Impact Investing 101

‘Tis the season to be jolly…and generous. In this season of giving, many focus on the charities and causes dear to their hearts. At NEPC, we are shining a spotlight on yet another way to give back: impact investing. This increasingly popular approach to investing seeks to achieve a financial return while also making a societal contribution. It aims to incorporate an investor’s social goals, priorities and beliefs into the process of selecting assets and investment strategies.

To this end, NEPC’s private wealth practice works with the firm’s Impact Investing Committee to tailor impact programs for high-net-worth individuals and families keen to embed their personal values and missions into their investment process. The Committee’s responsibilities include analyzing trends within impact investing, researching impact-focused managers, and working with clients to develop strategies that meet their needs.

Below, we provide an overview of impact investing, NEPC’s approach to it, and answers to the most commonly asked questions from clients.

1. What are the different ways to go about impact investing?

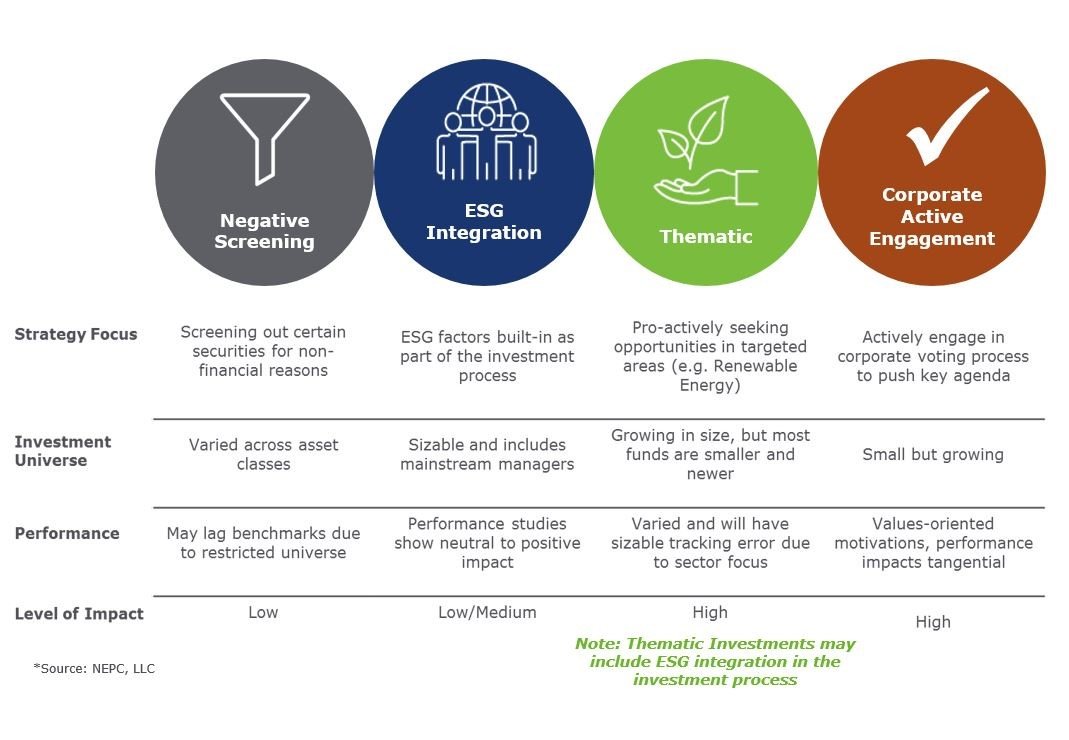

At NEPC, we divide impact investing into the following four distinct pillars (Exhibit 1):

Exhibit 1: Impact Investing Options

(a) Negative Screening

Negative screening can be effective if the goal is to avoid placing capital with businesses whose operations conflict with the investor’s goals. For instance, an investor can choose to avoid tobacco stocks or equities related to gambling. Negative screens are often applied to passive equity portfolios for a low cost, and can be customized to the investor’s preferences.

(b) ESG Integration

ESG integration is a fast-growing form of impact/responsible investing. ESG investing comprises the following three core non-financial elements (Exhibit 2):

- Environmental: This involves analyzing a company’s impact on the environment at global and local levels. Considerations include the company’s direct impact on the environment from waste to resource utilization. The environment’s potential influence on the company, mostly related to the scarcity of resources, is also examined.

- Social: The social factors look at how a company interacts with society, ranging from its employees and customers, to the broader community.

- Governance: The governance aspect of ESG analysis focuses on the alignment of interests between company management, its shareholders and other stakeholders.

Exhibit 2: What’s Behind the E, S and G?

