The ever-evolving economic conditions including higher interest rates and inflation, are impacting the Private Equity buyout industry:

- Limited Partners’ (LPs) risk appetite is changing, leading to shifts in how and where capital is allocated.

- Investment Manager selection will become more important over time, distinguishing between those General Partners (GPs) with value-creation strategies and those who relied heavily on favorable conditions.

- Certain buyout strategies that were overlooked in the past may now be well-positioned to deliver attractive returns.

- The Private Equity buyout industry is expected to continue growing and evolving, but modified approaches may be necessary from GPs and LPs, to achieve strong and consistent returns.

Deploying Capital Into a Changing Environment

The market for private equity buyouts continues to evolve as the underlying economic and industry dynamics have shifted over the past 18 months. Limited Partners (LPs) are approaching the opportunity set more cautiously and General Partners (GPs), accordingly, are adjusting their approach to investing capital. Following a decade of rock-bottom interest rates, low inflation, strong public market performance, and increased exposure to the asset class across institutional portfolios, the abrupt shift in economic conditions and ensuing policy response caused a significant slowdown across the U.S. private equity buyout ecosystem.

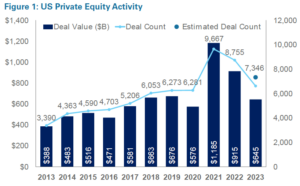

Over 2023, deal activity (Figure 1) declined 29.5%, while capital commitments slowed as the average duration to close for a buyout fund expanded to 15.3 months (highest point since 2011), and exit value fell by 26.4%1

Accompanying these changes are hints that the next decade may look formidably different from the prior one – specifically, as interest rates have increased amid persistent inflation, upping the risk of economic instability and creating greater uncertainty. The higher cost of capital will put pressure on private equity strategies that relied on cheap leverage to generate returns. Many underlying portfolio companies will not be able to generate sufficient cash flow on a levered basis to service debt burdens. Against this backdrop, LPs’ changing risk appetite (risk/return trade-offs) is altering how and where capital is allocated across portfolios and private equity buyout strategies, underscoring this evolving economic paradigm.

As the first quarter of 2024 nears its close, there are conflicting signals on how the remainder of the year will unfold. On one hand, transaction volume could increase from continued investor interest in private lending and if the broadly syndicate loan (BSL) market can overcome its recent setback in the fourth quarter (new issue loans backing U.S. LBOs totaled $2.2 billion in the fourth quarter compared with $15.3 billion in the third quarter). Additionally, public market trading multiples have moved higher than private M&A deal multiples, which historically preceded a run-up in M&A multiples. Finally, GPs may begin to feel pressure to put capital to work and realize investments following a subdued 2023.

Through conversations with intermediaries and GPs, there seems to be a collective sense (or want) that transaction volume will increase over the remainder of 2024; while hard to prove quantitatively, velocity has increased in the number of portfolio companies being prepped to go to market. On the other hand, valuations have not come down enough to entice buyers to enter the market aggressively given the debt environment. Deal multiples are down around 18% from peak in 2021, with much of that decline occurring on deals announced in 2023. Additionally, exit value in 2023 totaled $282 billion, which is 19.8% below pre-pandemic averages. Lastly, while private credit has helped fill the funding gap, the pace of activity has slowed recently, and it is unclear if it can sustain its momentum over the past year. This trend could suggest a figurative ‘bottom,’ but also may point to broader fatigue and a cycle whereby GPs hold on to assets until conditions improve so as to avoid forced sales.

While the economy is faring better than anticipated following aggressive monetary tightening, there remains uncertainty stemming from persistent inflation and higher interest rates, which means a less conducive environment for deal making. With a higher cost of capital that has moved from an all-in rate of 4%-to-5% two years ago to over 10% today, combined with tighter lending standards, and elevated financial stress on the consumer, pockets of stress are growing. The reality is that volatility is higher and more private equity-backed companies are straining under the weight of overvalued buyout transactions with high debt and interest loads (a 5%+ base rate puts many LBOs at risk of not covering debt expenses). Nearly $270 billion of leveraged loans carry weak credit profiles and are potentially at risk of default, according to Fitch Ratings as of the third quarter of 2023. While a surprisingly resilient economy so far has helped issuers withstand higher interest costs, things could unravel if there’s a shock to the economy.

