A growing number of large healthcare organizations and hospitals are now investing in private equity funds and/ or directly in businesses with the aim of improving care, driving innovation and garnering returns. At NEPC, we believe this trend will continue to gain momentum as healthcare systems turn increasingly to strategic investing to maintain and support a competitive advantage in a rapidly changing industry.

While the healthcare industry is constantly evolving, the rate of change has picked up dramatically in the past few years, driven by mergers and alliances, disruptions in public healthcare programs and policy, and evolving technology. Additionally, new competitive pressures are coming from some new and unlikely sources. In the last six months alone, drugstore giant CVS Health agreed to buy health insurance behemoth Aetna for $69 billion, while corporate titans Amazon, JPMorgan Chase and Berkshire Hathaway signaled their intent to form a new healthcare company. Both announcements have the potential to reshape the healthcare landscape.

We have been researching this growing trend of healthcare providers utilizing private equity as a strategic investment. We published our first paper on this topic, Thinking Ahead to Stay Ahead: Strategic Private Equity Investing in Healthcare, in the spring of 2016. This paper provided an overview of the private equity landscape and the strategic rationale for making healthcare related investments. Our follow-up paper, Caution: Construction Ahead – Healthcare Organizations Use Private Equity Investments to Support Innovation, explored governance and implementation based on discussions with healthcare providers. Both are available on our website www.nepc.com. We hope to use our research platform to provide a roadmap for our clients in the healthcare industry who may be contemplating this strategy and require sophisticated investment solutions.

THE SURVEY

For this paper, we conducted a survey to gain more visibility into how healthcare providers are approaching this new trend. We received responses from 21 healthcare organizations of which 19 had operating assets greater than $1 billion; 16 had revenues of over $2 billion, including eight with revenues exceeding $5 billion. The results underscore the predominance of large healthcare providers in strategic investing. They also reveal that this investment approach is still in its infancy stage, with the majority of respondents active in the space currently holding a small sample, totaling five or less investments.

We summarize below the results from our survey:

THE TAKEAWAYS

(i) Trend

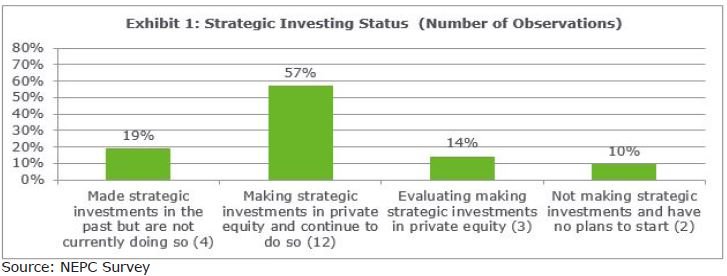

The majority of survey respondents – 71% – said they were either actively making strategic investments or were considering pursuing them. The remaining 29% said they were either not planning a strategic investment or have stopped their program, underscoring the challenges in building and sustaining these types of investments (Exhibit 1).

Our observations: We believe this strategic investing trend is likely to grow. To be sure, there is a high degree of difficulty in starting and managing a program. Therefore, it is vital to carefully consider and address issues around management complexity, governance, and performance measurement of both clinical and investment goals before embarking on a strategic investing plan.

(ii) Type and Implementation

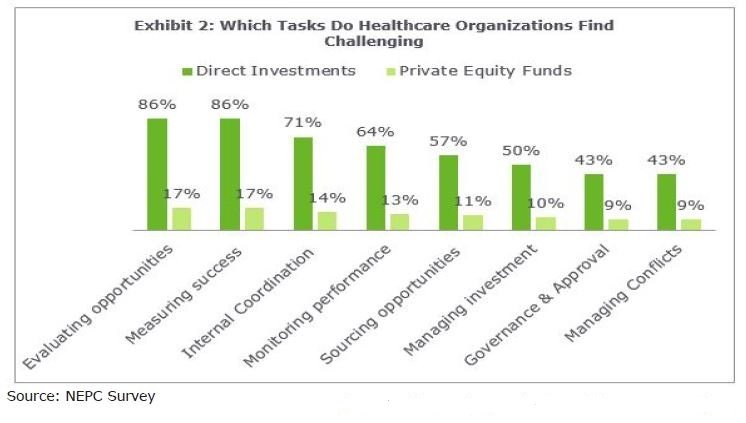

Nearly half the healthcare organizations surveyed invested in both private equity funds and direct investments. The two approaches may be viewed as complementary. Direct investments enable targeting clinical priorities with more precision, while investing in funds can provide broader access to companies (Exhibit 2).

Over a third of respondents—35%—favored only direct investments and 18%preferred to focus only on private equity funds. That said, 85% of respondents were more concerned at the prospect of evaluating a direct investment while less than 20% viewed vetting private equity funds as a challenge. This is not surprising given the complexities related to taking a direct ownership interest in a company compared to investing in fund.

Our observations: We agree with the survey results that highlight investing directly in a company as being more difficult than investing in a fund. However, once the investment is made, measuring the benefits and impact of the investment from a clinical and/or operational perspective are similar, which raises the question of whether this nuance is being overlooked. Additionally, selecting the best private equity manager to partner with can be a more involved process than simply investing in a fund only for returns. Specific traits that should be incorporated in the manager selection process include alignment of expertise with the organization’s clinical priorities, the breadth and depth of manager’s network of companies and industry contacts, and a willingness and history of working closely with Limited Partners.

