In this third and final installment of our series on Measuring Impact, we share best practices we recommend to clients on the implementation of impact measurement and management in portfolios.

In the earlier two pieces, we provide an overview of the common impact frameworks available in the market. We also discuss notable trends as the impact measurement and management industry continues to evolve.

Establishment of Goals

At NEPC, we have established a process to implement, measure and manage an impact investing program aligned with a client’s specific goals. Our aim is to ensure our clients have a rigorous understanding of not only their investment, but also the impact of their investment.

Successful measurement and management of your impact investing program starts by developing specific impact goals. When clients are interested in aligning portfolio investments with impact goals and developing an impact investing program, we frequently find that while their investment goals are well defined, their impact goals are not.

Additionally, points of view within the organization and its stakeholders may also be misaligned. Therefore, the first step in the process is to work closely with the client to assist them in establishing goals that are aligned to those of their organization and stakeholders. This is accomplished through a series of in-depth discussions, sometimes facilitated through customized surveys that allow stakeholders to share their views anonymously. Questions asked during this survey can include:

- Should the portfolio emphasize negative screening (exclusionary), environmental, social and governance (ESG) factors or thematic (proactive) investments?

- Should the portfolio consider an investment that has some but not all the desired characteristics?

- How should we evaluate the success of the portfolio?

The United Nations Sustainable Development goals (UN SDGs) (discussed in detail in Part One of this series) also serves as a foundation for these discussions.

During this process, we help our clients refine their goals to merge their impact aspirations with investable areas. For example, a family office may want to focus on alleviating poverty, reducing inequality, and increasing sustainability in cities and communities.

Taking this guidance, we can discuss potential areas of investment that align with these goals, such as private real estate investments focused on affordable housing or allocations to municipal investments within bond portfolios. The objective is not to finalize investment decisions, but rather to ensure that the impact goals under consideration are actionable within the investment portfolio, and that the impact and investment goals are aligned.

Investment Policy Statement Integration

Once impact and investment goals are determined, they are documented in the client’s investment policy statement. (The impact industry refers to this as documenting your Theory of Change.) Documenting the investment policy statement guides portfolio construction and outlines key indicators of success and their measurement.

While every investment policy statement is customized, reflecting the client’s unique goals, the following areas are typically addressed:

- Impact goals and areas of focus

- Scope of the program and tools used: The client can define specific targets for the program. For example, a client may adopt a goal of having a 100% mission-aligned portfolio or a target of 15% of the program invested with thematic managers aligned with the identified goals. They can also document which impact pillar(s) to utilize in their program (more on the pillars below).

- Decision-making process: Are decision makers willing to consider newer firms or funds with limited track records? Are they willing to take on illiquidity to pursue impact goals?

- Identify success metrics: What are the desired outcomes of the impact program? Ideally, this should include a description of how the program is monitored and measured (see more below).

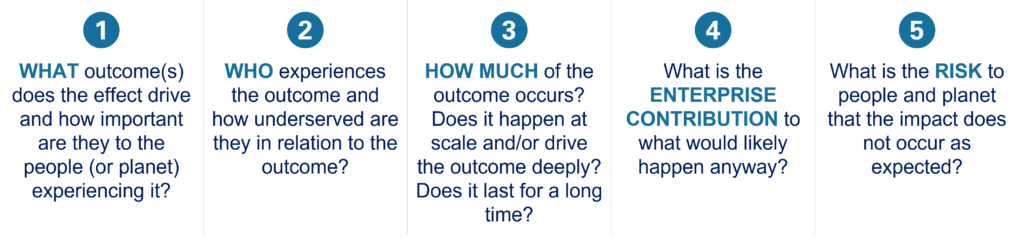

One framework for managing the process of establishing, documenting, selecting, implementing and measuring investment strategies is Impact Management Project’s Five Dimensions of Impact. The five dimensions can serve as a guide to ensure a potential investment will align with impact goals.

Impact Measurement and Management (IMM)

As noted in the NEPC Impact Investing Blueprint, we view impact measurement and management (IMM) as an ongoing process of evaluating, learning and improving. We customize the IMM approach for each client, based on their goals, preferred frameworks, which pillar(s) they are utilizing, and what types of underlying investments are in the portfolio.

For example, data from an investment manager who invests in U.S. public equity will differ significantly from data available from a private equity manager focused on sustainable energy. Below, we outline approaches that NEPC has used with clients at the individual investment level and the portfolio level.

