Investors seeking alternatives to small-cap stocks may want to pause and take a closer look to better understand the nuances of this asset class before passing on it.

Faced with a shrinking universe of small-cap equities and structural headwinds, many investment portfolios are opting for private equity instead. Investors are also discouraged by the lackluster performance of U.S. small cap companies—those with a market value between $300 million and $2 billion—as they are typically more vulnerable to higher rates and the vagaries of economic cycles*.

At NEPC, we believe this isn’t an either/or situation and small-cap stocks remain complementary to private equity allocations; there is room for both asset classes within an investment program. U.S. small-cap stocks can provide growth that is harder to come by elsewhere in the portfolio and offer a source of diversification. We also believe the challenges facing them offer an attractive entry point. At the same time, we urge investors to lean into an active implementation approach in order to mindfully navigate the nuances of this asset class.

A DWINDLING UNIVERSE

A trend of the number of publicly listed U.S. companies declining over the past decade has disproportionately impacted smaller companies. The Wilshire 5000 Total Market Index is a market cap weighted index of the market value of all American stocks actively traded in the U.S. It is regarded as one of the most comprehensive equity indexes. The Wilshire 5000 index listed 3,326 stocks as of December 2024, down from its peak of 7,562 stocks in 1998, underscoring a shrinking universe for public equity investors.

One may surmise that the catalyst for this trend stems from smaller companies staying private for longer, thus shrinking the opportunity set in the public markets. While it’s hard to ignore the dwindling numbers, we believe it is far more challenging to definitively conclude whether the most attractive small-sized companies are, in fact, those deciding to stay private.

