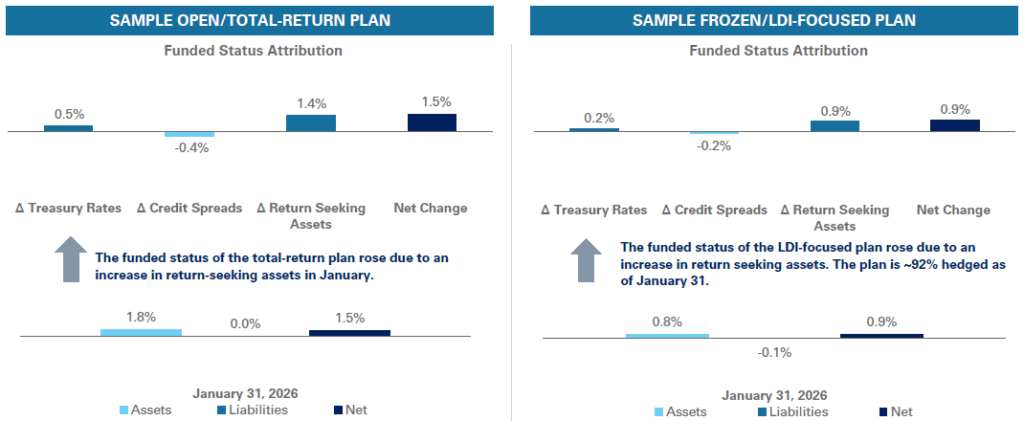

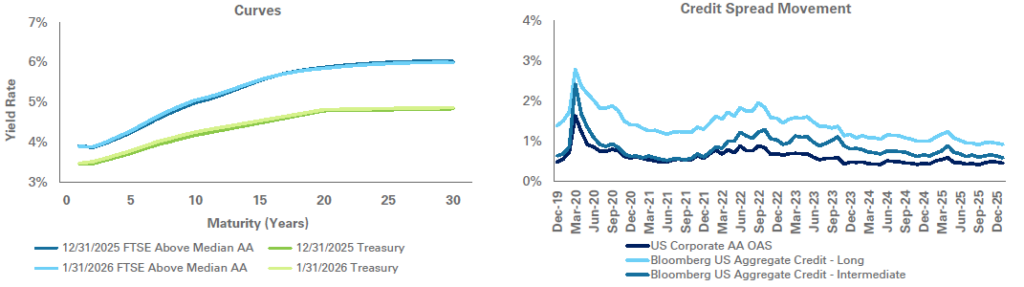

In January, defined benefit pension plan sponsors likely experienced an increase in funded status due to positive equity markets. The Treasury yield curve remained relatively unchanged; the 10- and 30-year yields increased slightly to 4.26% and 4.87%, respectively. The discount rate for NEPC’s hypothetical total return pension plan was unchanged at 5.62% and the frozen LDI-focused plan increased 1 basis point to 5.37%. The total-return pension plan and LDI-focused plan saw increases in funded status of 1.5% and 0.9%, respectively.

We anticipate continued market volatility and the potential for market disruption. Plan sponsors should diligently monitor sources of change in funded status versus expectations, as equities and interest rates are likely to remain volatile. This includes closely observing interest-rate hedge ratios and allocating across the yield curve as interest rates change.

Source: Factset, FTSE and Brentwood LLC, as of January 31, 2026

Rate Movement

Retiree Buyout Index

The Buyout Index for retirees is estimated to be approximately 106.2% of PBO, as of January 31, 2026

Recent Insights from NEPC

The Art of Terminating a Coporate Pension Plan

Voluntary Employee Beneficiary Association – An Overview

Recent Corporate Pension Headlines

Sponsors saw continued good news on the pension risk transfer (PRT) litigation front in January. The Verizon PRT case was dismissed on January 8th. The Department of Labor came out in support of Lockheed Martin. Weyerhauser, despite currently facing a PRT litigation case, announced a new PRT in the amount of $455 million. Plaintiffs have struggled to show actual, present, or imminent harm which has led to the dismissal of many cases to date though some remain outstanding. NEPC will continue to monitor the situation and provide updates to clients.

Sources:

DOL. (2026, February 3). US Department of Labor Files Amicus Brief Clarifying Legal Framework for Pension Risk Transfers. U.S. Department of Labor. https://www.dol.gov/newsroom/releases/ebsa/ebsa20260109-0.

NAPA. (2026, February 3). Lack of standing sinks another pension risk transfer suit. NAPA-Net. https://www.napa-net.org/news/2026/1/lack-of-standing-sinks-another-pensionrisk-transfer-suit/

Samuels, R. (2026, February 3). Weyerhaeuser announces new pension risk transfer, remains subject of a pending lawsuit. Pensions & Investments. https://www.pionline.com/institutional-investors/pension-risk-transfer/pi-weyerhaeuser-pension-risk-transfer-february-2026/