IMM by Pillar

Today’s impact landscape has four primary pillars clients can use to filter investment choices in their impact program. Depending on the type of strategy, we provide the following framework for clients pursuing an impact investing program:

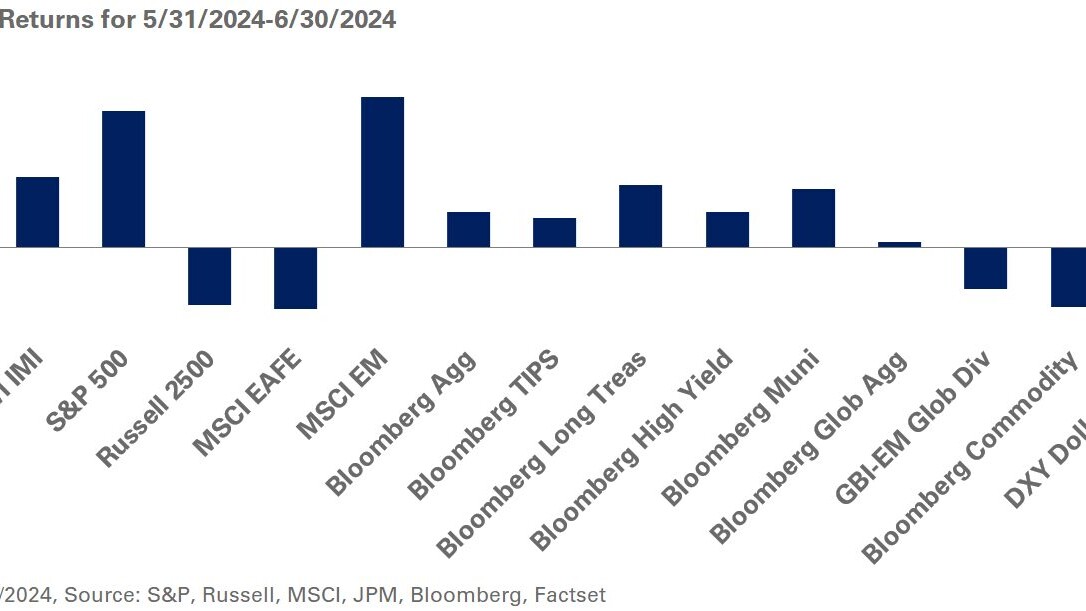

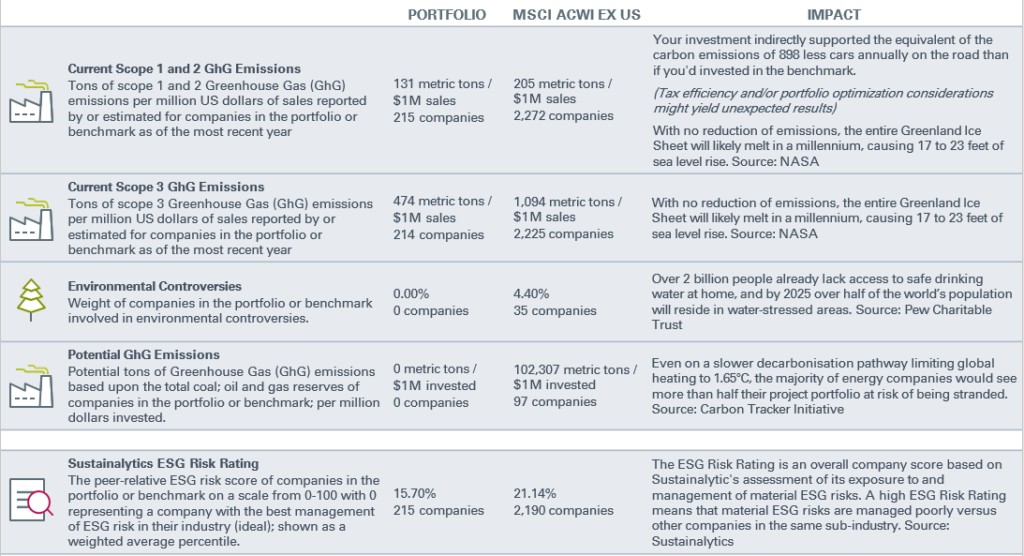

Screening: For clients that have incorporated screening into their program, NEPC partners with the investment manager, typically a passive equity manager, to review the portfolio on at least an annual basis. During the review, we focus on ensuring none of the excluded areas of investment are in the portfolio holdings. We also compare key performance indicators of the client’s portfolio to those of a relevant benchmark.

For example, the output below, provided by Parametric, offers metrics for a sample portfolio that has implemented a customized responsible investing screen. The sample metrics below illustrate how the client’s portfolio compares to the MSCI ACWI ex U.S. Index with regards to several environmental issues. Within the report, an overall ESG score is also provided. The full sample report can be found in the Appendix.

