Key Takeaways

- Investment broker and manager fees are not always aligned with the value they provide.

- Given low prospective returns, fee awareness is more important than ever if investors are going to meet their investment objectives.

- Investors can use a simple, objective framework to determine if a manager’s fee is worth the value they add.

When I attended business school over 20 years ago the book, Where Are the Customers’ Yachts? by Fred Schwed Jr. was on my reading list. The title refers to a question asked by a visitor to New York while admiring the yachts of the investment and finance professionals that lived in the city. Published in 1940, the book exposed the hypocrisy of bankers and brokers that charged their customers excessive fees.

In today’s world, the question posed by Schwed nearly 80 years ago may be more relevant than ever. Faced with concerns of a low prospective return environment, many investors have sharpened their focus on fees in an effort to afford their own “yachts”, i.e., maximize investment returns in support of investment program goals. While the increased focus on fees is laudable, it has driven some institutional investors to take an almost indiscriminate approach to cost cutting, foregoing investment opportunities that offer attractive return potential because the fees are perceived as too high.

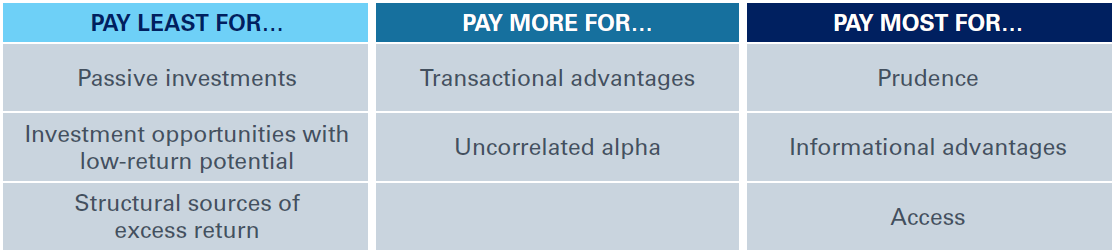

A more balanced approach would broaden the perspective of the investment decision to focus on fee awareness over fee reduction above all. This approach acknowledges that some opportunities are worth paying for and requires investors to factor in all costs—explicit and implicit—into their investment decisions. To get started, a simple framework can help investors.

Let’s briefly review each of these.

Pay Least

Passive Investments

Passive investment strategies take no-to-little subjective decision making or market expertise to employ. As a result, you should pay very little to passive investment managers to invest your money. Also, be mindful that there are many investment offerings marketed as actively-managed solutions (and priced as such) that exhibit a risk profile that looks and feels like passive exposure you can get for much less. Don’t be fooled.

Investment Opportunities with Low-Return Potential

In today’s low-yielding world, there are many low-risk opportunities that offer little upside. In some cases, management fees can erode a significant percentage of that upside. Investors should determine a percentage breakpoint to help them flag when the fees could be too high. For example, if a manager’s fee exceeds 25% of an investment’s estimated return potential, investors should take a closer look to understand why.

Structural Sources of Excess Return

There are many investment managers who employ “structural” investment strategies. These strategies overweight subsets of an investment opportunity set that tend to outperform over time. In many cases, those subsets also carry more risk as a trade-off for the higher returns. It’s rather easy to outperform an index when you simply take more risk to do so. While there is some merit in this investment approach, it isn’t worth paying high fees for.

Pay More

Transactional Advantages

Bigger is not always better, but in the area of transaction costs, manager size can be an advantage. In most cases, the bigger the manager, the better they are at getting favorable execution on their trades – small advantages that can add significant value over time.

Uncorrelated Alpha

Active investment managers can provide a source of diversification by generating an excess return stream that is uncorrelated with equity markets, which tends to be the dominant risk in most investor portfolios. While long-term outperformance should be the primary consideration for active management, investors should be willing to pay a higher fee to managers who can deliver uncorrelated excess returns.

Pay Most

Prudence

Experienced investors know that it is impossible to always make the right investment decision. Instead, investors should strive to make informed or prudent decisions. Prudence requires understanding the risks of the investments you make and quantifying the compensation or risk premium associated with taking those risks. Competent and trustworthy investment advisors can provide valuable input in this assessment process and are worth paying for. In the long run, those who disregard prudence could end up losing a lot more than the costs required to pay for it.

Informational Advantages

Informational advantages come in various forms and can add tremendous value in inefficient markets. Examples of informational advantages include experience, resources and access:

- Experience: do not hire a manager because they have convinced you that they are smart. Intellect alone is not enough. Instead, investors must partner with managers that have a deep bench of experienced investment professionals and wisdom gained through a time-tested investment process.

- Resources: in some cases, informational advantages can be the result of human and technological resources a manager has dedicated to identifying attractive investment opportunities. Look for managers who have the right resources to give them a competitive edge.

Access: some underdeveloped markets that offer attractive prospective returns can be hard to access. Managers that have access and experience investing in those markets may be worth paying for, given the extensive due diligence required to deploy capital in those markets.

Conclusion

Employing a framework like the one proposed takes experience. In some cases, it is fairly easy to attribute the primary source of returns, that is, market-driven or manager-influenced. In other cases, it can be very difficult to assess and takes an experienced eye. Make sure you have the right team of advisors to help determine if you are getting your money’s worth out of your management fees or just helping to fund one more yacht that you don’t own.