With ESG investing, the materiality of the information disclosed by companies is important. Although there is much ESG information disclosed publicly, it is often difficult to identify and assess the usefulness of the disclosures to make investment decisions, according to the Sustainability Accounting Standards Board (SASB). SASB identifies issues which are reasonably likely to impact the financial condition or operating performance of a company and, therefore, are most important to investors. NEPC has also developed a proprietary scoring card for ESG factors, which we apply to approved investment managers to assess the validity of their ESG approach.

(c) Thematic Investing

Under thematic investing, investors proactively seek investment in targeted areas. For example, a client who is interested in environment-friendly initiatives and sustainable energy may invest in a private equity fund focused on developing renewable resources.

(d) Corporate Active Engagement

Corporate active engagement can be pursued alongside negative screening, the integration ESG factors and thematic investing. It entails active engagement in the proxy voting process to push through key agenda items. Investors can manage their own engagement program or work with a firm that can assist with shareholder advocacy by putting forth shareholder resolutions and helping vote proxies.

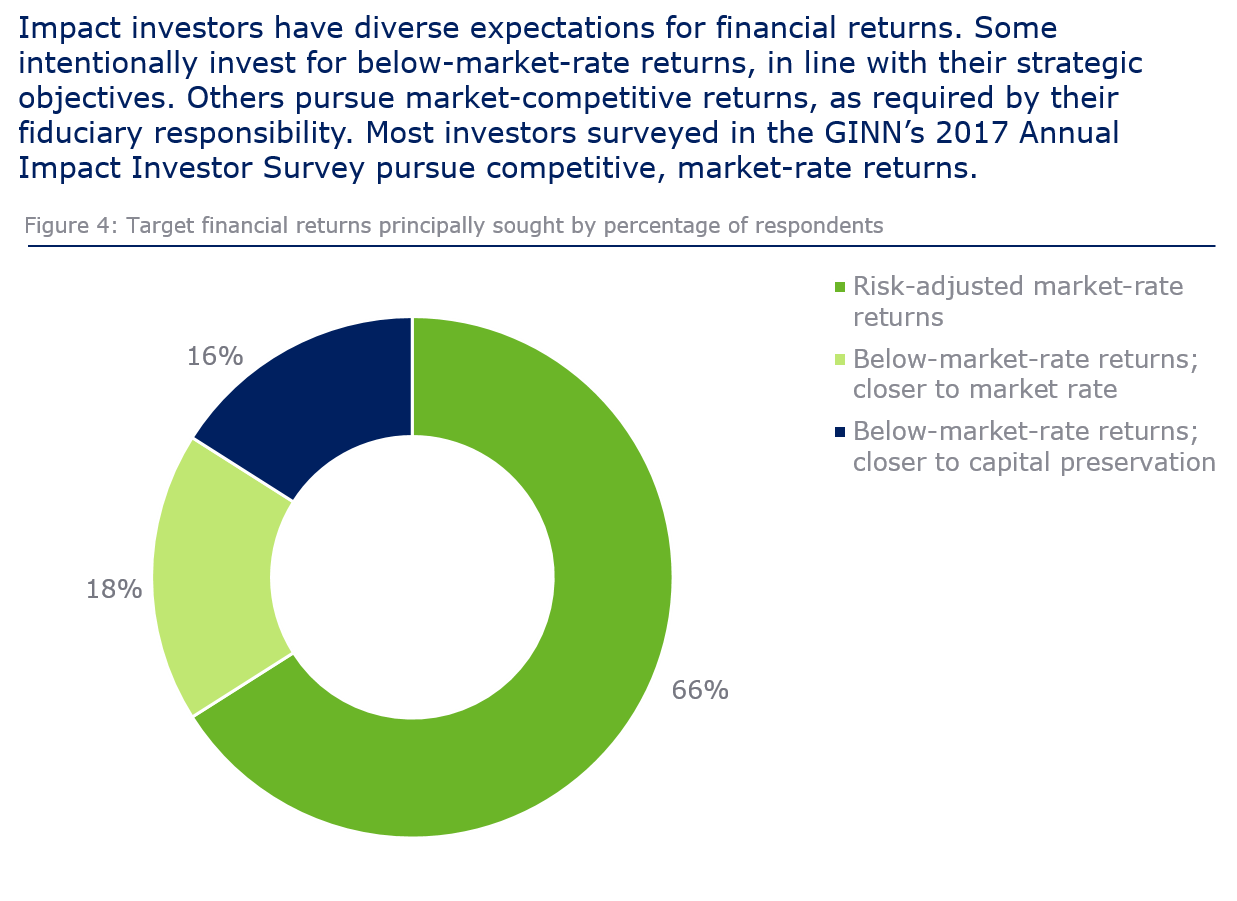

2. Are impact investments synonymous with below-market returns?

Historically, a common perception was that any sort of socially-responsible investment meant below-market returns or greater risks due to the reduced selection of opportunities imposed by ESG factors. That was before impact investing underwent an evolution. Now, most strategies focused on impact have the goal of delivering competitive returns. Indeed, many institutional investors who are implementing impact investing are bound by their fiduciary role to their beneficiaries or participants to only include investments that are targeting market returns. To this end, 66% of impact investors are seeking market returns, according to the Global Impact Investing Network’s 2017 Annual Impact Investor Survey (Exhibit 3).