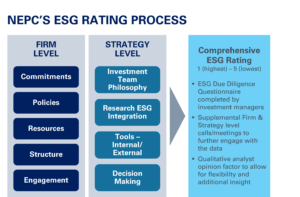

ESG integration: For clients who have implemented ESG integration, we use proprietary ESG ratings to evaluate the preferred investment managers in our program. These ratings are regularly updated as the investment managers’ processes evolve. The process we employ to develop our ESG ratings is mapped below:

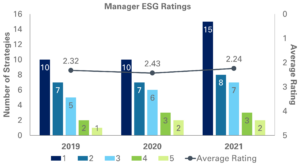

For clients who adopt ESG integration as a primary goal, we periodically review the ESG ratings of the managers in the portfolio and strive to improve the overall weighted average. This review follows a templated process and shows a quantitative look over time. The example below was designed to underscore a client’s progress over time by count and average score (managers score from 1 to 5, with 1 being the highest level of ESG integration).

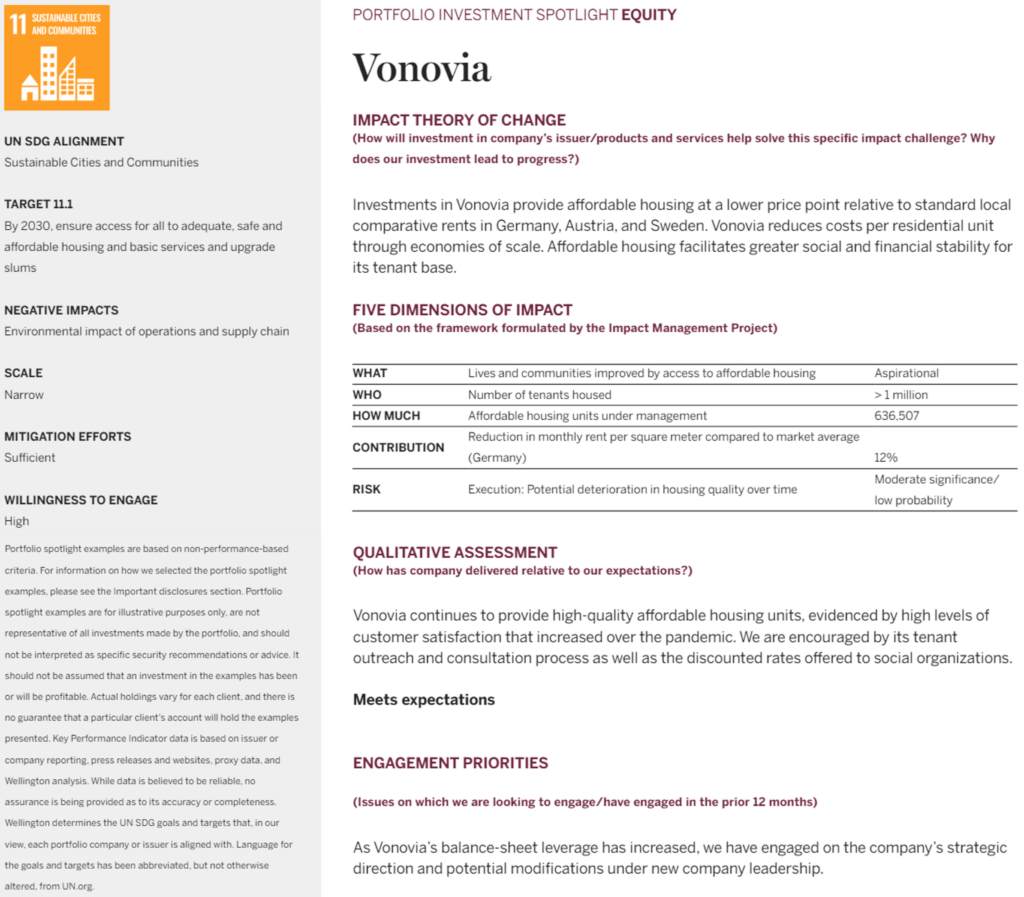

In addition to NEPC’s proprietary ratings, we will often compile and consolidate ESG integration information provided by the investment managers in the portfolio. As the industry evolves, there is greater consistency in reporting by investment managers, with many managers using the UN SDGs and other commonly used frameworks. The example below from Wellington’s Global Annual Impact Report highlights the money manager’s approach to evaluating companies in its portfolios.

This approach incorporates the UN SDGs, outlines a theory of change, discusses the five dimensions of impact, and provides a qualitative performance assessment.

Thematic investing: Similar to the example provided by Wellington, for thematic investments held in an impact investing program, NEPC will partner with the investment manager to provide information on how the strategy is performing relative to its goals. Those can then be evaluated relative to the client’s stated impact investment objectives.

