There are few matters of wealth management more fraught with tension than estate planning. Preparing to transfer wealth and assets to your heirs can involve emotions, family dynamics, legal structures, and a host of major and complex tax implications – is it any wonder that it is rich fodder for popular TV shows?

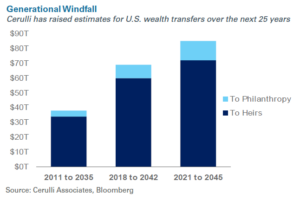

The challenges around succession planning are also exacerbated because of the so-called Great Wealth Transfer. That is the movement of assets, including real estate, investments and family-owned businesses, from the baby boomers—one of the largest and wealthiest groups in history—to a generation of heirs that may have a different view of money. However, while the challenges are real, we think common sense and some best practices can help families work through their succession plans without the drama of a show like Succession.

Not Your Father’s Estate Planning

But for individual clients and families, the challenges are typically a little closer to home. How can you structure a large portfolio of assets to meet the long-term needs of your family? What do your heirs need to know to succeed as financial stewards?

NEPC’s experiences with clients suggest there are some clear dos and don’ts, and a handful of best practices that can take the drama out of estate planning.

The Dos

- Communicate within your family before you develop your financial plan. Estate planning can involve uncomfortable discussions around mortality and legacy, and ignite family disagreements. But a good plan is almost impossible until families can address these emotional hurdles and create clear, unified goals.

- Be proactive in developing your estate plan. It can be hard to embrace estate planning, but it is risky not to. Waiting until the last minute may mean not being able to take advantage of techniques that can help you reduce your taxable estate. That means a much bigger tax bill, and a bigger share of your estate going to Uncle Sam.

- Get started on making transfers. Even if you do not have a full estate plan worked out, start making gifts as soon as you can. This will not only slowly reduce your estate tax obligations, but also it will give your heirs more time to build the value of their own estate.

The Don’ts

- Do not give away too much too soon. Get as detailed as you can about your own expenses and consider what goals you may still have for your wealth. Plans can change, and you will want to make sure you have resources if, for example, you want to start a new endeavor or make a large charitable gift.

- But…do not hang on to too much for too long. One of the benefits of good estate planning is the ability to consider various contingencies and find the right balance.

- Do not leave it to your heirs to figure it out. Heirs can struggle with the responsibilities of a large inheritance. They may not know how to safely manage wealth, or how to navigate family conflicts. They may not understand liquidity limitations and may wrestle with planning their spending. Head these challenges off by involving them in your planning, or by hiring a consultant to provide them with guidance.

Best Practices

The dos and don’ts are nearly universal, but the specifics of every estate plan will be unique to the person who creates it. However, NEPC has found some approaches can be useful to clients in many situations. Some of the techniques we frequently discuss with clients include:

- Take full advantage of all appropriate planning vehicles. For example, a GRAT (Grantor Retained Annuity Trust) allows the grantor to potentially pass a significant amount of wealth to the next generation with little or no gift tax.

- Take advantage of discounts for lack of control or lack of marketability. These discounts allow you to reduce the fair market value of an asset when transferring it to heirs, effectively reducing the tax liability. This approach can be particularly relevant when transferring interests in closely-held businesses or assets with limited marketability.

- Take advantage of step-ups. In charitable giving, it is almost always better to give away low-basis stock than to give away cash, so the recipient can benefit from a tax-free step-up in basis (and so you can remove a potentially large capital gains liability from your portfolio).

- Use the annual gifting exclusion. One of the easiest ways to reduce the taxable value of your estate is to take advantage of annual tax-free giving allowances. In 2023, you are allowed to give away $17,000 per person before gift tax kicks in (or $34,000 for a married couple). Note: The number of people you can give this tax-free gift to every year is unlimited. Consistently taking advantage of these allowances can make a large dent in your estate liabilities.

Planning with NEPC

NEPC’s Private Wealth team partners extensively with clients – and their trust and estate attorneys – to ensure that their estate plans are integrated into the investment management process. Reach out to your NEPC consultant to discuss your estate plan and for any questions you may have.