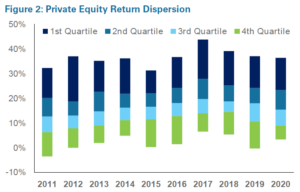

This implies the potential for greater dispersion in returns on capital that has yet to be deployed across buyout strategies, and a shift away from a landscape over the past decade where a ‘rising tide lifted all boats.’ This will make manager selection ever more imperative for LPs and will delineate GPs with true value-creation strategies versus those who rode the wave of favorable economic and financial conditions. Figure 2 shows the magnitude of return dispersion across private equity managers and the outperformance achievable through investing with top-quartile managers.

Additionally, as leverage has become less attractive (more expensive), GPs are prioritizing value-creation levers to grow EBITDA (i.e., organizational assessment and transformation, commercial operations, supply chain, data analytics and digitization, go-to-market, and/or strategic M&A) as opposed to a more passive ‘buy-and-hold’ strategy that worked well over the past decade as multiples steadily increased. In addition, as the cost of capital increased, debt, as a percentage of total deal value (loan-to-value), dropped to around 45% in 2023 from a 10-year average of 55%, meaning GPs are having to over-equitize deals and the LBO is now just the BO.

With private equity, specifically buyout strategies, becoming such an important return driver in institutional portfolios, NEPC is not forecasting (or recommending) a decrease in capital commitments. If anything, it is likely that more capital will flow into the asset class over the next five-to-10 years as allocation targets have steadily increased and private equity is becoming more accessible to retail investors. NEPC is also not forecasting an existential crisis or ‘shake out,’ as we believe the sheer magnitude of capital that has flowed into private equity and now needs to be deployed creates a pricing floor in many situations. Additionally, due to the structure of private equity funds that have a set investment period and fund life, GPs have pressure to deploy capital even if the market or opportunity set is not ideal. There is $2.59 trillion of global private equity dry powder ($955 billion U.S. dry powder) as of the end of 2023, which represented an increase of more than 11% over the December 2022 total, according to S&P Global Market Intelligence and Preqin data; roughly three-quarters of global dry powder reserved for private equity buyout strategies was raised within the past three years, according to Preqin. On one hand that means there is time still for GPs to put that capital to work, but as the clock is ticking, many GPs and LPs will feel a need to put capital ‘in the ground,’ which could create less than ideal outcomes if the opportunity set has not materially improved.

At NEPC, we believe new investment opportunities will emerge against the backdrop of an evolving economic paradigm. LPs and GPs looking to capitalize on those opportunities would benefit from a close examination of their approaches to deploying capital, portfolio construction, and value-creation, so as to ensure compatibility with the changing environment.

In this vein, there are buyout strategies that have garnered less attention (and capital) over the past decade that may be well-positioned in this new landscape to deliver attractive returns and add important exposure and diversification to portfolios. NEPC believes these strategies will take a larger portion of new capital commitments from LPs. Specifically, as NEPC scours the globe for attractive buyout opportunities, we are spending more time with GPs that offer flexible ‘all-weather’ solutions, stressed/distressed for-control strategies, operations-focused strategies, buyout secondaries, and more.

Over the remainder of this paper we will expand upon: (1) the current role of private equity in a portfolio and the role we expect it to play as a return generator, (2) an overview of the factors behind the current economic environment and how this impacts private equity, (3) the opportunities we see in private equity, and (4) final thoughts around the private equity opportunity set moving forward.

1Pitchbook. 2023 Annual US PE Breakdown.

The Importance of Private Equity

Private equity has become an integral part of a strategic asset allocation framework for total return-oriented portfolios. In the past two decades, private equity has evolved from a niche and underrepresented asset class to one found in most institutional portfolios and a growing number of retail investor portfolios.

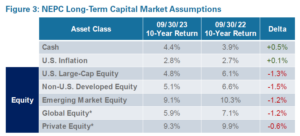

While past performance does not predict future results, long-term capital market assumptions, including those of NEPC (Figure 3), continue to reflect an elevated return profile for private equity relative to public markets.

Additionally, when the variable of manager selection is factored in, private equity model portfolios developed by NEPC show strong potential for significant outperformance above the long-term capital market assumptions.