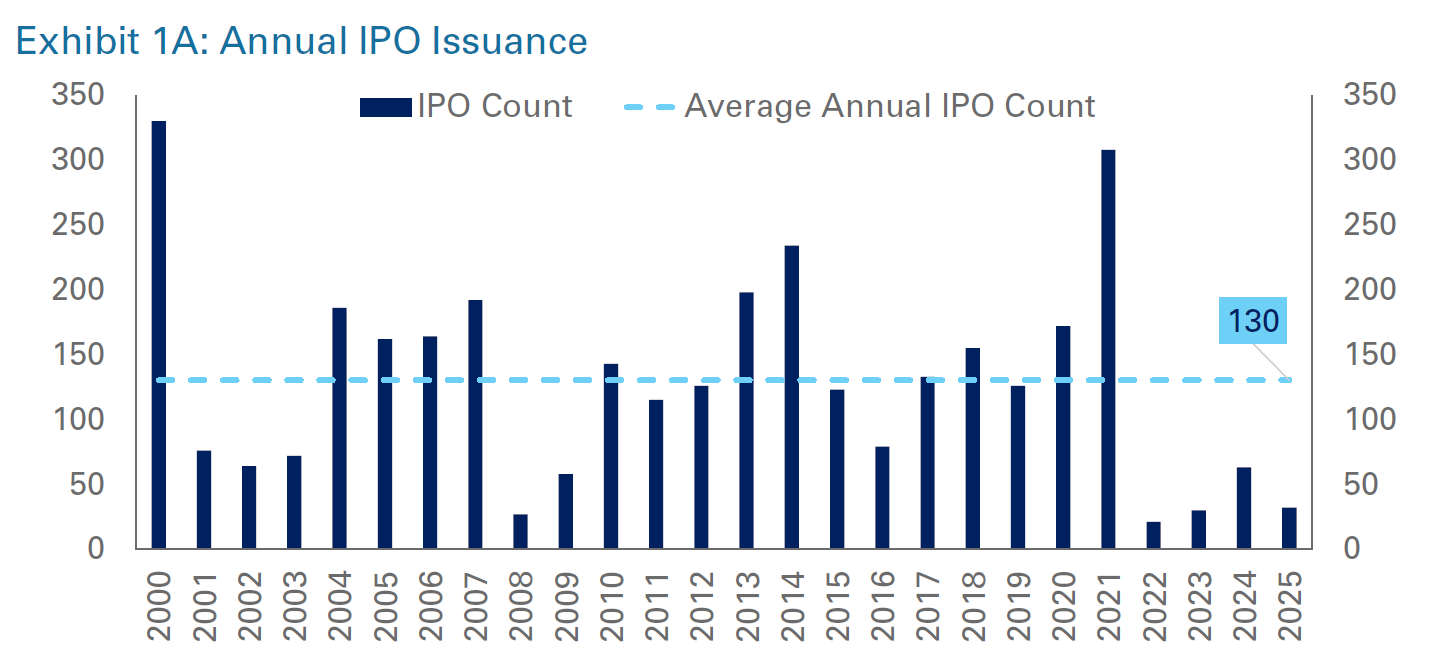

Those looking to make that argument might point to the number of initial public offerings (IPOs) decreasing over time. While the number of IPOs have significantly dropped relative to the early 1990s, the volume of IPOs, in more recent years, is hovering around the 20-year average (Exhibit 1A).

