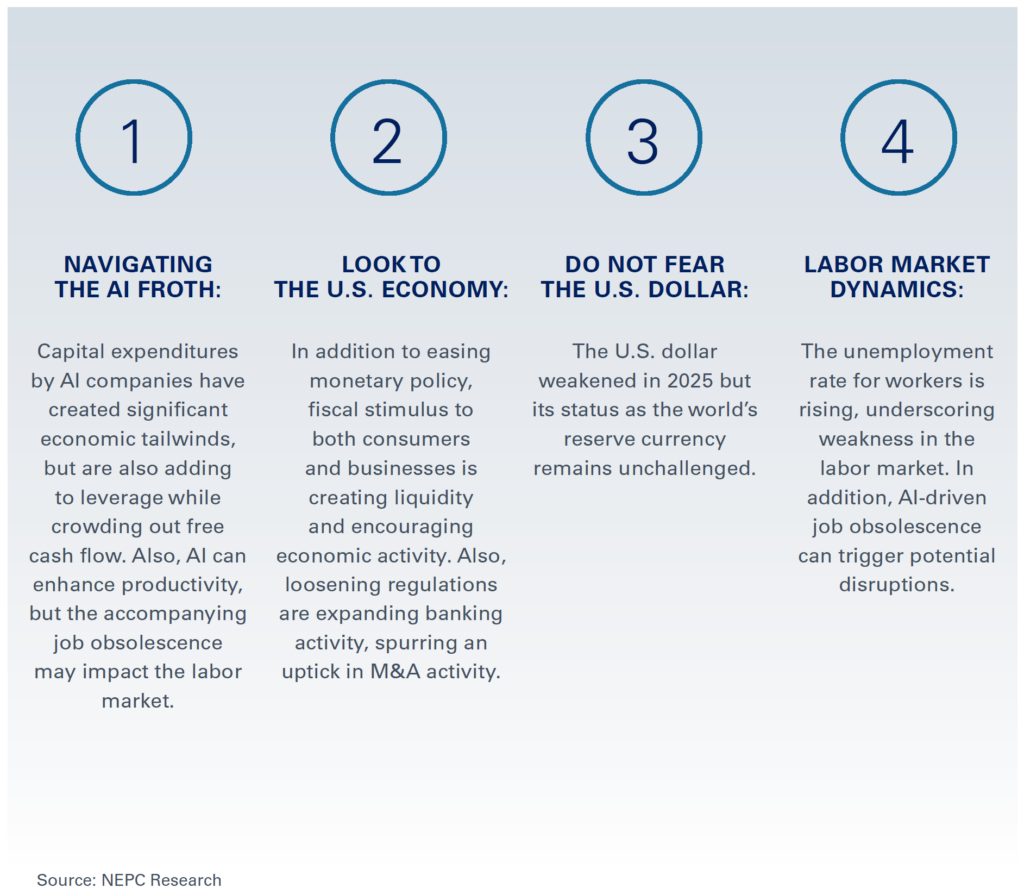

The new year begins with markets at a crossroads—Fed uncertainty, record-high equities, and the dominance of mega-cap stocks are creating both opportunity and risk. At NEPC’s investment offsite, we explored the market themes for 2026 and their impact on asset classes.

Observations: 2026 Investment Themes

NEPC’s Key Investment Implementation

- Maintaining a disciplined, diversified core portfolio

- We believe public equities will remain the primary return driver, with allocations anchored to ACWI based weights.

- A focus on diversification across markets and asset classes in an investment landscape marked by both opportunities and risks may be beneficial.

- Preserving exposure to safe haven fixed-income

- Safe-haven fixed income can provide downside protection and liquidity to cover near-term spending, and may also offer investors the opportunity to take advantage of market dislocations

- For taxable clients, investment grade municipal bonds may serve as safe-haven fixed income

- For tax exempt clients, a combination of Treasuries and TIPS can serve as safe-haven assets

- Allocating to private markets

- Private equity: We believe that following pacing plans, prioritizing high-conviction strategies and continuing to focus on lower-middle-market buyouts and seed stage in venture may be beneficial.

- Private credit: We believe it may be advantageous to favor more complex lending structures and stressed/workout strategies over vanilla direct lending.

- Pursuing select opportunities in real assets and real estate

- We have observed real estate fundamentals begin to stabilize across most property types (excluding office).

- Based on our observations, we believe it is a time to favor global real estate opportunities.

- In real assets, we believe care is needed with crowded themes like data centers, and consideration for opportunities in power infrastructure, which has structural tailwinds, may be beneficial.

- Rising of the Secondaries Market

- Equity secondaries can provide tools for proactive portfolio management. We believe considering the use of a secondary broker to provide insight into portfolio holdings and opportunities to adjust exposures may be beneficial.

- Private credit secondaries are rapidly expanding and may provide access to enhanced liquidity and return opportunities. We believe investors will benefit from being judicious in assessing pricing.

- Being intentional with hedge funds

- We believe in mindfulness with hedge fund allocations: seeking diversification or access to unique strategies not available elsewhere.

- Based on our observations, we believe a focus on healthcare/biotech and long/only strategies may be beneficial.

Read our disclaimers.