As an overall asset class, emerging markets may offer elevated return potential, especially when compared to developed markets. While investors tend to view emerging markets as a single asset class, major differences exist between the underlying markets. When evaluating emerging markets for a portfolio, investors should understand the nuances and complexities of this asset class.

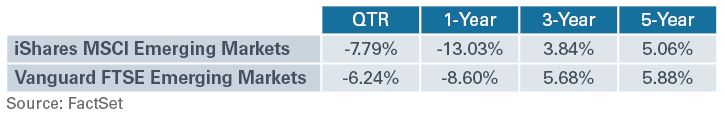

Figure 1: Emerging Market Classifications

WHAT IS AN EMERGING MARKET?

Exactly what is an “emerging market” – and how is it defined? Is a country classified as an emerging market due to its gross domestic product (GDP), per capita income or other quantifiable metrics? Surprisingly, the answer is no, because no universal definition of an emerging market exists. The International Monetary Fund (IMF) and many index providers interpret the definition differently, leading to varied results.

As the chart above shows, consensus has been reached on the classification for most countries. However, there are a few areas of disagreement. While countries such as Pakistan, Peru and Romania are considered “emerging” by some groups, others categorize these countries as “pre-emerging” or “frontier.” The FTSE Russell Index considers Poland and South Korea as developed, whereas MSCI categorizes these same countries as emerging.

And the categorizations are frequently changing. For example, FTSE upgraded Romania to emerging in September 2020 and downgraded Peru to frontier in September 2021, while MCSI downgraded Pakistan to frontier in November 2021.

For the most part, these classifications are based on subtle nuances which will have minimal impact on the index’s composition and performance due to their small weights within the index. However, one notable exception is South Korea, which is currently one of the larger weights in the MSCI Emerging Market Index with an allocation of more than 12%. On the other hand, FTSE and S&P consider it a developed market country, so it isn’t held within those indexes.

The lack of a universal definition for emerging markets and continuously shifting categorizations within indexes make investing in this asset class more challenging. How can investors be sure they are choosing underlying markets that fit their goals and objectives? Let’s take a look at a few strategies that should be considered when including emerging markets in a portfolio.

PASSIVE IMPLEMENTATION: SIMPLE AND EASY?

Investors may think passive implementation would be a relatively straightforward approach, one in which they forgo any alpha potential and lock in cheap fees to get efficient beta exposure. But it’s not that simple. Due to the different methodologies and compositions of the indexes, plus a lack of universal definition for emerging markets, investors must decide what index to track and what provider to use. This decision can have a meaningful impact when it comes to performance. Tracking error will likely be minimal, so it’s something that would remain mostly unnoticeable when looking at a fund in isolation. However, absolute returns – or the returns that really matter to the bottom line – can be substantially different.

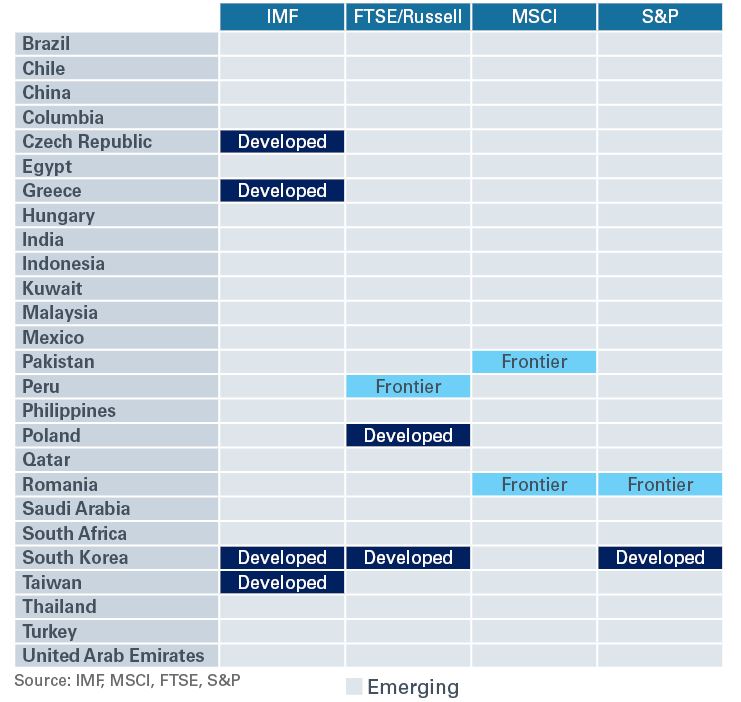

For example, let’s compare two of the most popular passive emerging markets ETFs: Vanguard Emerging Markets (VWO) and iShares Emerging Markets (EEM).

Vanguard utilizes the FTSE Emerging Markets Index while iShares utilizes the MSCI Emerging Markets Index – and the performance differential is stark. The ETFs show a 150 basis points (1.5%) difference over the most recent quarter and a difference of 450 basis points (4.5%) over the trailing year. The performance differential experienced here is meaningful and isn’t too dissimilar from what you might see when allocating to emerging markets in an active manner.

