Among family offices and private clients, some investment principles are well known: the importance of selecting appropriate strategies, the value of diversifying, and the need to integrate investment decisions with tax and estate planning. In contrast, selecting the right investment vehicle often receives less attention. But it shouldn’t, because the wrong decision may saddle a family with unexpected taxes, increased costs, or limited flexibility.

Broadly speaking, investors can access four types of investment vehicles. These include separately managed accounts (SMAs), commingled funds, mutual funds, and exchange-traded funds (ETFs). Note that, although ETFs are known primarily for their ability to provide low-cost index exposure, the universe of ETFs has been expanding to include actively managed options as well.

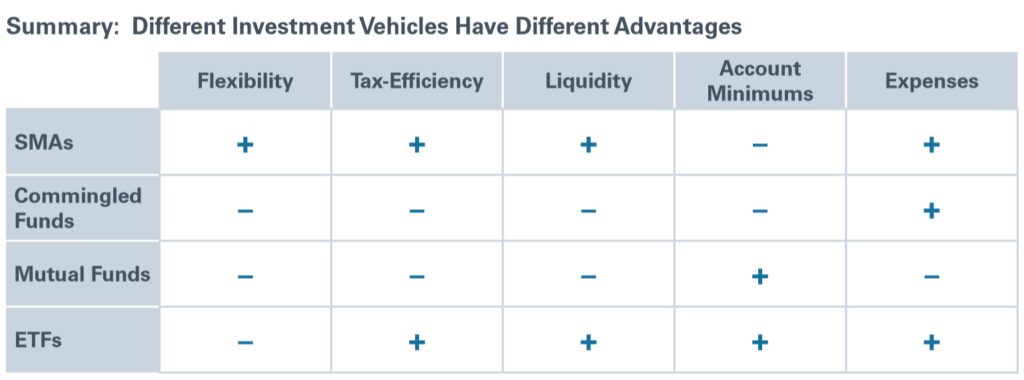

For taxable, high-net-worth investors, the primary considerations in selecting a vehicle are:

- Flexibility

- Tax efficiency

- Liquidity

- Account minimum

- Expenses

Briefly, SMAs provide the most flexibility, are highly tax efficient, and have relatively low expenses, but they require large minimum investments. The primary advantage of commingled funds is their low cost, while for mutual funds, the appeal is their low account minimums. ETFs have many advantages, but like other pooled vehicles, their flexibility is limited.

Commingled funds, mutual funds, and ETFs are vehicles in which the assets of individual investors are pooled together and managed collectively. A primary disadvantage of these vehicles is that individuals do not own the underlying securities directly and, therefore, they have no control over the holdings. These vehicles are best suited for investors who don’t have a need to customize their investment.

In contrast, an SMA is a single portfolio separately managed for one particular client. The investor owns the securities directly, and this provides a critical benefit: flexibility. This enables families, for example, to avoid the risk of overconcentration by excluding the company or industry in which they created their wealth. SMAs can also be helpful for families who wish to customize their account to align with their personal values. They also permit families to make charitable contributions with appreciated stock. Compared to other vehicles, the flexibility of an SMA is almost limitless.

TAX EFFICIENCY

For high-net-worth investors, the difference between pre-tax and after-tax returns can be especially significant. Although the underlying tax characterization (long-term gains, short-term gains, or ordinary income) may not vary materially from one vehicle to another, the ultimate tax treatment may.

Mutual funds afford the least degree of control over taxable events and, as such, tend to be the least tax efficient. This is primarily due to the manner in which these funds distribute gains. Each investor holding shares on the date of record receives a pro-rata share of the distributable gain for the year, even if those gains were achieved prior to the investor’s purchase. Investors can estimate the magnitude of this potential problem by evaluating the level of embedded capital gains in the fund prior to making an investment.

Compared to mutual funds, commingled funds are somewhat more tax efficient. They report gains and income annually but are not required to make distributions. Investors maintain their own cost basis and pay taxes only on returns that have accrued to them. But, like mutual funds, commingled funds provide investors with less control over taxable events that arise from the underlying holdings.

In contrast, ETFs and SMAs tend to be more tax efficient. With ETFs, the efficiency stems from the manager’s ability to handle inflows and outflows through the creation or redemption of units, rather than rebalancing within the fund. This minimizes taxable events and, in fact, capital gains are often not realized until the investor sells the ETF.

Due to the flexibility mentioned above, SMAs are even more tax efficient. An investor may request that turnover be minimized or that capital losses be used to offset capital gains in a technique known as tax- loss harvesting. In addition, investors don’t face the problem of embedded capital gains. Because they purchase and own the securities directly, they are taxed only on the realized gains achieved on holdings during the period in which they owned them.

LIQUIDITY

The liquidity of these four vehicles also differs widely. While ETFs and SMAs are the most liquid, mutual funds and commingled funds are less so.

With ETFs, investors can buy and sell them as they would individual stocks. These securities are priced in real time, enabling investors to trade on an intra-day basis to quickly turn a holding into cash at the desired price. Similarly, with an SMA, the manager can sell holdings quickly to make cash readily available.

In contrast, with a mutual fund, purchases and redemptions of fund shares occur only at the end of a trading day when those shares are priced at the net asset value. Thus, shares purchased early in the day are transacted at the same price as those purchased later. Commingled funds are even less liquid, typically offering purchases and redemptions only on a weekly, monthly or quarterly basis. This relative lack of liquidity versus ETFs and SMAs may be a concern to investors who want the ability to quickly shift portfolio exposures or increase liquidity.

ACCOUNT MINIMUMS

Account minimums vary widely. SMAs typically require large investments to ensure that the size of the account is sufficient to both pursue the desired investment strategy and maintain adequate diversification while also covering reasonable expenses for custody and trading.

Commingled funds are typically available with a lower investment minimum than SMAs, but they are normally utilized only by institutional investors (including family offices). Often, investment minimums of $1 million and up (and tax reporting via K-1 forms) preclude retail investors. By comparison, mutual fund and ETF accounts are easy to administer, and account minimums are low because operational expenses can be spread across a large investor pool.

EXPENSES

Fees are generally higher on mutual funds than on ETFs, SMAs and commingled funds with comparable strategies. (It is worth noting that with SMAs, accounts with non-US securities involve more complexity and expenses, including additional registration costs, extra paperwork and higher custodial fees.)

Because mutual funds are heavily regulated and have extensive disclosure requirements, legal expenses and operating costs are higher. Over long periods, these may detract from investor returns.

SUMMARY: MIXING AND MATCHING

Of course, most investors will employ more than one of these vehicles, depending on their financial situation. When asset sizes are large enough, an SMA is often the preferred option because of its greater flexibility and tax efficiency.

In many cases, though, a combination of vehicles may be the best approach. Your NEPC consulting team can assist in constructing a portfolio with the combination of vehicles that is most appropriate and advantageous for your situation.