies/management teams in their field.

Also, this is an opportunity for private equity fund managers to demonstrate the effectiveness of their sourcing. While travel restrictions persist, fund managers are limited to video meetings and conference calls, unable to meet with management teams in person, or conduct site visits. This will be a governing factor limiting new deal flow, especially for generalists who are less familiar with industry dynamics and the competitive landscape. For many funds, the deals currently under review were probably ones that were in the works prior to the outbreak; however, it is likely that there will be a dearth of activity if the pandemic is not brought under control and economies do not reopen in earnest.

Q: How attractive are opportunities in private credit relative to private equity? How should we allocate between them?

NEPC: We currently believe BOTH private credit and private equity present opportunities for outsize returns in the current environment. For most clients, we recommend continuing or expanding commitments to both strategies even if that results in an overweight position to private markets over the next several years. Clients could also use a portion of their fixed-income allocations to make room for new private credit investments, thereby increasing capacity for fresh private equity commitments. These allocations will provide investors the opportunity to capitalize on the higher illiquidity premiums for both private credit and private equity prevalent during the recession and start of the recovery. Investors should seek out robust near-to-mid-term returns from their opportunistic credit and distressed debt investments, while preserving private equity allocation to pursue higher multiple, total return buyout, growth equity and venture capital strategies that will boost overall performance over the long term.

Q: How has the Covid-19 pandemic and resulting recession changed NEPC’s viewpoints on private equity and private credit?

NEPC: Our post-pandemic outlook across private equity and private credit is largely more favorable for most private market strategies.

We expect most private equity strategies, whether primary or secondary, will benefit by making new investments in this environment at lower valuations. While large/mega buyout funds and late-stage venture capital are more likely to see higher current valuations more comparable with public stock markets, we believe that new commitments to other private equity strategies will benefit more from lower, more attractive valuations. Be it through investments in venture, growth or buyout strategies, we think that fund managers with demonstrated industry expertise and capabilities to drive strategic or operational improvements will be suited to help companies navigate the recession and capitalize on growth through the recovery.

We also believe that clients should commit to investments with exposure to innovation and new technologies, and to the Asia/Pacific region to capture long-term secular appreciation expected from these segments. Special situations and secondary-private equity strategies should benefit from increasingly distressed companies and sellers hit particularly hard by the recession.

For private credit commitments, we recommend opportunistic credit and distressed debt strategies, where private credit managers can capitalize on wider spreads, market inefficiencies and financial distress. Direct-lending opportunities are also likely to be more prevalent, as many small-to-mid-sized businesses are unable to tap public markets for debt financing or obtain adequate levels of bank loans to provide funding. However, with interest rates near or below zero in the US and Europe, niche lending and more flexible opportunistic credit strategies may provide higher-yielding investment opportunities than many direct-lending strategies.

Balancing short- and long-term benefits of investing in any illiquid strategy—be it private credit or private equity or a secondary or primary fund—is an important decision in portfolio construction that should consider each client’s unique constraints and goals. At NEPC, we stand ready to help clients understand these trade-offs, and to capitalize on the attractive investment opportunities across private credit and private equity fueled by the pandemic, the resulting recession and the subsequent recovery.

Disclaimers and Disclosures

- Past performance is no guarantee of future results.

- The information in this report has been obtained from sources NEPC believes to be reliable. While NEPC has exercised reasonable professional care in preparing this report, we cannot guarantee the accuracy of all source information contained within.

- The opinions presented herein represent the good faith views of NEPC as of the date of this report and are subject to change at any time.

- NEPC may provide background information on fund structures or the impact of taxes but you should contact your legal counsel or tax professional for specific advice on such matters.

This report contains summary information regarding the investment management approaches described herein but is not a complete description of the investment objectives, portfolio management and research that supports these approaches. This analysis does not constitute a recommendation to implement any of the aforementioned approaches.

In addition, it is important that investors understand the following characteristics of non-traditional investment strategies including hedge funds, real estate and private equity:

- Performance can be volatile and investors could lose all or a substantial portion of their investment

- Leverage and other speculative practices may increase the risk of loss

- Past performance may be revised due to the revaluation of investments

- These investments can be illiquid, and investors may be subject to lock-ups or lengthy redemption terms

- A secondary market may not be available for all funds, and any sales that occur may take place at a discount to value

- These funds are not subject to the same regulatory requirements as registered investment vehicles

- Managers may not be required to provide periodic pricing or valuation information to investors

- These funds may have complex tax structures and delays in distributing important tax information

- These funds often charge high fees

- Investment agreements often give the manager authority to trade in securities, markets or currencies that are not within the manager’s realm of expertise or contemplated investment strategy