This paper explores the topic of investment governance for faith organizations. FaithInvest’s earlier paper, From Faith Values to Investment, focused on the importance of investment policy statements (IPS) and guidelines for institutional faith-based asset owners, as the essential governing documents required for the successful integration of faith values with investments. This paper, co-authored by FaithInvest and NEPC, looks at the broader framework of investment governance.

An excerpt from the paper is shown below:

The Essentials of Good Governance

Like any asset owner, faith institutions have extensive governance duties regarding their investment planning, designed to ensure that the organization generates sustainable long-term income within risk guidelines. This is no small task, and the consequences of poor investment decision-making can be severe.

Within NEPC’s role as an investment consultant to both faith-based and secular institutions, we have found that success starts with the board of directors. The organization’s board must oversee a long-term investment strategy for its assets and ensure that strategy is properly executed. An effective governance framework establishes a process around investment decisions that relies on input from key members of the organization, as well as outside support.

The Roles of Good Governance

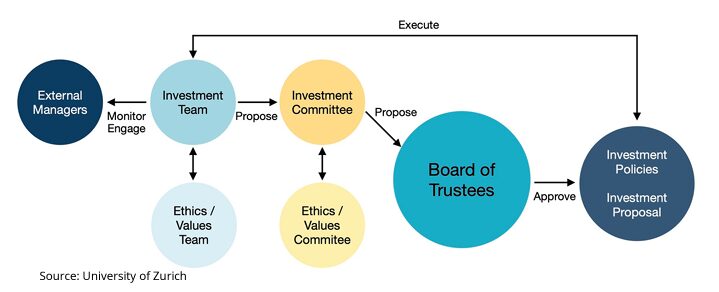

Effective investment governance lies at the intersection of detailed financial analysis and the organization’s mission and culture. As a result, at larger organizations investment decisions should be made by multiple teams working in concert, each with a specific role and set of responsibilities. At smaller organizations, a small team or one or two responsible people, working with a board, and possibly a consultant or advisor, may in combination fulfill the investment and ethics roles. A graphic of typical governance bodies is shown below.

The board of directors (sometimes simply called the board, or by other names, such as governance committee or oversight committee), holds a central position in overseeing investment decisions.

Ideally, boards have individuals with diverse expertise, including investment experience, and a shared commitment to the organization’s mission. Their role is less to make specific investment decisions than to identify priorities, set an overall investment strategy, provide guidance on risk tolerance, monitor the resulting investment program and results, and provide communication to relevant interested parties on their oversight activities, investment holdings and results. They are primarily responsible for approving the organization’s investment policy statement (IPS), which creates guidelines for all future investment decisions.

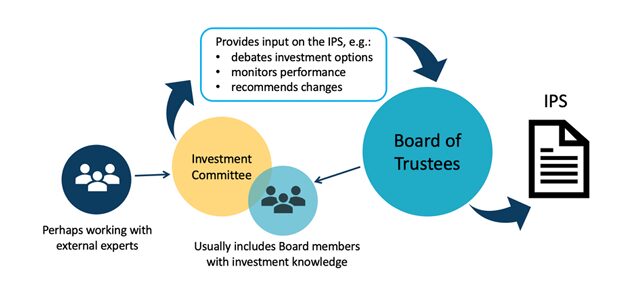

In the above example, the IPS is developed based on input from the investment committee, which also debates investment options, monitors performance, and recommends changes. This group usually includes board members with investment knowledge, perhaps working with external experts. Investment committees may oversee an investment team of internal or external investment experts who are responsible for executing investment policies.

Based on recommendations from the investment team, the investment committee will select and engage external portfolio managers. Their role is to manage the day-to-day activity within the organization’s accounts, make buy and sell decisions, manage risk exposures, and report regular updates.

Some organizations, notably faith-based groups, establish an ethics committee to assess the ethical implications of potential investments, and establish, review, approve or recommend ethics related policy and guidelines. Ethics committees can take many forms – they may be an independent committee, for example, or a sub-team of the board or investment committee but their primary role is to determine if the organization’s financial strategies are in alignment with its mission and ethical standards. Please refer to Ethics in Faith-based Investment Governance later in the report for more details on the roles and makeup of an ethics committee.

The Tools of Governance

At larger organizations, these various committees and teams make investment decision-making a multi-layered process involving many points of view. This is by design. Any nonprofit program must successfully balance the needs and concerns of the organization, the community, and the donors. It is not always effective to rely on a single team – or even an outside expert – to set that balance correctly.

For that reason, the two best tools of investment governance are:

- A clear delineation of roles and responsibilities among the various people, teams or service providers (e.g. investment consultant or advisor) that provide input, and a defined process for how they interact.

- Regular communication and collaboration between the board and other decision-making bodies to ensure that the team’s actions align with the overarching goals and values of the nonprofit, or in the context of this report, the faith organization.