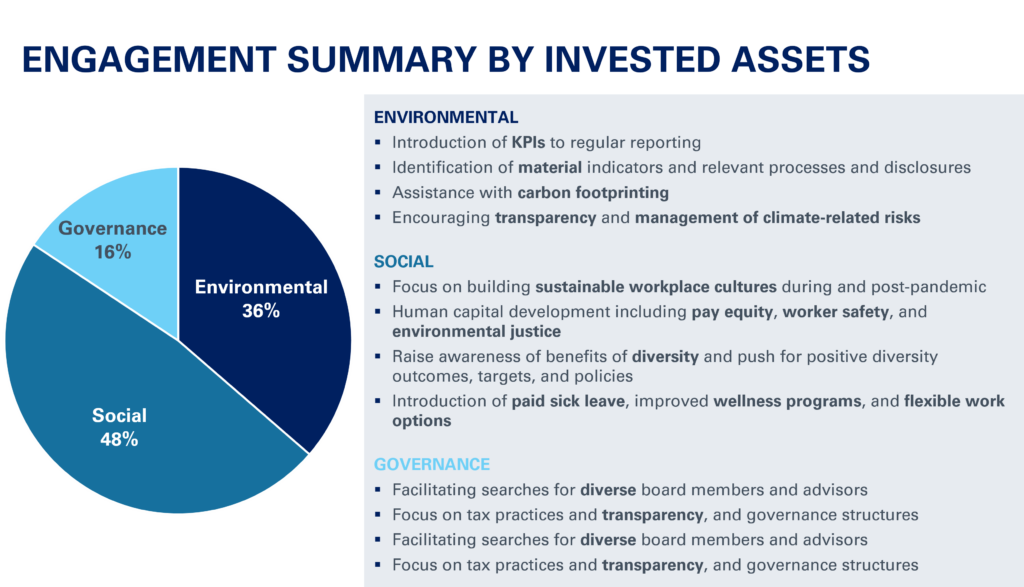

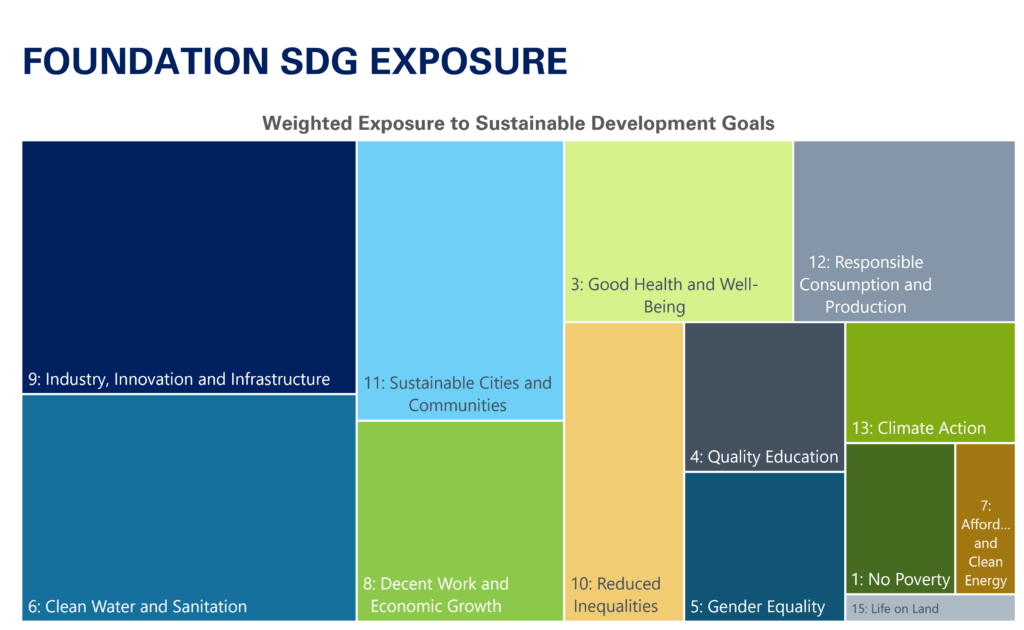

Total portfolio: NEPC provides a summary of the overall performance of funds within the impact investing portfolio. For example, the following summaries were prepared for a family foundation:

Impact Program Evaluation and Management

Implementing an impact investing program is not enough; it is also important to manage results over the long term. Once the measurement is complete, the final step of the process is to evaluate results and determine if any modifications should be made to the program. Some of the questions we discuss with clients during an impact program review are as follows:

- Did the program meet your stated goals?

- If goals unmet, what were the roadblocks?

- Do goals and expectations need adjustment, or should we add new targets and goals?

- Is an update to the Investment Policy Statement (IPS) needed?

At NEPC, we help clients implement and manage a successful impact investing program by defining goals, integrating an investment policy statement, measuring performance, and continuously evaluating program performance. For more information about partnering with us to manage your impact investing program, please reach out to your NEPC consultant or contact us here.

This piece was written by Stacey Flier, CFA, Principal, Senior Consultant, and Krissy Pelletier, Partner and Co-head of NEPC’s Impact Investing Committee.