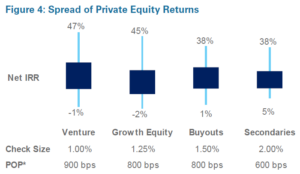

Note: POP* is NEPC proprietary measurement for ‘Potential Out-Performance’ and is the upside potential from strong manger selection (25th percentile to 50th percentile spread). IRR spread calculated as pooled 10-yr IRR through 2019. Vertical lines represent 5th percentile (top) and 95th percentile (bottom). Blue bars represent spread between 25th and 75th percentiles. Check size is a % of the total client NAV. Fund of Fund allocations are included in relevant strategy types (LBO, VC, etc). Expected return reflects NEPC capital market assumptions as of 6/30/23.

Manager selection within private equity is key as the dispersion of returns between median and upper quartile GPs is much larger than that found within public markets. As a result, selecting top performing managers can add significant outperformance versus the benchmark.

Shown in Figure 4, NEPC’s proprietary POP (‘Potential Out-Performance’) is a calculation of potential upside from strong manager selection (25th percentile to 50th percentile) and shows that the spread between the performance of the 25th and 75th percentile buyout GPs can be up to 800 basis points. This implies that having access to GPs that can consistently generate above median returns is essential for top performing private equity portfolios. NEPC has a dedicated research team focused on scouring the globe to identify best-in-class GPs that our clients can partner with, and we believe this is one, if not, the most important component to building a high-quality private equity program.

A significant component within private equity, driving the historic and forecasted outperformance, is the illiquidity premium. This, in its simplest form, implies that investors should be compensated for the risk of holding illiquid assets over a prolonged period. While the illiquidity premium may be less than it was 20 years ago due to increased competition and greater efficiencies, NEPC believes that private markets will continue to outperform public markets over a medium-to-long-term time frame (Figure 5).

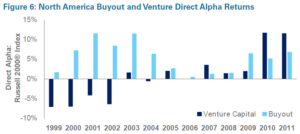

The advantages of private equity strategies in a portfolio are plentiful. Outside of strong absolute performance, private equity has had strong risk-adjusted returns (Figure 6), and can help mitigate overall portfolio volatility, especially in times of underperformance of public markets.

Digging deeper, private equity can be divided into three distinct sub-asset classes: buyout, growth equity, and venture capital. All three offer compelling opportunities, strong potential returns, and important diversification characteristics.

Buyout strategies and the role they play in a portfolio possess multiple positive attributes.

First, at a portfolio level, buyout strategies have historically generated more consistent returns with less risk (at a high level due to investments in profitable and mature companies) than growth equity and venture capital. As a result, they are seen as an anchor or core building block in most private equity portfolios. Additionally, buyout strategies offer exposure to a growing investable opportunity set that can help diversify portfolios across company size (market caps), sectors, geographies, and business models. Furthermore, information asymmetries still exist, which allow GPs with the proper skills sets to capitalize on these inefficiencies and generate compelling returns. Further, buyout strategies are based on the GP owning a controlling interest in the underlying company. This, in combination with the long-term nature of private equity fund structures, allows the GP full control over decision-making, value-creation initiatives, and multi-year growth strategies. Lastly, buyout strategies can help smooth returns within a private equity portfolio as returns are typically less volatile than venture capital or growth equity.

As with any investment, there are risks in investing in buyout strategies or any other private equity sub-asset class. The two most commonly associated risks are illiquidity and permanent capital loss. Illiquidity refers to the risk related to private equity funds locking up capital for 10-to-12 years and, in some cases, even longer. If portfolio liquidity needs are not managed correctly, this can be problematic; when liquidity is managed in a holistic manner and investors know their true liquidity needs, illiquidity does not translate into greater risk. Permanent capital loss can be greatly diminished through diversification within a private equity portfolio, alongside manager selection. A well-constructed private equity portfolio should have no greater risk of permanent capital loss than other alternative investments.

Moving forward, NEPC expects to see allocations to buyout strategies and overall private equity continue to grow across both institutional and retail portfolios. We believe private equity can continue to outperform public markets across a long-term investment horizon, especially with strong manager selection. NEPC’s view is that a disciplined pacing plan is the best way to approach private equity to achieve consistent performance, in addition to vintage year diversification and strong manager selection.