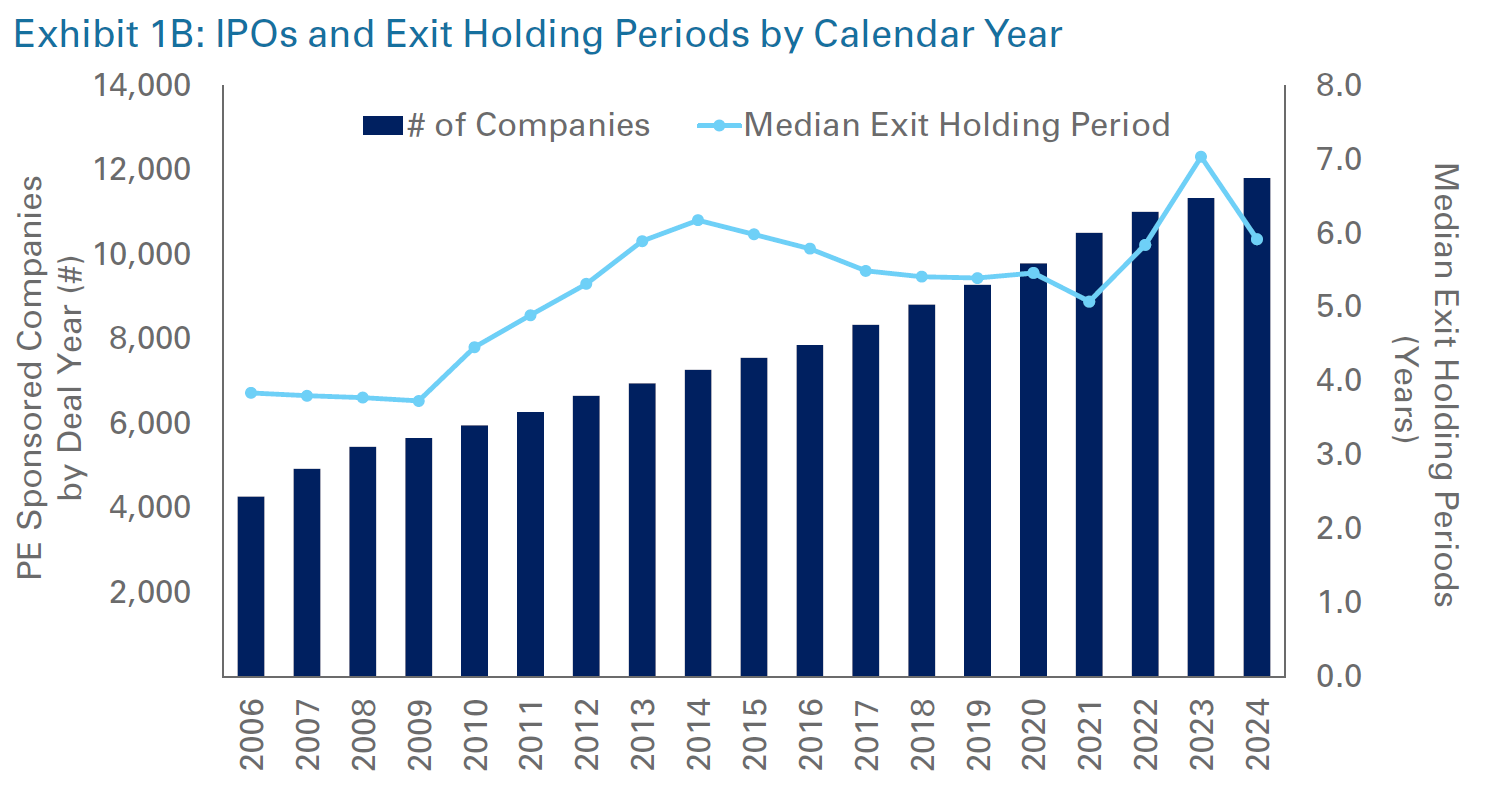

A more pronounced headwind has been the record number of un-exited sponsor companies within private markets, and general partners holding these assets for a longer period. As a result, the number of un-exited sponsor companies have doubled in the past 15 years and the median holding period has increased to 5.9 years, up from 3.7 years – a 59% increase (Exhibit 1B). These two trends, combined, are leading to companies staying private longer. This has remained top of mind for our clients who have historically looked for U.S. small-cap stocks to provide growth that is harder to come by elsewhere in the portfolio. However, with companies staying private for longer, investors fear that a higher portion of smaller companies’ early growth is now occurring while they are private — depriving them from benefiting through the public markets.

LAGGING PERFORMANCE: LIABILITY OR OPPORTUNITY?

