Investors in less liquid investments, like private assets, may be forced to contend with the denominator effect when publicly-traded markets take a tumble.

When public securities decline, private market allocations—whose valuations tend to lag by at least a quarter or more—can appear outsized in an investment portfolio as the ratio of private assets (the numerator) to total portfolio assets (denominator) jumps. It may be tempting to try to rebalance out of this overallocation, but reducing private markets is challenging and expensive. Private market sellers may not only face unfavorable prices, but also miss out on potentially higher returns reaped by funds raised during a recession, our analyses show.

At NEPC, we generally discourage clients from selling in the secondary market at current valuations as widening bid-ask spreads make price discovery and deal execution challenging. In most cases, we also discourage shunning commitments completely, which would result in skipping vintage years. Our private equity team has observed that private-market vintages during and immediately following recessionary periods in the United States experienced a noticeable increase in performance and illiquidity premiums compared to those immediately preceding a recession, particularly in direct-equity strategies like buyout and venture capital. Intuitively, this outperformance in recessionary times makes sense given that these vintages benefit from lower purchase prices than vintages prior to a downturn.

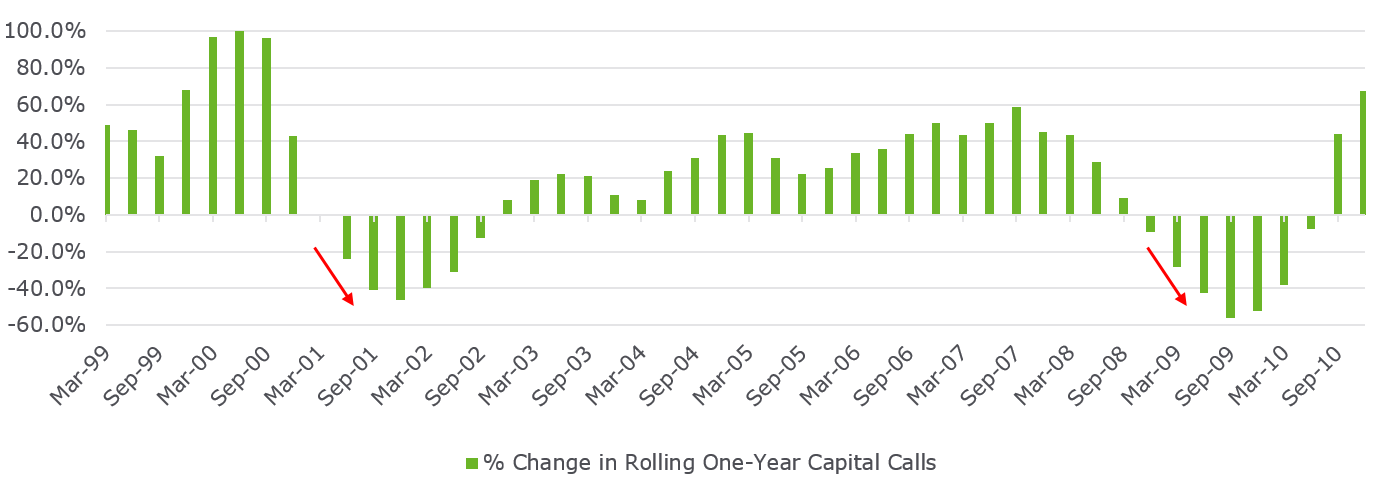

When we look at capital calls during an economic slump, we observe decreases of as much as 40%-to-50% compared to prior periods as activity typically slows around new deals (Exhibit 1).

Exhibit 1: Change in Global PE Rolling One-Year Capital Call

Source: Thomson One/C|A as of 09/30/2019

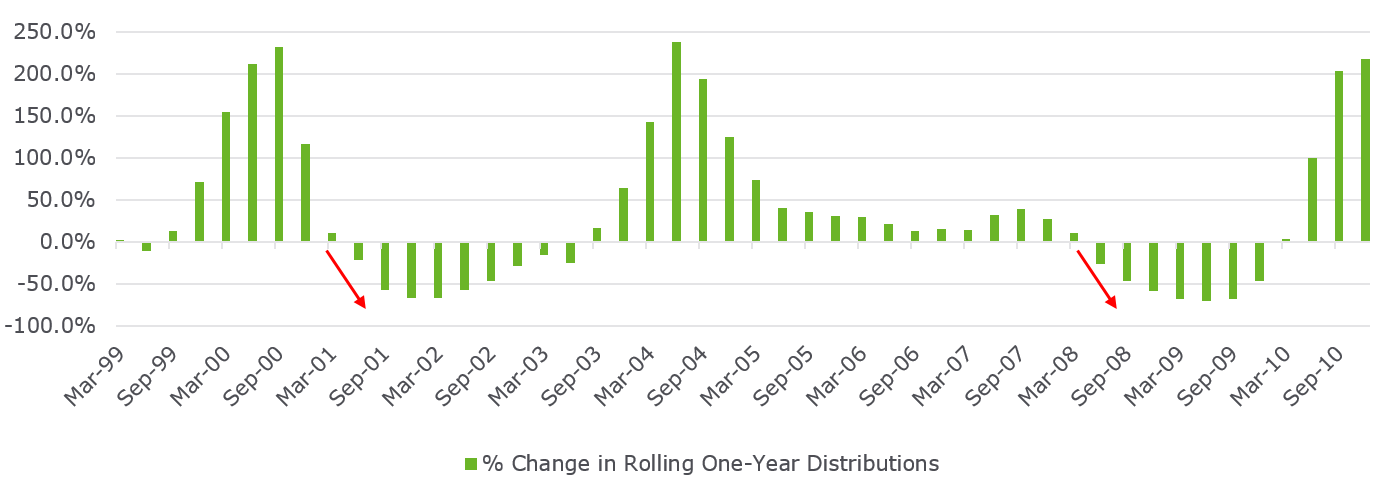

We also see declines in distribution activity of 50%-to-70% on a rolling basis compared to prior periods (Exhibit 2).

Exhibit 2: Change in Global PE Rolling One-Year Distribution

Source: Thomson One/C|A as of 09/30/2019

To be sure, there can always be exceptions to these patterns and the circumstances driving each recessionary period are different. Still, we would expect credit managers, particularly those specializing in distressed credit, to continue to call capital in the near term to maximize opportunities offered by this counter-cyclical strategy. The more recent phenomenon of fund managers using lines of credit at the fund level may also change the dynamics of capital calls as they may be needed in the short term to repay these credit lines. However, based on historical data, we would expect private equity programs to be net users of cash in the short-to-medium term.

In turbulent times like these we suggest letting the dust settle in public markets, allowing updated valuations to flow through to private-market assets. Once revised, valuations in private investments can be compared to public-market assets to develop a clear plan for future commitments. In certain instances, we may also recommend adjusting the pace of budgeted commitments for the year. For example, if private-market portfolios are at or close to the target allocation and investors are concerned about overshooting the allocation, an option could be to haircut the budgeted amount of commitments for the year by a small percentage, for instance, 10%. If investors plan to decrease their commitment budget during these times, we recommend maintaining good manager relationships and taking advantage of new ones by making smaller commitments to more or the same number of managers rather than larger commitments to fewer managers.

For investors able to adopt a more aggressive approach—especially those below target and trying to build toward a target allocation for their private-markets strategy—we advise leaning into the turbulence by committing to managers and funds that can potentially perform well coming out of this period. We caution against going all-in as diversification by vintage year is still important, but overweighting commitments in the near term could potentially benefit investors still building a portfolio to target.

Please reach out to us if you have questions on the denominator effect or are concerned about its impact on your portfolio.