Diversity, equity and inclusion (DEI) policies are now common aspects of hiring practices for healthcare organizations. But as is true for many industries, healthcare systems are looking beyond human resources to find ways to create impact. Increasingly, they are discovering opportunity in their investment programs.

In fact, a key finding in NEPC’s 2022 Healthcare Operating Funds Survey, which looks at the thoughts and actions of healthcare leaders, reveals healthcare systems are increasingly discussing the merits of adding DEI to their investing approach.

A Growing Movement

Healthcare systems face complex financial challenges with consistently rising operating costs, volatile investment returns, and narrow profit margins. At the same time, these firms have been grappling with ways to provide meaningful impact at a personal, community and corporate level.

The addition of a DEI-focused investment program addresses both challenges. DEI programs are characterized by a commitment to include diverse-owned or -led firms among your investments. The potential of formalizing DEI goals in your investment program can provide access to new opportunities that could deliver measurable and lasting benefits. This allows health systems to pursue investment returns for profit while also promoting a meaningful impact to the greater good.

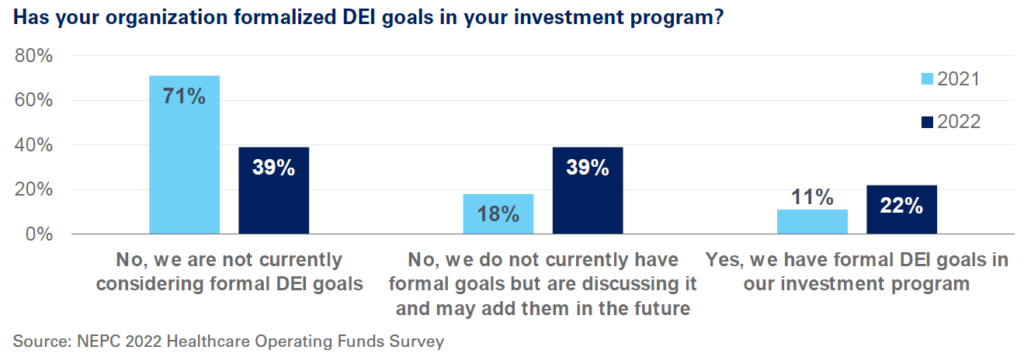

Awareness of the win-win nature of DEI investing is on the rise, and our 2022 survey suggests it is growing quickly. In 2021, only 29% of survey respondents were considering DEI as part of their investment programs. One year later, nearly 60% of survey participants said they were discussing formalized DEI investing goals.

The number of healthcare systems that have already adopted DEI goals also increased significantly. Only 11% of survey respondents said they had formal DEI goals in their investment program in 2021; that doubled to 22% in 2022.

Meeting the Need

While DEI policies have been an area of interest for a while, we are now having more discussions around formalizing DEI goals as part of the investment programs for healthcare systems. Today, roughly 59% of our clients utilize diverse-owned or -led firms in their portfolios across $40.7 billion in assets.

At NEPC, we have years of experience in helping clients adopt DEI-based programs. As early adopters, we’ve built relationships with a large roster of diverse managers and have put them to work meeting client needs. We’ve also played a role in helping clients identify appropriate DEI policies to include in their investment policy statements.

Still, there is more work to be done, and NEPC is continuing to seek more efficient ways to help clients promote diversity. In 2021, we launched our Explorer Program to identify and engage with diverse-owned and -led investment firms not currently covered by NEPC. As our universe of these firms expands, we are now focused on meaningful ways to include high-conviction firms in our clients’ portfolios.

We are also a founding member of the Investment Diversity Advisory Council (IDAC), an independently-operated forum that sets DEI investing standards and accelerates the adoption of DEI in the asset management industry. Our work within the DEI investing community and with healthcare clients is a testament to our commitment to serve as a driver of positive change.

Whether your organization is exploring the merits of investing in DEI firms or actively creating formal DEI goals for your investment program, we have resources to enable you to navigate the DEI landscape successfully. Let us help your healthcare system make a meaningful impact at a personal, community and corporate level.

Contact your NEPC consultant to learn more about putting NEPC’s DEI investing strategies to work for your healthcare system.