Figure 2: Performance (as of 3/31/2022)

So why is there such a big difference? This stems from the difference in methodology discussed earlier. Particularly, how the different indexes that each fund track define “emerging markets” and, therefore, what countries they invest in. The allocation effect, or rather what countries are excluded or included—and at what weight—has played a large role in the performance differential. For example, the absence of South Korea—roughly a 12% weight in iShares Fund—has benefitted Vanguard over this time period. In addition, the methodology for what stocks are included has played a role—FTSE holds roughly 500 more stocks than MSCI and this additional diversification has been beneficial for the Vanguard Fund as well. While these differences can seem subtle, the impact can be large.

These differences illustrate why it’s important for investors to understand which index their investment is tracking and if it aligns with their objectives, even when applying a passive investing approach.

HOW TO INVEST IN EMERGING MARKETS: IMPLEMENTATION STRATEGIES

While passive implementation of emerging markets within a portfolio isn’t as straightforward as it seems, it is still a viable strategy for many investors. In the following section, let’s compare the methods investors can use to invest in emerging markets and uncover the pros and cons of each approach.

PASSIVE IMPLEMENTATION – CHEAP AND EFFICIENT BETA?

Pros: Historically, emerging markets have been one of the more expensive areas to invest passively. But passive investing has gained popularity over the years, pushing down expenses across the board. Investors have benefited due to economies of scale; some funds can be invested in for less than 10 basis points, making it a cheap way to get access to a broad set of emerging markets companies.

Cons: While the management fees for emerging markets have decreased, other elements of friction make it more difficult for these passive funds to closely track the index they are designed to replicate. As a result, these funds are almost guaranteed to underperform the index. Although this underperformance is unlikely to be substantial, it’s something that investors should consider. And, as mentioned earlier, the fund’s index selection or classification of countries as emerging markets will have a meaningful impact on performance.

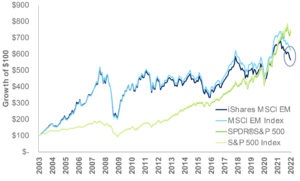

Figure 3: Tracking Error in Passive Funds can be Elevated

Relative to Other Markets

GLOBAL EMERGING MARKETS: PROS & CONS

Pros: Most strategies combine a broad array of over 20 countries into a single investment strategy. When funds have a single mandate that sifts through various factors and deploys capital how they see fit across countries and stocks, investors can realize a huge benefit and ease of investing within these markets – whether in the form of a more systematic or rules-based approach such as a passive strategy, or by weighing relative value for one security versus another in an active strategy. The returns by country can vary widely and price action can be swift with elevated volatility. Given all these variables, having a structure and strategy in place to allocate accordingly is imperative and reduces the need for investors to constantly adjust their emerging markets exposure.

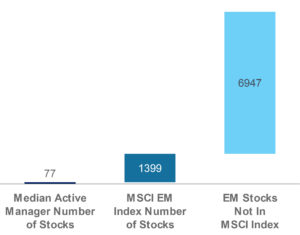

Cons: Within this implementation approach, the broad array of countries encompasses a wide range of stocks. Indexes only hold a sample of these stocks, and global emerging markets managers typically hold an even smaller sample. For instance, the MSCI Emerging Markets Index holds 1,399 securities and the FTSE Emerging Markets Index holds 1,907 securities. Meanwhile, the average global emerging market manager holds 185 securities, with the median manager holding 77 securities.1 That’s a mere fraction of the over 8,300 securities available worldwide.2 When thinking about this from a per-country perspective, many strategies may only hold one or two stocks per country, out of the hundreds or even thousands available. The sampling used severely limits both the opportunities and additional diversification benefits.

Figure 4: Number of Emerging Markets Opportunities

REGIONAL OR COUNTRY-SPECIFIC INVESTING – A TARGETED OR CUSTOMIZED APPROACH?

Pros: The universe of emerging markets is very large, diverse and highly variable. It is challenging to even refer to this universe with a singular name, considering how different each country is, the various stocks within each country, and how differently each country can behave. Allocating by specific country or region provides investors with two benefits. First, they can adjust their portfolio specifically based on countries that appear to be more favorable and are not subject to country allocations decided on or defined by a broader global emerging markets mandate. Instead, investors can control the asset allocation decision between countries, taking advantage of increased flexibility and customization to reflect their views and goals. Second, the number of securities in emerging markets is vast, and indexes and most broad emerging markets mandates only hold a sampling of companies. A larger pool of securities to invest in provides more opportunities for diversification within an underlying market.

Cons: Maintaining, monitoring and adjusting all the various exposures is an arduous process and requires considerable resources to manage. Investors may not have the time, knowledge or context to conduct research regarding country weightings or returns. Additionally, a larger number of investments creates a higher level of complexity, while an increased focus on individual line items versus the bigger picture may be counterproductive for investors.

Figure 5: Number of Emerging Markets Opportunities

INVESTING IN EMERGING MARKETS EFFECTIVELY

While emerging markets as an overall asset class may provide investors with potentially elevated returns, it’s important to remain cognizant of the fact that emerging markets is not a universally defined term. Additionally, exposure to emerging markets can vary by index and fund, depending on the methodology used.

When evaluating the approach to emerging markets in your portfolio, you would be well-served to dig into the emerging markets asset class and learn more about its nuances (and idiosyncrasies). Decide on which emerging markets fit your views and your goals, and if you want to retain control of portfolio management or delegate to a fund manager. As with all asset classes, there is no one “right” approach to investment management. Instead, every investor needs to decide what strategy and individual investments are right for them. To learn more, please contact your NEPC consultant.