Exhibit 3: Financial Performance of Impact Investments

Like any asset, the performance of impact investments can vary broadly by the type of program pursued. For clients engaged in negative screening within a passive portfolio, investment managers typically exclude the unwanted sector(s) and then optimize the portfolio relative to its index to reduce tracking error. In some cases, this results in an overweight to industries correlated with the excluded sectors, which may be undesirable to investors. In this situation, the remaining sectors, post-exclusion, can be capitalization-weighted, which may result in higher tracking error relative to the index.

Many investors incorporate ESG factors into their decision-making process as another way of controlling risk. Strong ESG performers tend to exhibit operational strength and are more

resilient to issues ranging from ethical lapses to climate risks. ESG factors can be implemented across most asset classes without giving up risk-adjusted returns, according to investment manager BlackRock.

Many impact investments focused on themes such as water resources and sustainable energy are executed via private equity vehicles. Several studies have been carried out to review the performance of these types of funds. The GIIN Perspective published “Evidence on the Financial Performance of Impact Investments” in November 2017, which provided data on a number of these studies. Its primary conclusions are summarized below:

- Market-rate returns are achievable in private equity impact investing. Both the CA-GIIN and Wharton studies found that market-rate-seeking private equity impact investing funds can achieve returns comparable to conventional private equity funds. The CA-GIIN benchmark found mean returns of 5.8%, top quartile returns above 9.7%, and a standard deviation of 10.8%, and the Wharton study found gross IRR of 9.2% from a sample of 32 private equity funds. Among exited investments—thus excluding write-offs—the McKinsey study found an average gross IRR of 11%. Once fees, expenses, and carry are taken into account, one would expect net returns to be close to what was calculated in the CA-GIIN study. Among conventional investments, CA has found 10-year pooled returns of 11.0% p.a. among global PE funds (excluding the US)1 and of 10.0% among US funds.2

- As in mainstream investing, impact investment returns vary widely. The CA-GIIN study found individual fund returns ranging from -15.4% to 22.1% among the middle 90% of participating funds. Likewise, the WSII study found a confidence interval of the median microcap PME ratio ranging from 0.74 to 1.15 with similar ranges reported in other complementary analyses. The McKinsey study, which conducted analysis at the transaction level, found IRR ranging from -46% to 153%. This degree of variation is also found in conventional private equity, illustrating that in any private investing fund manager selection is key to success.

1 “Global ex US PE/VC Benchmark Commentary: Fourth Quarter 2016.” Cambridge Associates. August 2017.

2 “US PE/VC Benchmark Commentary: Fourth Quarter 2016.” Cambridge Associates. August 2017.

In conclusion, market-rate returns are achievable in impact investing. Studies have shown that market-rate-seeking impact investments have comparable return distributions to conventional investments.