What Got Us Here

Anticipating and understanding current and future opportunities in private equity requires an understanding of what transpired in the global economy over the past decade. Much of what the global economy is wrestling with today is linked to policies instituted in the aftermath of the Great Financial Crisis, specifically rock-bottom interest rates and the injection of trillions of dollars into the global financial system to stimulate growth. As a result, financial conditions eased significantly, and the economy stayed in an expansionary mode for more than a decade.

This environment of ultra-low interest rates and substantial amounts of liquidity being pumped into the economy caused many investors to chase returns across a number of asset classes. Low yields in investments such as cash and bonds were not high enough to meet return-hurdles for many investors. In an effort to find attractive returns, investors increased their allocation to private equity.

In turn, private equity increased velocity (deal activity), fueled by more capital commitments and easy financial conditions, i.e., cheap leverage. At the same time, exits increased as GPs had capital to deploy, the public markets were receptive to IPOs, and add-ons for inorganic growth were attractive. This contributed to LPs experiencing heightened levels of distributions that were re-invested and shortened fund cycles as GPs deployed capital faster and came back to market with larger fund sizes.

This increased velocity continued through a measured quantitative tightening program from 2014 to 2019 and went into over-drive following the response to COVID-19 in early 2020 that saw the Fed funds target rate cut to essentially zero with massive amounts of fiscal stimulus provided. This created an environment for persistent inflation to take hold and the Federal Reserve (and European Central Bank later) responded with aggressive monetary tightening. Between January 2022 and May 2023, the Fed raised the fed funds rate by 500 basis points.

The impact of this tightening has been significant on private equity. Transaction volume plummeted, starting in the second half of 2022 and continuing through 2023 due to economic uncertainties, a closed IPO market, rising cost of capital, and a mismatch between buyer and seller expectations. Not surprisingly, exits declined dramatically and many investors experienced negative net distributions (capital calls exceed distributions) for the first time in years. This, in turn, caused LPs to pull back on new private equity commitments and GPs to slow fundraising in the face of less capital and slower deployment.

Under these circumstances, private equity buyout performance has stayed relatively resilient, but may start to exhibit downward pressure over the next several quarters. GPs have been able to push price increases along to the end-consumer and supply-chain and labor issues that were prominent in 2021 and 2022 have moderated. Moving forward, we expect to see more bifurcation in performance across companies that are struggling under high-debt service loads versus those with financial flexibility to pursue growth strategies. Additionally, the industry is approaching a wall of loan maturities in 2025 and 2026 that was last refinanced in a low-rate environment.

Moving Forward and Opportunities in Private Equity Buyout

Private equity and buyout strategies in particular will adapt and evolve to fit within the context of the current landscape, both from a GP and LP perspective. The current environment will be characterized by economic uncertainty, higher (if not persistent) inflation, and higher interest rates. Fears of a largescale recession seem to have abated moving into 2024 as economic indicators have held up (mainly driven by strong consumer spending) and a ‘soft landing’ looks more attainable, but uncertainty remains and there are clear pockets of stress in the system as more private equity-backed companies are straining under price pressures and higher debt and interest loads. While things can change in a flash, it seems reasonable to conclude the economy has entered a new phase of the cycle and private equity will be investing against a different backdrop than the previous decade.

It is prudent here to highlight the impact of higher interest rates on buyout strategies where leverage is typically used. One could argue that the most relevant market dynamic is NOT whether or not the U.S. or other developed economies experience a ‘recession’ over the next 12-24 months, but rather whether the cost of capital will remain elevated.

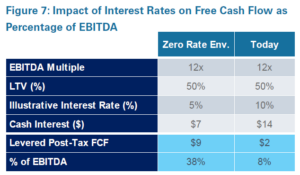

Elevated interest rates are causing GPs to modify how they underwrite new investments and deploy capital for growth initiatives. The ‘typical’ leveraged buyout (levered at ~6x EBITDA) that has been so attractive over the past decade may result in the destruction of equity value as some businesses may be unable to generate sufficient cash flow on a levered basis. At today’s interest rates, cash interest, taxes and maintenance capex estimates for many companies could consume nearly 100% of EBITDA. The illustrative table in Figure 7 shows that on a representative “last-cycle” transaction with 50% LTV debt, a 15% EBITDA margin target, where the purchase price was 12x, and interest expense has gone from 5% to 10%, a business converts less than 10% of its EBITDA into free cash flow, a reduction of ~80% versus the same business in the prior, zero-rate environment.

