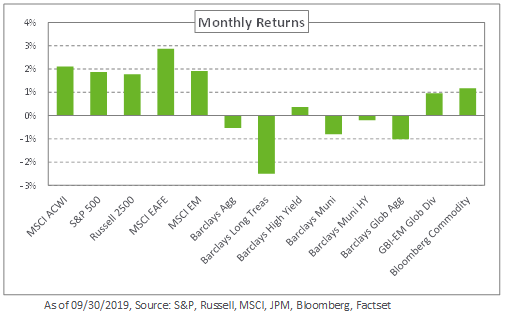

Risk assets were in the black in September following a challenging summer marked by an escalating trade war between the United States and China, and sluggish economic growth. Global equities rallied as central banks in the US and Europe eased monetary policy to offset concerns around an economic slowdown. The MSCI EAFE Index led the way, increasing 2.9% last month, on the back of a massive, open-ended stimulus plan from the European Central Bank. The S&P 500 Index and the MSCI EM Index gained 1.9% each in September.

Following a rate cut last month by the Federal Reserve, the short-end of the Treasury yield curve moved modestly lower. However, the curve steepened at the 10- and 30-year points by 18 and 16 basis points, respectively. As a result, the Barclays US Treasury Index and Long Treasury Index declined 0.8% and 2.5%, respectively, in September. Global rates also moved higher with the German bund increasing 13 basis points and the 10-year Japanese bond yield moving six basis points higher – reflecting investors’ increased appetite for risk following the ECB’s stimulus package. In credit, spreads posted a moderate decline across domestic investment-grade indexes. The Barclays US High Yield Index eked out a 0.4% monthly return as spreads on lower-quality indexes fell.

Within real assets, spot WTI crude oil declined 1.7% during the month, with losses of 7.0% for the quarter; that said, year-to-date gains total 19.9% so far this year.

As we move into the fourth quarter, we remain cautious about risk assets in the face of slowing global growth and the US economy in the late stage of the market cycle. To this end, we encourage reducing return-seeking credit and recommend shorter-duration safe-haven fixed income.