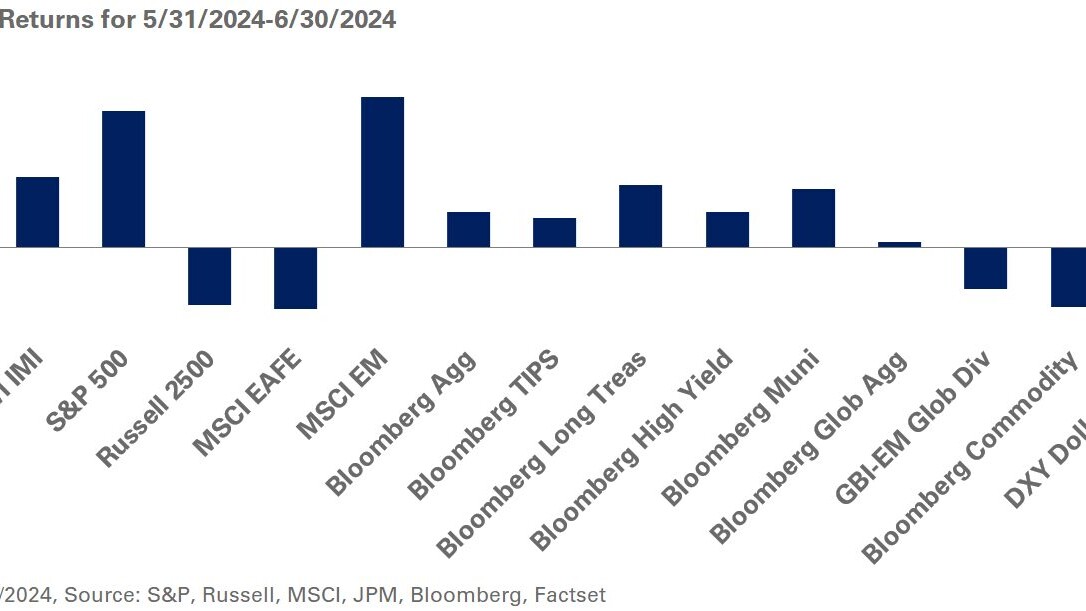

Corporate pension plans saw mixed results in funded status in August amid rising discount rates and falling equities. The Federal Reserve met in Jackson Hole, WY for its yearly economic symposium, where Chair Jerome Powell remained steadfast in the central bank’s commitment to fight inflation, even at the cost of “a sustained period of below-trend growth.” The Treasury yield curve rose, flattened, and remained inverted between the one- and 10-year tenors as investors continued to grapple with the Fed’s stance and its economic impact. Total-return plans outpaced LDI allocated plans due to a lower hedge of rising discount rates as Treasury rates rose and credit spreads were little changed. NEPC’s hypothetical pension plans witnessed a funded status gain of 1.8% for the total-return plan compared to 0% for the LDI-focused plan.