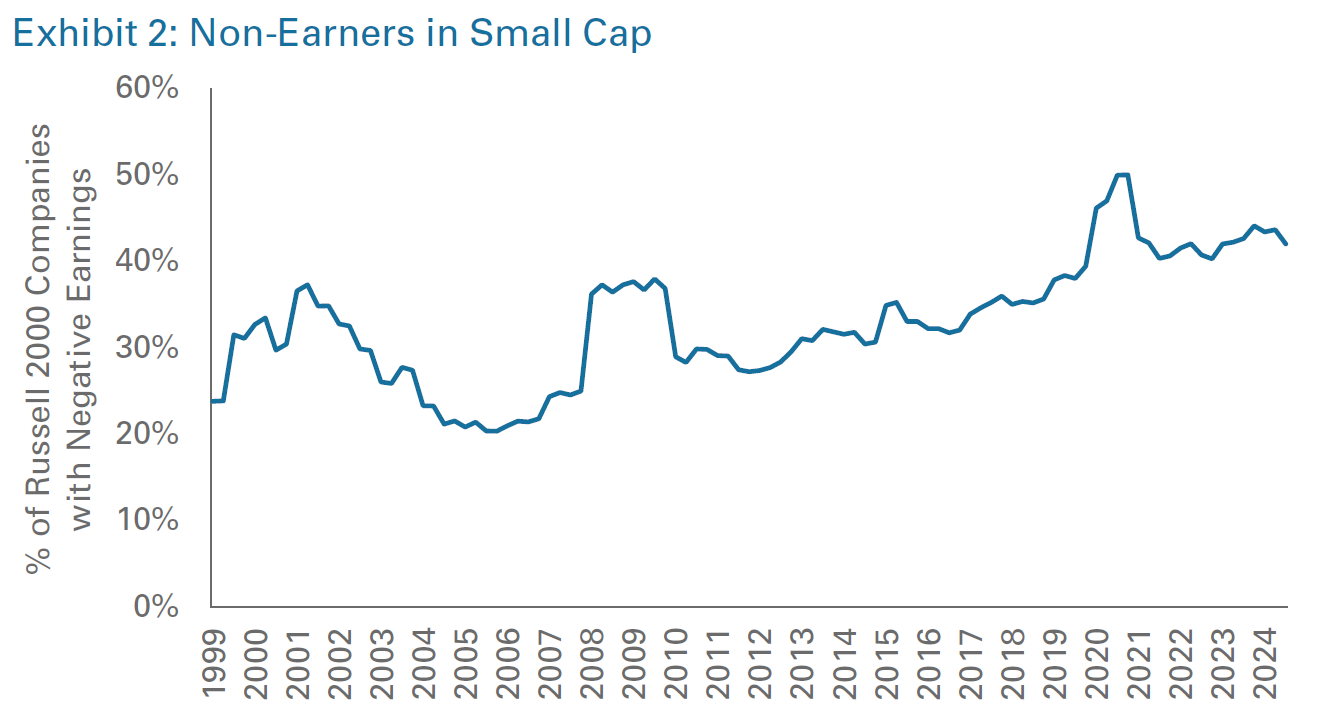

It is also important to acknowledge that U.S. small cap companies that remain public continue to trail their larger U.S. counterparts and are becoming increasingly unprofitable (Exhibit 2).