While the impact of higher rates is real, NEPC does not envision a wholesale change of any magnitude in terms of how private equity buyout capital is deployed. Rather, there are opportunities for nuanced changes and approaches that may be better suited for the current and future investing landscape. As one would expect, a change we are already observing is a lower percentage of debt and higher percentage of equity in transactions, as rates are impacting credit availability, underwriting and return expectations. As mentioned earlier, debt as a percentage of total deal value (loan-to-value) in the leverage loan market, dropped to 45% over 2023 versus a 10-year average of 55%. Debt to EBITDA ratios have also contracted sharply, shrinking to 5.2x year-to-date from 5.9x in 2022. We believe manager selection will be even more important moving forward as dispersions in returns will increase due to less accommodative monetary conditions. LPs may also alter their investing criteria/approach to take advantage of the environment, in a direct response to the recent lack of liquidity across many portfolios.

NEPC’S Private Equity Buyout Program: Areas of Focus

Flexible all-weather strategies: As the economic environment remains uncertain, there is value in private equity buyout strategies that are structure agnostic and can make investments in quality businesses at disciplined valuations regardless of the broader market cycle or exogenous macro factors. These flexible strategies are characterized by an ability to pursue traditional leveraged buyout transactions, complex carve-outs, structured and stressed opportunities, debt with equity-upside, and capital solutions that are outside of a formal restructuring process.

Within these flexible strategies, NEPC is paying particular attention to GPs that have experience pursuing corporate carveouts and divestitures. The current dynamics of inflation and rates, alongside cost rationalization, are pushing companies to proceed with portfolio pruning and sales of non-core units. Further, any thought of a potential recession in the years ahead may act as a catalyst for management teams to recast financials with a sale. These types of deals can be easier for GPs to finance and there are a vast number of value creation levers that can be employed.

The ability to be opportunistic should increase the opportunity set of these mandates and increase the risk/reward profile by finding the best entry point, regardless of its position in the capital stack. Within a portfolio context, NEPC recommends exposure to these strategies as core positions that can deploy capital throughout a cycle.

Stressed/distressed for control: True distressed-oriented strategies are lacking in many LP portfolios today. This should not come as a surprise, as monetary policy over the past decade created an environment where under-performing companies could access cheap debt and kick the proverbial can down the road with little consequence. This environment caused distressed-oriented funds to pivot towards more traditional leveraged buyouts (LBOs) or cease to remain active. While it is unclear if broad distress will become a reality, indicators point to more stress in the system (i.e., corporate leverage, credit card and auto loan delinquencies).

In conversations with GPs, it is evident that distress-for-control opportunities are looking more attainable, and GPs are starting to build positions in distressed names across many sectors. Corporate defaults and bankruptcies have largely been subdued in both the leveraged loan market and across U.S. businesses more broadly, mainly because top-line growth has been strong. However, revenue and EBITDA growth of small-cap public companies has started to slow, suggesting an increased risk of failures.

When performing due diligence on distress-oriented GPs, NEPC is focused on a given team’s experience deploying a similar strategy through past economic downturns and skill set in structuring complex transactions. Within a portfolio, NEPC views distress-oriented strategies as an important exposure that can act as a hedge against economic dislocations. It should be noted that, at times, these private equity strategies may overlap with distressed debt funds and exhibit similar characteristics. The differentiator is that distressed private equity strategies may invest via debt or through equity; if investing via debt, they are looking to eventually take control of the underlying company and push forward value-creation initiatives.

Operationally focused value-creation: Being able to drive growth via operational improvements (organic EBITDA growth) has always been important within private equity and may be more so moving forward due to multiple compression, economic uncertainties, and the elevated cost of capital. The last decade saw a dynamic where multiple expansion drove a significant amount of return across buyout strategies and diminished the importance of organic growth. What is attractive about creating value via an operational approach is that there is less dependency on the direction of macro forces and/or monetary policy, and these improvements can result in improved financial performance across the cycle.

