Don’t rule out value stocks just yet.

We believe it isn’t time to give up on value even though this investment strategy has lagged growth equities for more than a decade now. Growth investing has not only outperformed value since 2008, but also it has widened its lead in this economic downturn with the COVID-19 outbreak fueling a seismic shift in the consumption of goods and services that have favored growth stocks. That said, value loyalists say these stocks, given their current cheapness, could be poised to outpace growth equities. After all, historically, value and growth have taken turns outperforming one another.

Meanwhile, advocates of growth investing state the expensive valuations of these stocks may be justified, pointing to the dominance of mostly technology companies—a staple in growth portfolios—in the world today. At NEPC, we believe both styles play a part in investment portfolios. We recommend a diversified portfolio that includes growth and value companies with market capitalizations spanning the entire spectrum.

The Case for Value

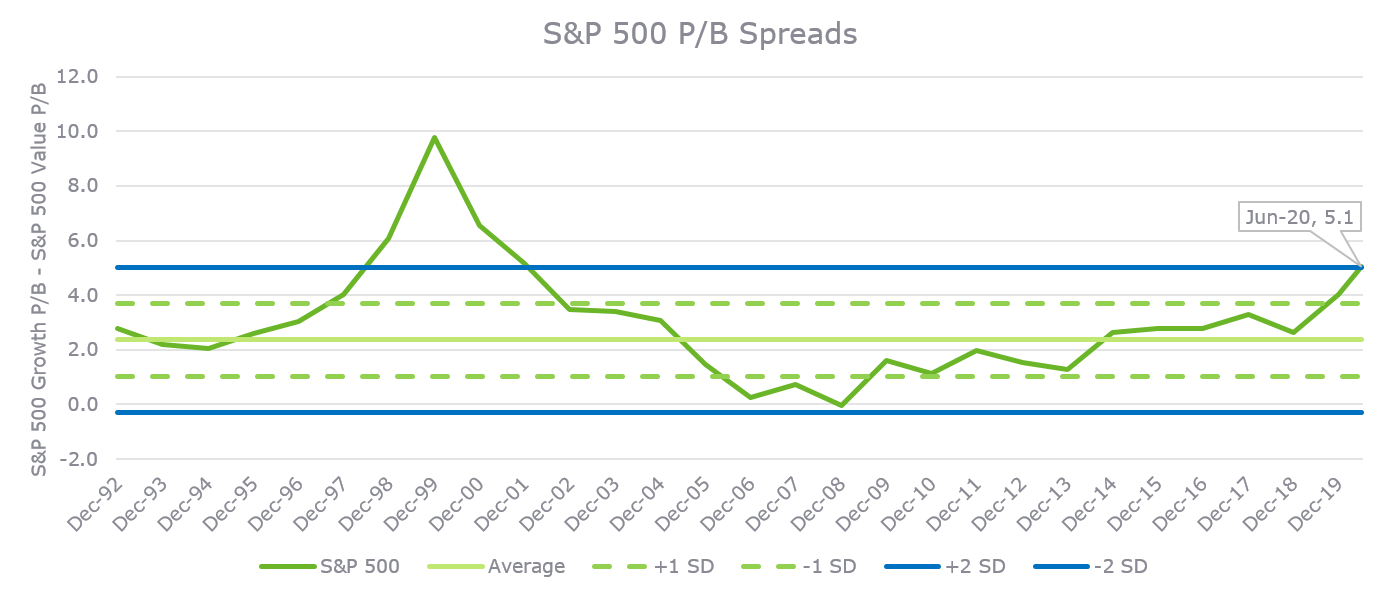

Using the price-to-book ratio, a popular valuation metric that compares a firm’s stock market value to its book value (an accounting value of the firm), we find that growth stocks are pricier relative to their value peers. In fact, the difference between their price-to-book valuations is currently the widest it has been since the dot.com bubble of the late 1990s and the early 2000s, according to data from the S&P 500 Value and the S&P 500 Growth indexes. Looking back, what came after such a notable gap in valuation spreads between value stocks and growth equities is one of the largest rallies of value stocks, where the S&P 500 Value Index beat out the S&P 500 Growth Index from 2000 through 2006.

The extreme difference in valuation spreads today point to potentially attractive entry points to invest in value companies, while highlighting the fact that growth stocks may be getting ahead of their underlying fundamentals (Figure 1). To that end, if value stocks are potentially at the precipice of their next bull run, investors would be remiss to exclude them from their portfolios. While the chasm between the P/B spread between value and growth stocks could further widen, it is reasonable to expect this spread to converge in the future.

Figure 1: Historical P/B spreads of S&P 500 Growth and S&P 500 Value Indexes

Source: FactSet

The Case for Growth

Those in the growth camp agree to disagree. They point to the justified P/B multiple, a valuation metric that calculates a P/B ratio grounded in the company’s fundamentals; the justified P/B ratio increases as the underlying return on equity (ROE) increases. Investors use ROE to determine the capital efficiency of an underlying asset, that is, the earnings generated by the underlying capital of the business.

NEPC analyzed the average ROE and P/B of the S&P 500 Growth and S&P 500 Value indexes from 1992 through June 2020, and we determined that the premium associated with the valuation of growth stocks relative to value equities is partially warranted. While growth names exhibit a higher P/B multiple, on average, growth stocks also have higher ROE, on average (Table 1). As stated earlier, using the justified P/B equation, a higher ROE would lead to a higher justified P/B, assuming all else is equal. The higher ROE for growth stocks can be explained by the predominance of technology companies which tend to be service-based and light on physical assets; they do not have to invest large sums of capital in factories and machinery to produce and distribute their products like an industrial manufacturer or utility company.

Table 1: Average P/B and ROE from 1992-June 2020

| P/B | ROE | |

| S&P 500 Growth Index | 5.0x | 25% |

| S&P 500 Value Index | 2.0x | 13% |

To be sure, there are limitations to this analysis which mainly focuses on ROE as the main differentiator between the indexes. For instance, intangible assets—non-physical assets such as intellectual property and the value of a brand name—constitute much of the value of technology firms; these assets can be a challenge to accurately quantify and can distort the true valuation of a growth company. That said, the outsized gains reaped by technology firms in recent quarters demonstrate that growth stocks are not necessarily as overvalued as many may believe.

While growth stocks have a higher collective ROE than value equities in the S&P 500 Index, investors must determine if this large difference in ROE between growth and value will persist in the future. Some argue that many growth equities possess structural advantages in their business models, enabling them to maintain their lead in ROE over value stocks. At the same time, these wide gaps in valuations between growth and value equities may offer an attractive entry point into value, potentially setting them up for an eventual comeback. At NEPC, our expertise is not in reading tea leaves. What we do strive to excel at is setting up our clients for long-term financial success by constructing diversified portfolios that can weather the vagaries of markets and economic cycles. To that end, we believe that investment portfolios can benefit from both value and growth assets. For our more comprehensive views on this topic, please reach out to your NEPC consultant.