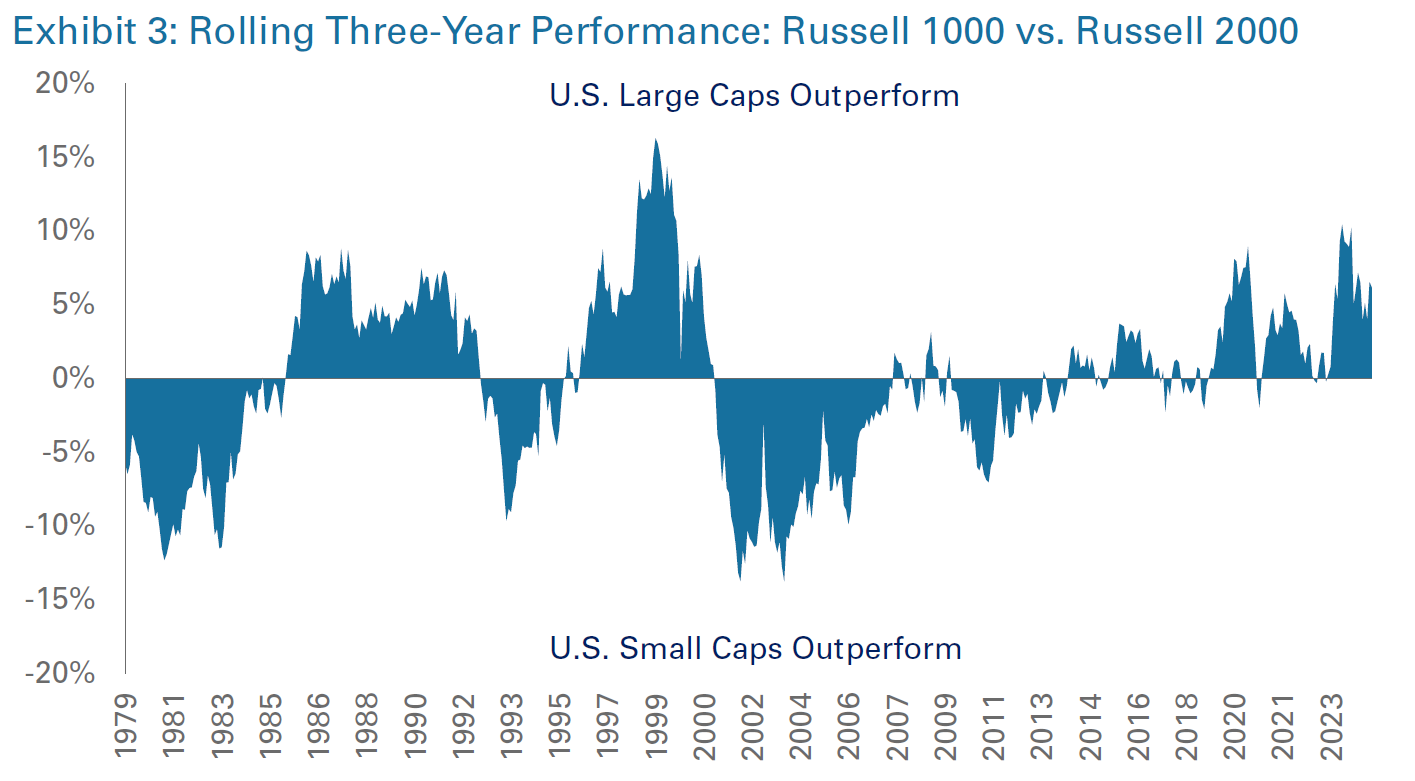

While almost every asset class has lagged U.S. large-cap stocks over the past several years, the investment landscape for U.S. small companies has become increasingly more challenged during that time as shown in Exhibit 3. As a result, over a third of the Russell 2000 Index consists of companies without earnings which we dissect in Exhibit 2. Market participants have pointed to macreconomic and regulatory headwinds, increased M&A activity, and heftier financing costs linked to floating-rate debt as potential reasons behind this underperformance. In a volatile market, these non-earners face a steeper uphill climb relative to their peers.

However, at NEPC we believe that while these structural headwinds are real, the current environment offers an attractive entry point into the asset class. First, if history is any indication, small-cap equities should eventually catch up to their large-cap peers as the performance of U.S. large-cap stocks compared to small-cap equities tends to be cyclical (Exhibit 3).