Roles, Responsibilities, and Process. As noted earlier, the board sets the overarching vision and goals for the investment program, which is captured in the IPS. The investment committee evaluates specific investment alternatives, while the ethics committee contributes to the establishment of investment guidelines and flags decisions that could be in conflict with the organization’s values. The investment team executes the strategies and reports results, often with the help of outside advisors or managers.

It is common for roles and responsibilities to blur, particularly at smaller organizations. Board members may want to make the call about specific investment options, or investment teams and external managers might wish to “fill in the gaps” on their own when an issue arises that isn’t covered in the IPS. For example, consider what happens when an unexpected market event causes portfolio value to drop sharply in a short period of time. In the interest of speed, should the external investment manager have the discretion to change course without seeking formal approval from the board?

Considering how quickly markets can change, unexpected issues like this can arise often. When they do, your organization benefits when everyone in the decision-making chain understands their role and how they need to proceed.

Communication. Consistent, planned communication is one of the best ways to ensure organizations make good decisions with their investment plans, even in the midst of stressful market events or changes in staffing.

Of course, the primary goal of communication between the committees and the board is to ensure that investment actions align with the overarching goals and values of the organization. But regular communication can also help build consensus around other challenging topics.

One such topic is striking the right balance between risk and return, particularly as market trends evolve. Talking on a regular basis about investment risk, particularly in different risk environments, can help your organization establish risk management protocols that are more likely to stand the test of time.

Furthermore, regular assessments of the organization’s investment performance are essential. Boards should establish metrics for success, track key performance indicators, and use the insights gained to refine investment strategies. Continuous communication, including regular reporting to stakeholders and donors, allows for better transparency and accountability. Ultimately transparency is the hallmark of effective governance.

The Best Practices of Government

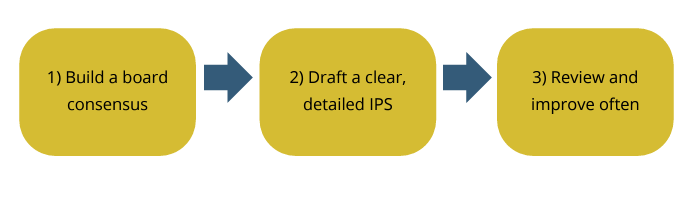

Having the right roles and processes in place is foundational to governance success in the nonprofit sector. But there are three areas of investment decision-making where what you do is less important than how you do it. Meeting these three goals can go a long way toward establishing a consistently effective governance structure.

- Build a board consensus.

An organization’s leaders – and its stakeholders – may have differing opinions about how assets should be invested. But when an IPS includes vague statements, unclear compromises, or half measures, investment teams and portfolio managers will find it difficult to successfully implement the board’s guidance. For this reason, investment decision-making must start with clear guidance from a unified board.

Trustees are likely to face tricky questions on the way to achieving consensus. Perceptions of risk may vary widely, as will expectations of return.

Investment committees and external managers can answer questions and raise potential issues, but strategic decisions must be made by the board. As with any key organizational issue, unanimous agreement can be hard to achieve. Make use of board voting procedures that are appropriate to the organization to define the priorities for the organization’s investment policies.

2. Document board decisions in a clear, detailed Investment Policy Statement

The IPS may be the most critical document an organization has in terms of the health and efficacy of its investment program. It captures board guidance, and it establishes the standards and rules that will become essential measuring sticks for the investment committee and external manager.

Whatever the board’s decisions are, they must be documented in detail within the IPS. Ideally, the IPS will include not just broad goals or general outcomes that the board is seeking, but also data-driven guidelines and measurements.

This task can be challenging when values-based considerations are included in the IPS, because the language around non-financial considerations can be less precise than with financial information. However, without unified and well documented board guidance, the investment committee and external managers will struggle to find investments that are a good fit for the organization.

3. Review and update the IPS regularly

Most organizations already review their investment programs on a quarterly basis to examine performance and assess success in meeting financial goals. This is also an excellent opportunity to talk about risk decisions and market changes. These pro forma updates should culminate in a discussion around whether updates to the IPS are needed.

IPSs are not “set it and forget it” documents. They are meant to capture the best thinking of the board, and they need to evolve as the board assesses new information and seeks to make improvements. Updating the IPS gives the investment committee and their partners better information and encourages a focus on continual improvement.

Take the time at least annually to ask rigorous questions of the investment consultants and raise issues that require board guidance. Vote on updates and document them in the IPS.

Best Practices Help Create Better Outcomes

These roles, tools, and best practices don’t guarantee that an organization won’t face losses or difficult financial considerations from time to time. But they do ensure that an organization has a well-organized and properly governed process for making financial decisions.

As a result, the organization will:

- Be less likely to make major or persistent mistakes that undermine its mission.

- Have more and better options to address financial challenges.

- Be prepared to answer questions and build confidence among stakeholders and internal staff.

These practices are generally accepted as universal. Now let’s turn our attention to the special governance considerations that apply to faith-based organizations. To do so, we will tap into the knowledge base of FaithInvest.

Click here to read the full “Faith-based Investment Governance” whitepaper.