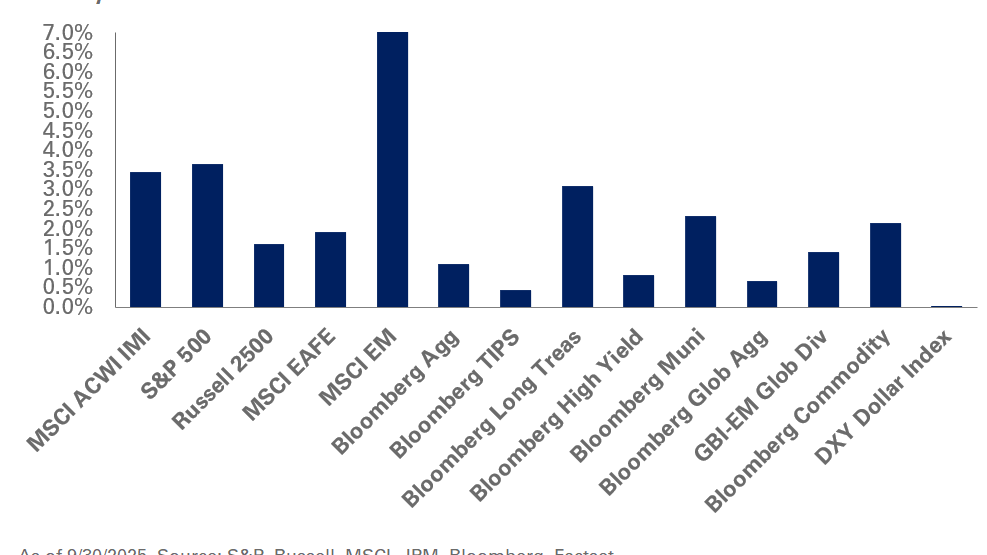

International and domestic equities posted significant gains in the second quarter. Short-term interest rates declined while long-term interest rates rose for the three months ended June 30. During the same period, the 30-year Treasury yield increased 19 basis points to 4.78%. In addition, there was a 15 basis point decline in long-credit spreads. The movement in Treasury yields resulted in static pension discount rates, with the discount rate for the open total-return plan rising five basis points to 5.65% and the discount rate for the frozen LDI-focused plan remaining unchanged at 5.44%.

We estimate the funded status of our total-return plan increased about 6.5% over the quarter. As a result of gains from return-seeking assets, our LDI-focused plan experienced a funded status increase of 3.7%.

Total-return plans may want to consider the impact of rate volatility on plan liabilities and the role of LDI in light of the current rate environment. For certain plan sponsors, lower rates may increase liabilities and reduce funded status, which could lead to higher required contributions and PBGC variable-rate premiums. NEPC consultants are available to discuss the impact and cost of various pension finance and derisking strategies in light of rate movements and volatility in the market.

Recent Corporate Pension Headlines

Due to a provision in the Bipartisan Budget Act of 2015 (BBA 2015), the PBGC premium filing due date for plan years beginning in 2025 may be accelerated to September 15, 2025 instead of the normal due date of October 15, 2025. This one-time provision will impact when cash needs to be raised to fund the premium payment. The PBGC premium due date is expected to revert back to October 15 in 2026.

PRT Litigation Update:

On March 31, 2025, Alcoa’s motion to dismiss the lawsuit was approved, while Lockheed Martin’s motion was denied. Decisions on other pending cases have yet to be finalized. NEPC remains committed to monitoring the ongoing litigation and will continue providing timely updates to clients.