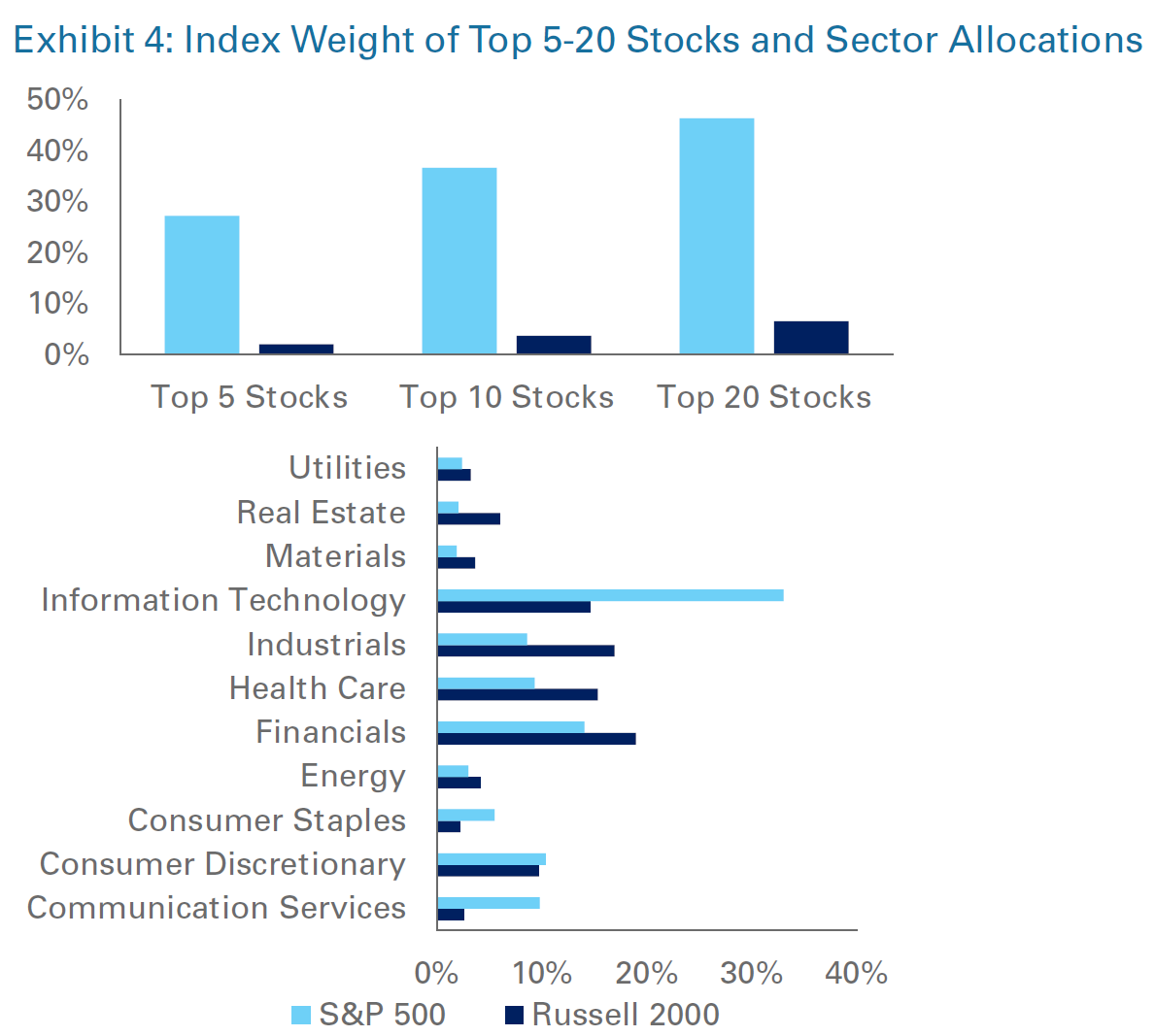

Second, there is currently no index concentration risk in the small-cap space, and its sector exposure generally complements large-cap equities, making it a useful tool for portfolio construction (Exhibit 4).

ROOM FOR TWO

In our experience, private equity firms often target companies that are far smaller than those represented in the U.S. small-cap universe. For instance, in our experience, buyout strategies investing in the lower-middle-to-large/mega market focus on portfolio companies with an enterprise value of $10 million to $1 billion or higher. The average enterprise value of small-cap constituents within the Russell 2000 is above $2 billion. As such, only a handful of mega private equity funds are realistically targeting companies that would otherwise be part of the Russell 2000 Index if they went public. This supports our belief that U.S. small-cap equities are complementary to private equity allocations, and there is space for both within an investment program. From a portfolio construction perspective, it is beneficial to have exposure to the entire market cap spectrum.

ENTER: ACTIVE MANAGEMENT

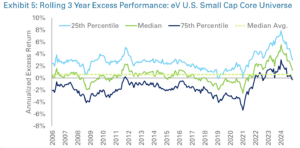

Data is Net of Universe Median Fees. US Small Cap Core Universe vs. Russell 2000 Index.

At NEPC, we believe these trends reinforce our recommendation for active management in the U.S. small-cap space. Investors should continue to lean into an active implementation approach as they navigate a potentially narrower opportunity set and a growing cohort of unprofitable companies.

Despite structural headwinds from private markets or, perhaps, because of them, we have seen active managers persistently add value, net of fees, in the rolling three-year excess return of the median manager within the eVestment U.S. small cap core universe (Exhibit 5); while there are periods of underperformance, the median manager, on average, outperforms the index by 0.59% over all the rolling three-year periods (net of fees), from 2006 to 2024.

Structural changes within an asset class not only present challenges, but also opportunities and creative solutions from the investment industry. As a result, we expect to see more traditional U.S. small-cap active managers embrace hybrid solutions that will allow them to invest in companies regardless of whether it is public or private. We have also started to hear from private equity firms as they begin to incubate products that would target these cohorts of small companies at a lower fee, lower leverage, and stronger liquidity profile than traditional private market funds, providing a quasi-public equity solution in the small-cap space.

For investors able to take on illiquidity risk, there is the potential to consider these hybrid or crossover funds within the small-cap space. However, we suggest working closely with NEPC’s investment team to assess these opportunities as the level of skill among investment managers to source and manage public versus private names can vary widely.

To learn more please contact your NEPC consultant.