(iii) Focus

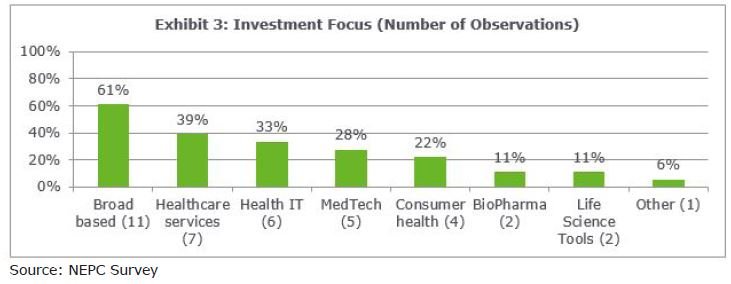

A majority of respondents—61%—indicated they are taking an opportunistic approach towards allocating capital with a broad-based focus that invests across a number of different healthcare verticals. (Exhibit 3)

Our observations: As the strategic investing trend evolves, we believe providers may seek a more targeted approach with a narrow focus on specific clinical goals and needs; this would be followed by assessing the pipeline of potential funds or companies that operate in that space in a more comprehensive manner. The processes to vet ideas will likely go through a transition as organizations learn from their initial investments and more organizational structures are put in place.

(iv) Investment Holding

There were 17 observations, showing the different ways these investments can be held; the responses totaled more than 100% as two organizations selected multiple categories. Nearly half the respondents—47%— held their strategic investments as stand-alone entries on the balance sheet. A lower number—35%—held them within the operating assets portfolio. Only two organizations had them structured as special entities while 12% did not specify how they held their strategic investments. Interestingly, none of the organizations highlighted their endowment as the funding source of their investments. The fact that just two organizations have special vehicles reflects that most have relatively few investments in place, and still treat these investments as opportunistic compared to investing a budgeted amount each year.

Our observations: Aside from select very large healthcare systems that have been making strategic investments for many years, most healthcare systems’ programs are much less established at this point. So, those who are yet to enter the fray shouldn’t feel that they are late to the game.

(v) Measuring Success

Assessing the success of these investments is a challenge given their long-term time horizon. Many survey respondents—85%—were somewhat daunted by the prospect of measuring the outcomes for direct investments, while less than 20% felt the same way for private equity funds. This is understandable from the viewpoint of gauging financial health; however, similar challenges exist for direct and private equity investments when measuring clinical results, as noted earlier.

Our observations: Articulating clear goals, objectives and milestones ahead of funding an investment are particularly important for measuring clinical success and the financial progress of direct investments. Given a direct investment may require additional capital, it is important to have the data available to assess whether you should continue to fund the company. It is worth noting that the size of the investment does not necessarily have to be large to realize clinical benefits; healthcare systems offer insights and value to companies and fund managers that go beyond what other investors can provide. It is also important to be patient as financial and clinical benefits may take a long time to appear, especially for venture-type investments.

(vi) Governance

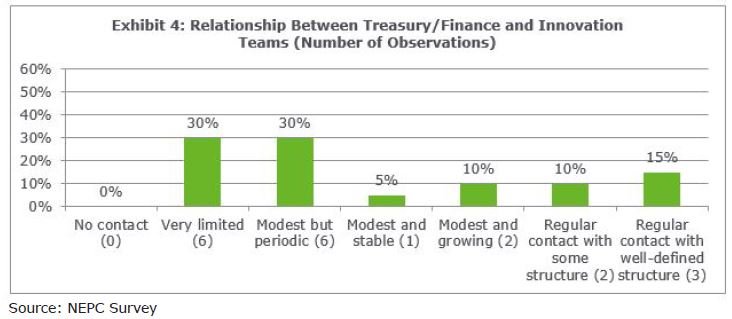

A majority of the respondents—75%—felt the relationship between the Treasury/ Finance and Innovation teams was limited or modest; only 25% indicated a regular contact with some or a well-defined structure in place. (Exhibit 4)

Our observations: This appears to be an area for improvement within a number of healthcare systems. It is apparent in our conversations that many organizations are still trying to “figure this out.” We have seen several cases where initially small investments have been made, and the governance structure is then addressed. One of the challenges with strategic investments is that they require a tremendous amount of coordination to both put the investments in place and to monitor them. Often, many individuals involved in the process have other responsibilities, so their ability to focus on an investment or relationship is limited. To this end, having a point person or a team that owns the process and investments should be evaluated if not in place already.

CLOSING THOUGHTS

As the healthcare industry evolves rapidly, the ability to innovate is viewed by many organizations as critical to their ongoing success. We believe large providers using strategic investments as a component of their strategy to improve patient care, innovate and earn returns is an emerging trend that is here to stay. We see strategic investing as being similar to other trends, for instance, investing in alternatives and liability-driven investing, which were once uncommon but are routine today. As more organizations choose this path, we anticipate an increased focus on best practices and governance, and on learning from others who have successfully executed strategic investment programs.