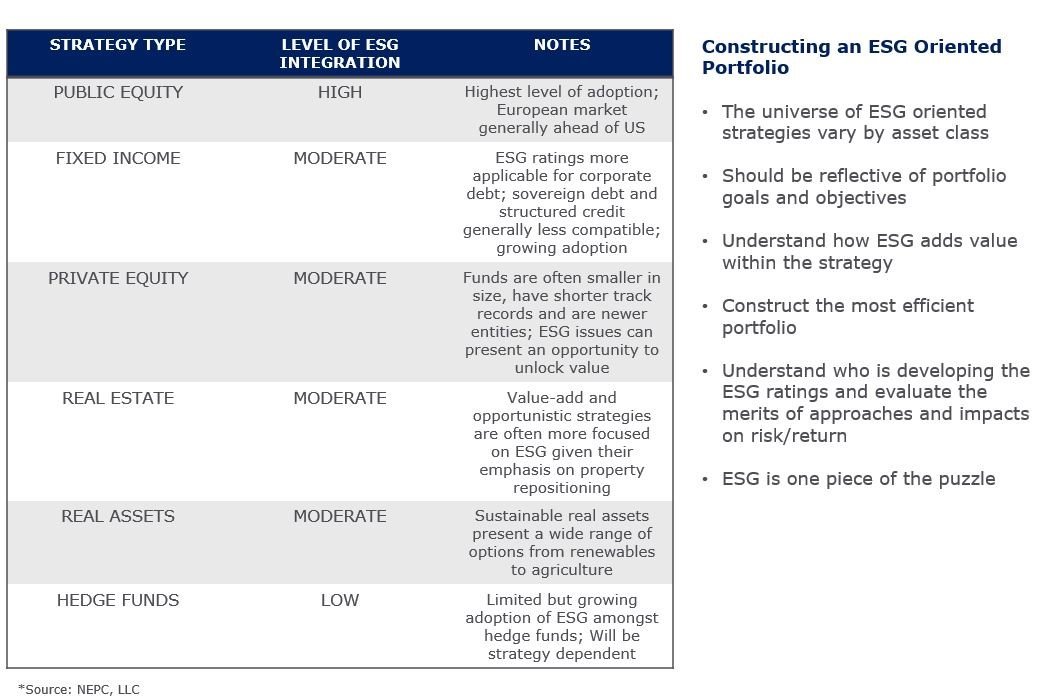

3) How can high-net-worth individuals incorporate impact investing into their portfolios?

Private wealth clients have substantial flexibility compared to institutional investors, who are subject to more regulation and disclosure requirements, in designing an impact program tailored to their goals and needs.

The first step before investing is to define your goals (Exhibit 4). In some cases, families may already have a mission statement or a foundation where social issues important to them have been outlined. In other cases, exploring a potential impact program may start with a conversation around the family’s objectives and may also serve as an initiation of the younger generation into wealth management. At NEPC, we can help facilitate this discussion and, in some cases, bring in outside experts.

Exhibit 4: Defining Your Goals

Once the goals have been identified, we recommend developing a blueprint for the impact program (Exhibit 5). This can be incorporated into the overall investment policy statement for the family’s wealth or it can be a separate document. The blueprint should include the financial and impact goals of the program, the decision-making process, and performance metrics to measure the program.

Exhibit 5: Impact Investing Blueprint

In terms of actual investments, the choice is varied (Exhibit 6). In the liquid public-markets space, options include investing in impact-focused equities, bonds and exchange-traded funds. For example, municipal bonds, a key component of many private-wealth fixed-income portfolios, can be aligned with an investor’s impact goals. As an example, one of NEPC’s approved managers in the municipal bond space can customize a client’s portfolio keeping in mind the following considerations:

- Negative/exclusionary screening based on specific ESG criteria

- Positive/best-in-class screening to include companies or sectors with strong ESG factors

- Sustainability-themed assets

- Impact/community investing aimed at solving social or environmental issues

Exhibit 6: Relative ESG Integration by Investment Type

For equities, many private wealth clients have passive tax-loss harvesting portfolios as part of their stock holdings. Applying customized screens to better align the portfolio to the client’s social goals, while still tracking an index, is a service offered by many passive equity providers.

NEPC maintains an approved list of active managers that focus on ESG and thematic investing. We have developed an ESG evaluation tool that uses quantitative and qualitative assessment. We employ a quantitative approach to standardize comparison across managers in all asset classes.

The qualitative assessment analyzes the true intent of ESG integration. The tool examines the investment manager’s ESG integration process at both the firm and strategy level. At the firm level, we evaluate the commitment the firm has made to ESG integration, the resources it has allocated and its engagement policies. At the strategy level, we examine how the firm’s ESG policies are implemented within the strategy.

Clients interested in a longer-term approach can explore impact investment opportunities within private equity and private real assets. NEPC’s Impact Committee works in conjunction with our research group to source, vet and approve private investment opportunities for clients who would like to incorporate impact investments into their private equity program.

4) How can one effectively measure the success of impact investments?

Gauging the effectiveness of impact investing not only helps validate the mission, but also brings a measure of accountability to the process.

To this end, an increasing number of vendors can assist in impact measurement, providing either an off-the-shelf report or one tailored to individual preferences. The success of a program can be measured by focusing either on pure impact metrics or a combination of impact and financial metrics. For example, a report may examine the number of jobs created, the geographic regions targeted, and the communities that benefited. In addition, the same report may also provide standard financial metrics such as returns, risk, exposures and attributions. Some investment firms have started facilitating these reports while customizing them in-house. Some funds also report their investment holdings by mapping them to the UN Sustainable Development Goals (SDGs). The United Nations has identified and consolidated 17 SDGs based on humanitarian and environmental focus areas (Exhibit 4). Mapping the portfolio to such SDGs may make it easier for investors to validate and measure the impact achieved.

At NEPC, we help clients determine the metrics that matter to them. These metrics are then used to measure performance either by using external vendors that can help customize reports (at an added cost) or by obtaining the reports directly from the underlying investment firms. We can also assist with evaluating the level of ESG integration in investment products and rolling it together to provide an average rating for the overall portfolio. Since this area is still evolving, options are not as standardized as other parts of the financial industry. That said, the growing momentum and improvements in the quality of output are very encouraging for investors.

Exhibit 7: Client Case Study: Family Foundation

At NEPC, our private wealth team is excited to discuss impact investing with clients (Exhibit 7). To continue the conversation, please reach out to your NEPC consultant today.