In recent months, the annual inflation rate hit 5.4% — a level not seen in decades – and consumer expectations of future inflation have risen as well. The Federal Reserve has softened its stance on inflation, saying it will tolerate an average rate of 2% rather than treating that as the maximum rate that is acceptable. Should investors be worried that higher inflation is on the horizon?

Not necessarily. We tend to agree with the Fed that the recent surge in inflation has been heavily influenced by the abrupt shutdowns and dramatic re-openings fueled by the COVID-19 pandemic. In addition, pandemic-related bottlenecks in global supply chains have resulted in shortages, driving up prices in certain sectors.

But it’s also true that accommodative monetary policy, combined with extraordinary fiscal spending during the pandemic—covered in our key market theme of permanent interventions—is fueling higher inflation expectations. With inflation front and center, now may be a good time to review its potential impact on your family’s investments. Inflation:

- affects different asset classes differently,

- alters the composition of returns, and

- increases your tax burden.

ASSET CLASSES: NOT ALL ALIKE

The first thing we need to pay attention to is the immediate effect inflation can have on performance. From a short-term return perspective, inflation affects asset classes differently. For example, fixed income securities generally perform poorly because inflation reduces the value of fixed payments.

Not all segments of the fixed-income market are affected equally. For example, bonds with longer maturities have payments that extend further into the future, giving inflation more time to erode their value. In contrast, floating-rate debt normally performs better because the interest rate is reset as rates rise. High-yield bonds also can do better because they offer a higher rate, which provides a greater buffer to protect the investors’ principal.

In contrast to bonds, equities have generally fared better as long as inflation rates remain moderate. Companies can often pass price increases on to customers, helping to cover rising costs and keep the bottom line growing.

Real assets such as real estate also tend to hold up well. Historically, real assets have maintained their value during periods of rising prices, so making an allocation to this asset class can provide inflation protection.

THE COMPOSITION OF RETURNS: NOMINAL VERSUS REAL

Longer term, inflation undermines the value of all assets. But a lesser-known concern is its impact on the composition of returns. Generally, the price return on any investment can be broken down into the portion that is “real” and the portion that is due to inflation. For example, if the stock market rises 10% but inflation is running at 2%, then the “real” return is 8%.

Even low rates of inflation can have a significant impact when compounded over long periods. If a portfolio produces a real return of 7.2% over 10 years, it will double in value. But if the nominal rate of return is 7.2% and the rate of inflation is 1.5%, then the real return is just 5.7%. This extends the time required for the real value of the portfolio to double to nearly 13 years. If inflation runs at 3% annually, that 7.2% nominal return becomes just 4.2%. At that rate, the time required to double the real value of the portfolio increases to about 17 years.

The difference between nominal and real returns can have a large impact on all investors, but it can be particularly relevant to families focused on stewardship for the next generation. Those who want to leave their wealth to the next generation typically want to transfer an amount that is at least equal to what they have earned or received on an inflation-adjusted basis.

TAXES: AN OVERLOOKED IMPACT

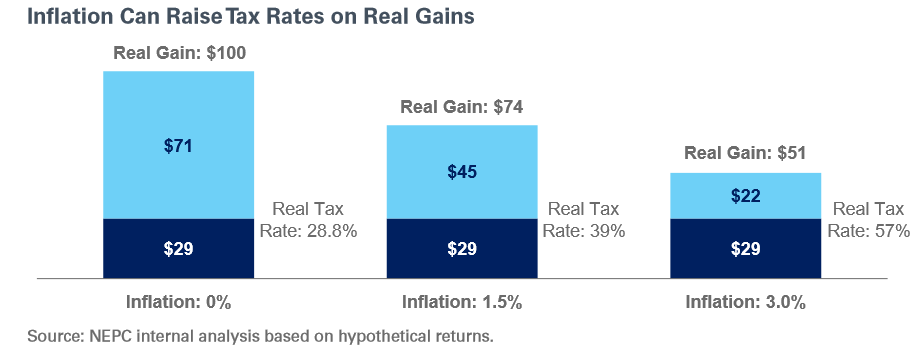

The effect of inflation on an investor’s tax burden also deserves attention. Since taxes are levied on nominal gains, investors pay tax not only on real gains but also on those that are due to inflation.

For example, if a stock is purchased for $100 and earns a 7.2% nominal return for 10 years, it would be worth $200, giving a gain of $100. But if the inflation rate is 1.5%, then about $26 of the gain is due to inflation, leaving a real gain of $74.

Now, consider the tax impact: If the investor pays a 20% capital gains rate, has a 5% state tax rate, and is subject to the 3.8% Obamacare tax, they would pay 28.8% on the $100 nominal gain. But as the chart shows, since the real gain was only $74, the tax payment of nearly $29 amounts to a “real” tax rate of 39%.

With a higher rate of inflation, the tax impact is greater. If inflation is 3%, the real return is 4.2%, producing a real gain of $51. With a 28.8% tax rate, the tax on that real gain is 57%.

NEXT STEPS

Inflation can have an adverse impact on your portfolio, so when it becomes a real risk, investors should take measures to protect their investments. NEPC Private Wealth is prepared to discuss inflation-fighting strategies that suit each individual client and their portfolios.

At this point, we continue to believe the latest bout of pricing pressures will be short-lived. However, if they persist, the Fed is well-equipped to combat them as it did in the early 1980s, when inflation reached nearly 14.5%. Although the cure–higher interest rates–was painful, it was successful. Since then, inflation has posed little threat.

We continue to closely monitor inflationary pressures for signs they will persist. For those interested in learning more about our view on this topic, please check out our Q2 2021 Quarterly Market Webinar: Reframing Inflation Expectations.