Additionally, an operational lens can be used across companies of all sizes and in all sectors and geographies. Defining operational value-creation can be quite broad, but typically includes building scalable and best-in-class business processes and systems (manufacturing footprint and distribution network studies, tools to support SKU optimization, demand and supply planning, fulfillment and logistics strategies, ERP implementation), implementing continuous improvement and lean principles, and strategic sourcing.

Strategic buy-and-build: Strategic M&A can be another value-creation lever that we believe is attractive moving forward when executed correctly. The basic formula for the buy-and-build strategy is to purchase market-leading platform companies in focus industry sectors and augment them by acquiring additional businesses through add-on acquisitions to strengthen the platform companies’ competitive position. Add-on acquisitions can expand the scale of companies, transform local or regional companies into national platforms, extend the platform companies’ product offerings, and create operational advantages. Strategic acquisitions can also deliver substantial EBITDA improvement from revenue and cost synergies. By combining organic growth with growth via acquisitions, it is possible to achieve a more rapid increase in EBITDA. Further, add-on acquisitions can typically be purchased at lower multiples, blending down the overall platform multiple cost. Additionally, we feel that buy-and-build strategies focused on the lower-middle-market are more attractive in the current environment as middle-market and upper-middle-market strategies are more dependent on debt markets to secure large debt packages to execute M&A.

Buyout secondaries: The development of the broader private equity markets over the last decade has caused secondary opportunities to grow exponentially. Secondaries can offer the growth and diversification benefits of the private equity asset class within a more efficient time period. Periods of uncertainty or economic volatility can increase the opportunity set as sellers use the secondary market as a way to achieve liquidity, and buyers/investors can find attractive discounts to net asset value across fund investments and single-asset transactions. While spreads on average have not experienced meaningful widening, there continue to be pockets of value.

Cycle-tested GPs: Much of the success of private equity firms is driven by the investment professionals implementing and executing value-creation strategies. While the economic context matters, great investors can adapt and evolve to succeed within their environment. Investors who have experience deploying capital through cycles and lived through periods of market turbulence and down markets will be better prepared to navigate this next phase of private equity.

While the above areas of focus may seem comprehensive and cover most of the buyout universe, there are areas we are less enamored with due to current and near-to-midterm market dynamics. Strategies that are predicated on financial engineering, multiple expansion, growth-at-all-costs tech, buy-and-builds in the upper-middle market, and GPs with no discernible differentiator are just a few examples of these.

Importantly, manager selection is extremely nuanced and is more of an art than a science. Identifying GPs that can consistently generate strong returns comes down to the individuals, process, infrastructure and alignment. Prevailing macro conditions are important and may provide tailwinds or larger opportunity sets for specific buyout strategies, but as the asset class is long term in nature, economic condition will change over the life of a fund and the GP needs to be prepared to invest across a cycle. Thus, being able to identify return drivers, and gauge if they are repeatable or not, will lead to more consistent manager selection and stronger performance.

Conclusion

The private equity buyout industry has gone through many iterations and will continue to grow and evolve in this next stage of the economic cycle. The opportunities moving forward are attractive, but modified approaches may be necessary from GPs and LPs to achieve strong and consistent returns. Higher rates, stubborn inflation, and unknown bumps in the economy over the ensuing years (not to mention geopolitical events) may disrupt specific vintage year returns, and also create pockets of opportunity where attractive returns can be generated with the right approach and process.

For now, the era of cheap capital is over, and private equity buyout returns will be less driven by leverage and multiple expansion. Due to this, dispersion in returns is likely across the industry and performance will be driven by GPs abilities to execute growth strategies, rather than financial engineering or macro-driven dynamics. The opportunity for private equity buyout strategies to produce strong absolute and relative performance has not changed, but the approach and process will need to evolve. Private equity will remain a return driver across institutional portfolios and continue to grow as more investors embrace the asset class and as long-term capital market assumptions—including those of NEPC—continue to reflect an elevated return profile for private equity relative to public markets.

It is unlikely that there will be a wholesale change of any magnitude in terms of how private equity buyout capital is deployed. Rather, there are opportunities for nuanced changes and approaches that may be better suited for the current and future investing landscape. At NEPC, we are focused on identifying strategies and GPs that are well positioned to invest in the next phase of the cycle and have the tools and experience to navigate a changing environment.